Small Business, Big Impact: Expert Advice to Help Your Business Thrive in 2025

(BPT) - Small businesses are the backbone of the American economy. They are at the heart of communities, creating jobs, driving innovation, and cultivating local pride. In fact, small businesses make up 99.9% of all companies and employ nearly half of the private workforce, according to the U.S. Small Business Administration.

From the Main Street auto shop to the neighborhood dentist, these businesses embody the entrepreneurial spirit that fuel our nation. Their success is vital to our collective prosperity and the U.S. economy.

That's why Synchrony partners with hundreds of thousands of small businesses and health and wellness providers, offering flexible financing solutions to help them better serve their customers and communities as well as smart tools and resources to help them grow.

To thrive in today's competitive and ever-changing market, here's key proven advice from Synchrony's small business partners who have successfully adapted to change and bolstered their resilience.

Tip #1: Take Personalization to the Next Level

In a marketplace saturated with choices, small businesses must offer more than great products. Creating a personalized customer experience is essential. This means going above and beyond to provide hyper-personalized experiences that resonate with each customer's unique needs and preferences.

Data analytics is a powerful tool that can help you understand what your customers like, tailor your offerings and discover new opportunities for growth. Like hospitality and retail businesses use data for personalized rewards, you can use data in your industry to better understand your customers, identify high-value new customer segments, optimize marketing and sales strategies, and deepen customer loyalty.

And the post-purchase experience is also key to building lasting customer relationships. For instance, a first-time ATV buyer who is an aspiring powersports enthusiast needs more than just the vehicle. They need gear, training, licensing information, trail recommendations, and maintenance tips. For dealers, this is your chance to introduce the many service offerings that are available to them before they walk out the door and create a rewarding, enduring experience.

Tip #2: Flex to the Way Customers Want to Pay

Offering flexible financing benefits both your business and your customers. It gives customers access to the products and services they want, while providing small businesses with a steady stream of revenue and working capital to grow and serve more people. This is especially important in sectors like health and wellness, where insurance may not cover all the costs.

Dr. Peter Drews of Drews Dental Services in Maine uses financing to better serve his patients' needs and streamline his business. By offering CareCredit, a Synchrony financing solution, his patients have the option to pay for the care they want over time and within their budget. This approach not only helps customers manage their finances, but also streamlines the practice's operations and allows more time and focus for patient care.

Consider introducing financing options that fit your business and help your customers make purchase decisions with confidence.

Tip #3: Invest in Your Employees' Tech Skills

Your employees are your greatest asset. Investing in their technical skills is a crucial investment in the future success of your business. Providing training and development opportunities that will empower your employees will help deliver exceptional service and enhance their job satisfaction.

Muffadal Simba of Merlin Complete Auto Care in Chicago understands this principle. By investing in new technology, including digital vehicle inspections and upgrading his team's technical skills, he ensures his staff can provide top-notch, personalized service to every customer. "Teaming up with Synchrony has helped us better reach our customers and grow our business," said Simba. "We've been able to significantly increase sales by investing in new technology using a Synchrony small business grant."

Explore setting up training workshops, online courses, or mentorship programs to keep your employees' skills sharp and relevant.

Tip #4: Engage the Community

Getting involved in your community can help your small business build strong connections with people and contribute to the well-being of your local neighborhood. By actively participating in community events, supporting local initiatives, or addressing area needs, you build goodwill, strengthen your relationship with potential customers, and create a lasting impact.

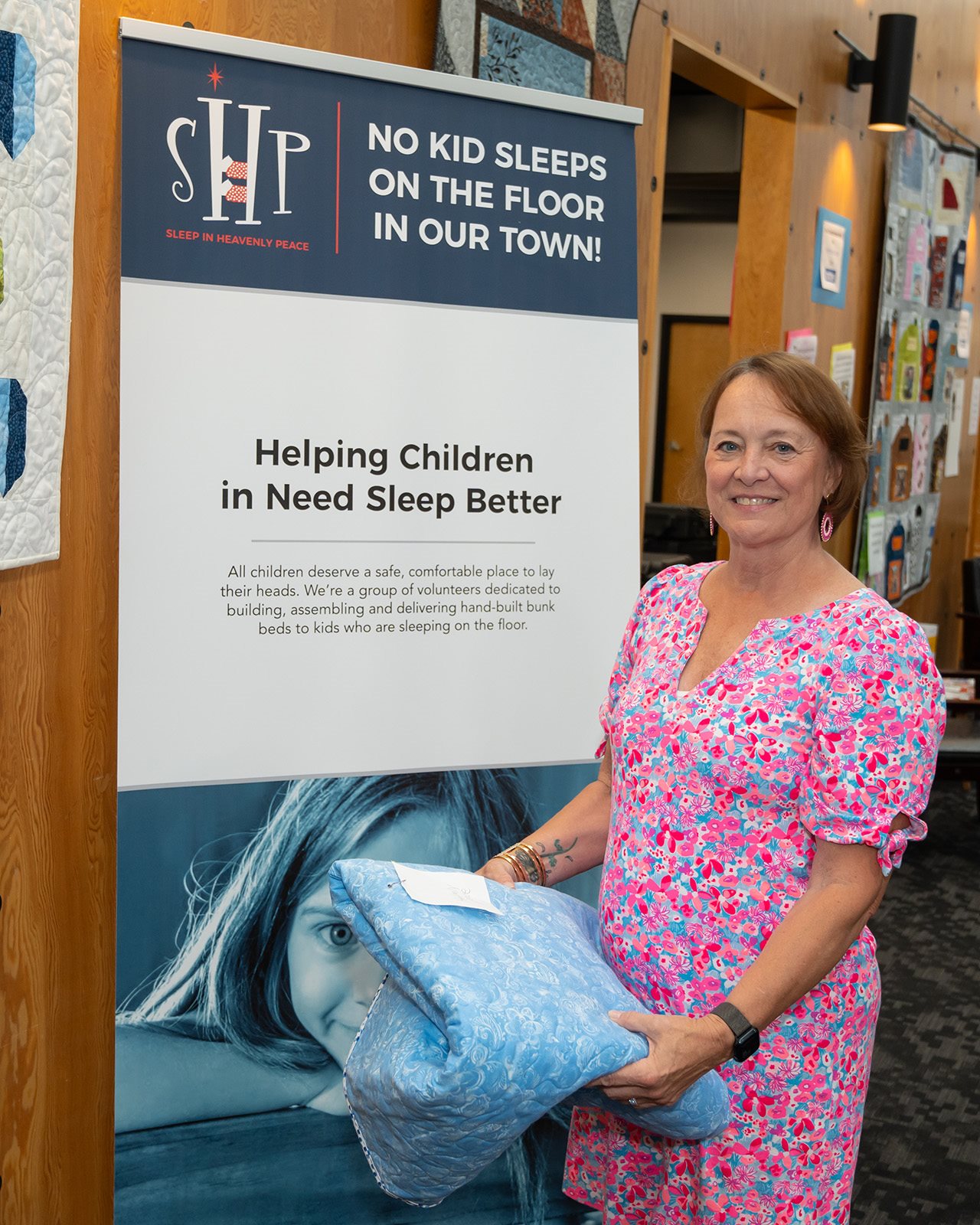

Take Jolene Fitch from Finger Lakes Fabrics as an example. Her quilt shop in Skaneateles, New York, brings the local crafting community together to collaborate with nonprofits and host fundraisers, blanket drives, and hat drives. When Fitch first opened her shop, she distributed 115 free fabric and pattern kits to the community, giving people a chance to handmake and design pillows that were then donated to Sleep in Heavenly Peace, a charity that supplies beds to children in need.

Tip #5: The Best Small Businesses Lift Up Other Small Businesses

Collaboration and mutual support are vital within the small business ecosystem. By supporting other local businesses, you create a network of shared success. This could involve recommending their services, collaborating on projects, or simply offering advice and mentorship.

Ben Stowe of NLFX Professional in Minnesota exemplifies this collaborative spirit. By partnering with manufacturers to offer symposiums and seminars, in addition to selling lighting, audio, and video equipment, he's not only supporting his own business but also empowering other entrepreneurs with valuable skills and knowledge.

Adopting these strategies is key for small business owners to forge a path toward long-lasting success, contributing to both their bottom line and the vibrancy of their communities. By investing in your business and your community, you're investing in a brighter, stronger future.

Source: BrandPoint