Guanajuato Silver Reports Third Consecutive Quarter of Positive Mine Operating Income

Company Announces Improved Q4 and Year-End Financial Results

VANCOUVER, BC / ACCESS Newswire / April 28, 2025 /Guanajuato Silver Company Ltd. (the "Company " or "GSilver ") (TSXV:GSVR)(OTCQX:GSVRF) is pleased to announce financial information and production results for the three and twelve months ended December 31, 2024. The Company 's consolidated financial statements for the fourth quarter and the year ended December 31, 2024 and Management 's Discussion and Analysis ( "MD&A ") thereon can be viewed under the Company 's profile at www.sedarplus.ca. All dollar amounts are in US dollars (US$) and prepared in accordance with IFRS Accounting Standards (IFRS) as issued by the International Accounting Standards Board. Production results are from the Company 's wholly owned El Cubo Mines Complex ( "El Cubo "), Valenciana Mines Complex (VMC), and the San Ignacio Mine ( "San Ignacio ") located in Guanajuato, Mexico, and the Topia Mine ( "Topia ") located in Durango, Mexico.

Selected Q4 2024 Highlights:

Positive mine operating income of $2,662,682 represents a 416% improvement over the previous quarter and is the third consecutive quarter of positive mine operating income.

EBITDA* up 587% over the previous quarter to $2,256,538. Adjusted EBITDA* up 96% over the same period to $1,750,081; this is also the third consecutive quarter of positive Adjusted EBITDA*.

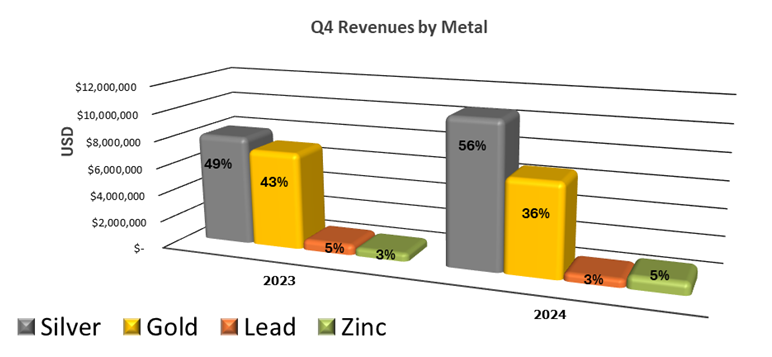

Revenue for the quarter of $19,038,311 represents a 4% increase over Q3 2024; this also represents a 15% increase in revenue over Q4, 2023. The average realized silver price for the quarter was $31.44. The average realized gold price for the quarter was $2664.40. Over 90% of the Company 's revenue is derived from the production and sale of silver and gold.

Production for the quarter was 730,485 silver equivalent ounces ( "AgEq "). Production consisted of 385,342 ounces of silver, 3,298 ounces of gold, 739,440 pounds of lead and 985,895 pounds of zinc. See Footnote 1 to the table in "Operating and Financial Highlights " for the details of the assumptions for the AgEq calculation.

Operating costs remained consistent with the previous quarter;cash cost of $19.84 per AgEq ounce was 6% higher than the previous quarter; All-In Sustaining Cost (AISC)* of $24.98 per AgEq ounce was 5% higher than Q3 2024; cost per tonne of $106.21 was 4% higher than Q3 2024.

James Anderson, CEO & Chairman, said, "Guanajuato Silver 's path towards establishing full mine profitability was confirmed during the 4th quarter; results in Q4 continued their positive trajectory as capex investments made over the previous 12-months continued to positively impact the business. Further evidence is shown in Mine Operating Cashflow moving from a negative $156K in 2023 to a positive $12.6M in 2024; importantly, Working Capital* also improved in 2024 by US$3.1M. Buoyed by higher precious metals prices, Guanajuato Silver completely retired two debt facilities in 2024, and with only one gold denominated loan still outstanding, our ultimate goal is to be a growing, debt-free precious metals producer. "

*EBITDA, (Earnings Before Interest, Taxes, Depreciation and Amortization) Adjusted EBITDA, AISC and working capital are non-IFRS financial measures with no standardized meaning under IFRS, and therefore they may not be comparable to similar measures presented by other issuers. For further information and detailed reconciliations of Non-IFRS financial measures to the most directly comparable IFRS measures see "Non-IFRS Financial Measures " in this News Release.

Q4 2024 OPERATING AND FINANCIAL HIGHLIGHTS

The following table summarizes the Company 's consolidated operating and financial results for the three months ended December 31, 2024 as compared to the three months ended September 30, 2024.

Silver equivalents are calculated using an 84.86:1 (Ag/Au), 0.03:1 (Ag/Pb) and 0.04:1 (Ag/Zn) ratio for Q4 2024; and an 84.04:1 (Ag/Au), 0.03:1 (Ag/Pb) and 0.04:1 (Ag/Zn) ratio for Q3 2024, respectively.

Cash cost per silver equivalent ounce includes mining, processing, and direct overhead. See Reconciliation to IFRS in the Non-IFRS Financial Measures section of this news release.

AlSC per AgEq oz includes mining, processing, direct overhead, corporate general and administration expenses, on-site exploration, reclamation, and sustaining capital. See Reconciliation to IFRS in the Non-IFRS Financial Measures section of this news release.

See Reconciliation of earnings before interest, taxes, depreciation, and amortization in the Non-IFRS Financial Measures section of this news release.

Mine Operating Cashflow Before Taxes, Cash cost per silver equivalent, cost per tonne, AISC per AgEq ounce, EBITDA, Adjusted EBITDA and working capital are non-IFRS financial measures with no standardized meaning under IFRS, and therefore they may not be comparable to similar measures presented by other issuers. For further information and detailed reconciliations of non-IFRS financial measures to the most directly comparable IFRS measures see "Non-IFRS Financial Measures " in the Non-IFRS Financial Measures section of this news release.

Based on provisional sales before final price adjustments, before payable metal deductions, treatment, and refining charges.

Mine operating cash flow before taxes is calculated by adding back depreciation, depletion, and inventory write-downs to mine operating loss. See Reconciliation to IFRS in the Non-IFRS Financial Measures section of this news release.

Year-end 2024 OPERATING AND FINANCIAL HIGHLIGHTS

The following table summarizes the Company 's consolidated operating and financial results for the years ended December 31, 2024 and 2023:

Silver equivalents are calculated using 84.48:1 (Ag/Au), 0.03:1 (Ag/Pb) and 0.05:1 (Ag/Zn) ratio for 2024 and an 82.91:1 (Ag/Au), 0.04:1 (Ag/Pb) and 0.05:1 (Ag/Zn) ratio for 2023, respectively.

Cash cost per silver equivalent ounce include mining, processing, and direct overhead. See Reconciliation to IFRS in the Non-IFRS Financial Measures section of this news release.

AISC per AgEq oz include mining, processing, direct overhead, corporate general and administration expenses, on-site exploration, reclamation, and sustaining capital. See Reconciliation to IFRS in the Non-IFRS Financial Measures section of this news release.

See Reconciliation of earnings before interest, taxes, depreciation, and amortization in the Non-IFRS Financial Measures section of this news release.

Mine Operating Cashflow Before Taxes, Cash cost per silver equivalent, cost per tonne, AISC per AgEq ounce, EBITDA, Adjusted EBITDA and working capital are non-IFRS financial measures with no standardized meaning under IFRS, and therefore they may not be comparable to similar measures presented by other issuers. For further information and detailed reconciliations of non-IFRS financial measures to the most directly comparable IFRS measures see the Non-IFRS Financial Measures section of this news release.

Based on provisional sales before final price adjustments, before payable metal deductions, treatment, and refining charges.

Mine operating cash flow before taxes is calculated by adding back depreciation, depletion, and inventory write-downs to mine operating loss. See Reconciliation to IFRS in the Non-IFRS Financial Measures section of this news release.

DERIVATIVES NOTE

27% of the net loss for the year was generated by the derivative stemming from the Gold Credit Facility with Ocean Partners UK Ltd. ( "Ocean Partners "); this is a non-cash loss that has no impact on the operations of the Company.

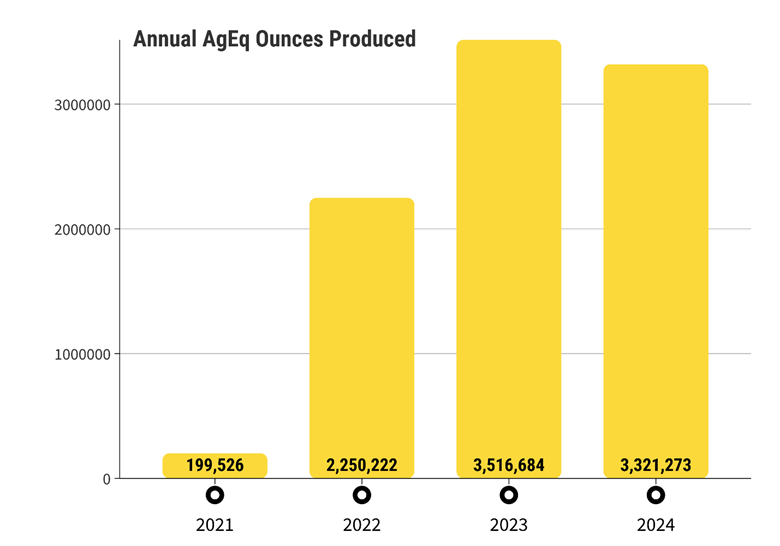

Silver equivalents are calculated using 84.48:1 (Ag/Au), 0.03:1 (Ag/Pb) and 0.05:1 (Ag/Zn) ratio for 2024, and 82.91:1 (Ag/Au), 0.04:1 (Ag/Pb) and 0.05:1 (Ag/Zn) ratio for 2023, and 83.22:1 (Ag/Au), 0.05:1 (Ag/Pb) and 0.07:1 (Ag/Zn) ratio for YTD 2022, respectively. Silver equivalents for 2021 are calculated using 80:1 (Ag/Au) for Q4 2021.

NEW GOLD CREDIT FACILITY

The Company is also pleased to announce that amended terms of the Gold Credit Facility with Ocean Partners UK Ltd. ( "Ocean Partners ") have been agreed (subject to final documentation) to provide Guanajuato Silver with greater financial flexibility over the duration of the new Gold Loan Credit Facility (the "New Facility "). Under the terms of the New Facility, two-thirds of the outstanding balance will be amortized over 36 months starting April 2025, and repayable in equal fixed installments of 131.7 ounces of gold bullion, representing approximately 10% of Guanajuato Silver 's monthly modelled gold production. The remaining one-third of the outstanding balance, 2,366 gold ounces, will be paid on conclusion of the 36-month term. The New Facility will reduce payments by over 206 gold ounces per month, or approximately $700,000 monthly based on current gold prices. The Company 's silver production remains completely unhedged.

James Anderson, Chairman & CEO, said, "Our association with Ocean Partners has been among the most successful partnerships we have formed to date in Mexico. The willingness of Ocean Partners to help create solutions that improve our business has been an important component of our success. In addition to providing for improved financial flexibility, the New Facility will allow for increased capital deployment toward exploration and development opportunities. We look forward to continuing our relationship with Ocean Partners as we build Mexico 's next mid-tier precious metals producer. "

In connection with the terms of the New Facility, and subject to TSX Venture Exchange approval, 4,550,000 warrants with an exercise price of C$0.24 will be issued to Ocean Partners; the warrants have a 36-month term.

NON-IFRS FINANCIAL MEASURES

The Company has disclosed certain non-IFRS financial measures and ratios in this MD&A, as discussed below. These non-IFRS financial measures and non-IFRS ratios are widely reported in the mining industry as benchmarks for performance and are used by Management to monitor and evaluate the Company 's operating performance and ability to generate cash. The Company believes that, in addition to financial measures and ratios prepared in accordance with IFRS, certain investors use these non-IFRS financial measures and ratios to evaluate the Company 's performance. However, the measures do not have a standardized meaning under IFRS and may not be comparable to similar financial measures disclosed by other companies. Accordingly, non-IFRS financial measures and non-IFRS ratios should not be considered in isolation or as a substitute for measures and ratios of the Company 's performance prepared in accordance with IFRS.

Non-IFRS financial measures are defined in National Instrument 52-112 - Non-GAAP and Other Financial Measures Disclosure ( "NI 52-112 ") as a financial measure disclosed that (a) depicts the historical or expected future financial performance, financial position or cash flow of an entity, (b) with respect to its composition, excludes an amount that is included in, or includes an amount that is excluded from, the composition of the most directly comparable financial measure disclosed in the primary financial statements of the entity, (c) is not disclosed in the financial statements of the entity, and (d) is not a ratio, fraction, percentage or similar representation.

A non-IFRS ratio is defined by NI 52-112 as a financial measure disclosed that (a) is in the form of a ratio, fraction, percentage, or similar representation, (b) has a non-IFRS financial measure as one or more of its components, and (c) is not disclosed in the financial statements.

WORKING CAPITAL

Working capital is a non-IFRS measure that is a common measure of liquidity but does not have any standardized meaning. The most directly comparable measure prepared in accordance with IFRS is current assets net of current liabilities. Working capital is calculated by deducting current liabilities from current assets. Working capital should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. The measure is intended to assist readers in evaluating the Company 's liquidity.

MINE OPERATING CASH FLOW BEFORE TAXES

Mine operating cash flow before taxes is a non-IFRS measure that does not have a standardized meaning prescribed by IFRS and therefore may not be comparable to similar measures presented by other issuers. Mine operating cash flow is calculated as revenue minus production costs, transportation and selling costs and inventory changes. Mine operating cash flow is used by management to assess the performance of the mine operations, excluding corporate and exploration activities, and is provided to investors as a measure of the Company 's operating performance.

EBITDA

EBITDA is a non-IFRS financial measure, which excludes the following from net earnings:

Income tax expense;

Finance costs;

Amortization and depletion.

Adjusted EBITDA excludes the following additional items from EBITDA:

Share based compensation;

Non-recurring impairments (reversals);

Loss (gain) on derivative;

Significant other non-routine finance items.

Management believes EBITDA is a valuable indicator of the Company 's ability to generate liquidity by producing operating cash flow to fund working capital needs, service debt obligations, and fund capital expenditures. Management uses EBITDA for this purpose. EBITDA is also frequently used by investors and analysts for valuation purposes whereby EBITDA is multiplied by a factor or "EBITDA multiple " based on an observed or inferred relationship between EBITDA and market values to determine the approximate total enterprise value of a Company. Management believes that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results because it is consistent with the indicators management uses internally to measure the Company 's performance and is an indicator of the performance of the Company 's mining operations.

Cash Cost per AgEq Ounce, All-In Sustaining Cost per AgEq Ounce and Production Cost per Tonne

Cash costs per silver equivalent oz and production costs per tonne are measures developed by precious metals companies in an effort to provide a comparable standard; however, there can be no assurance that the Company 's reporting of these non-IFRS measures and ratios are similar to those reported by other mining companies. Cash costs per silver equivalent ounce and total production cost per tonne are non-IFRS performance measures used by the Company to manage and evaluate operating performance at its operating mining unit, in conjunction with the related IFRS amounts. They are widely reported in the silver mining industry as a benchmark for performance, but do not have a standardized meaning and are disclosed in addition to IFRS measures. Production costs include mining, milling, and direct overhead at the operation sites. Cash costs include all direct costs plus royalties and special mining duty. Total production costs include all cash costs plus amortization and depletion, changes in amortization and depletion in finished goods inventory and site share-based compensation. Cash costs per silver equivalent ounce is calculated by dividing cash costs and total production costs by the payable silver ounces produced. Production costs per tonne are calculated by dividing production costs by the number of processed tonnes. The following tables provide a detailed reconciliation of these measures to the Company 's direct production costs, as reported in its consolidated financial statements.

AISC is a non-IFRS performance measure and was calculated based on guidance provided by the World Gold Council ( "WGC "). WGC is not a regulatory industry organization and does not have the authority to develop accounting standards for disclosure requirements. Other mining companies may calculate AISC differently as a result of differences in underlying accounting principles and policies applied, as well as differences in definitions of sustaining capital expenditures. AISC is a more comprehensive measure than cash cost per ounce and is useful for investors and management to assess the Company 's operating performance by providing greater visibility, comparability and representation of the total costs associated with producing silver from its current operations, in conjunction with related IFRS amounts. AISC helps investors to assess costs against peers in the industry and help management assess the performance of its mine.

AISC includes total production costs (IFRS measure) incurred at the Company 's mining operation, which forms the basis of the Company 's total cash costs. Additionally, the Company includes sustaining capital expenditures, corporate general and administrative expense, operating lease payments and reclamation cost accretion. The Company believes this measure represents the total sustainable costs of producing silver and gold concentrate from current operations and provides additional information of the Company 's operational performance and ability to generate cash flows. As the measure seeks to reflect the full cost of silver and gold concentrate production from current operations, new projects capital at current operation is not included. Certain other cash expenditures, including share-based payments, tax payments, dividends and financing costs are also not included.

The following tables provide detailed reconciliations of these measures to cost of sales, as reported in notes to the Company 's consolidated financial statements.

Silver equivalents are calculated using 84.86:1 (Ag/Au), 0.03:1 (Ag/Pb) and 0.04:1 (Ag/Zn) ratio for Q4 2024; an 85.11:1 (Ag/Au), 0.04:1 (Ag/Pb) and 0.05:1 (Ag/Zn) ratio for Q4 2023, respectively.

Cash cost per silver equivalent ounce includes mining, processing, and direct overhead.

AISC per oz includes mining, processing, direct overhead, corporate general and administration expenses, on-site exploration, reclamation, and sustaining capital.

Production costs include mining, milling, and direct overhead at the operation sites.

Consolidated amount for the three months ended December 31, 2024, excludes $8,563 in relation to silver bullion transportation and selling cost from cost of sales.

Silver equivalents are calculated using an 84.48:1 (Ag/Au), 0.03:1 (Ag/Pb) and 0.05:1 (Ag/Zn) ratio for YTD 2024; and an 82.91:1 (Ag/Au), 0.04:1 (Ag/Pb) and 0.05:1 (Ag/Zn) ratio for YTD 2023, respectively.

Cash cost per silver equivalent ounce include mining, processing, and direct overhead.

AISC per oz include mining, processing, direct overhead, corporate general and administration expenses, on-site exploration, reclamation, and sustaining capital.

Production costs include mining, milling, and direct overhead at the operation sites.

Consolidated amount for the year ended December 31, 2024, excludes $43,130 in relation to silver bullion transportation and selling cost from cost of sales.

Stock Option Grant

In addition, the Company will grant a total of 7,700,000 stock options to directors, officers and employees of the Company. The stock options will be granted on April 28th, 2025, have an exercise price of C$0.20 and expire on April 28th, 2030.

Qualified Person

William Gehlen, a Director of Guanajuato Silver, is a Certified Professional Geologist with the American Institute of Professional Geologists (No. 10626), and a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

Mr. Gehlen has reviewed and verified technical data disclosed in this news release and detected no significant QA/QC issues during review of the data and is not aware of any sampling, recovery or other factors that could materially affect the accuracy or reliability of the drilling data referred to herein. The verification of data underlying the disclosed information includes reviewing compiled assay data; QA-QC performance of blank samples, duplicates and certified reference materials, grade calculation formulas and production reports from each of the Company 's mining operations.

About Guanajuato Silver

GSilver is a precious metals producer engaged in reactivating past producing silver and gold mines in central Mexico. The Company produces silver and gold concentrates from the El Cubo Mine, Valenciana Mines Complex, and the San Ignacio mine; all three mines are located within the state of Guanajuato, which has an established 480-year mining history. Additionally, the Company produces silver, gold, lead, and zinc concentrates from the Topia mine in northwestern Durango. With four operating mines and three processing facilities, Guanajuato Silver is one of the fastest growing silver producers in Mexico.

ON BEHALF OF THE BOARD OF DIRECTORS

"James Anderson "

Chairman and CEO

For further information regarding Guanajuato Silver Company Ltd., please contact:

JJ Jennex, Gerente de Comunicaciones, T: 604 723 1433

E: jjj@GSilver.com

GSilver.com

Guanajuato Silver Bullion Store

Please visit our Bullion Store, where Guanajuato Silver coins and bars can be purchased.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains certain forward-looking statements and information, which relate to future events or future performance including, but not limited to, GSilver 's growth, the path towards establishing full mine profitability, the positive trajectory resulting from capex investments made over the previous 12-months, the goal is to be a growing, debt-free precious metals producer, the terms of the proposed Ocean Partners New Facility and its impact on GSilver 's finances, increased capital deployment toward exploration and development opportunities, becoming Mexico 's next mid-tier precious metals producer and GSilver 's status as one of the fastest growing silver mining company in Mexico.

Such forward-looking statements and information reflect management 's current beliefs and are based on information currently available to and assumptions made by the Company; which assumptions, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include: that definitive documentation will be concluded for the New Facility, that the TSX Venture Exchange will approve the New Facility; the potential quantity, grade and metal content of the mineralized material at El Cubo and San Ignacio, the geotechnical and metallurgical characteristics of such material conforming to sampled results and metallurgical performance; available tonnage of mineralized material to be mined and processed; resource grades and recoveries; assumptions and discount rates being appropriately applied to production estimates; prices for silver, gold and other metals remaining as estimated; currency exchange rates remaining as estimated; availability of funds for the Company 's projects and to satisfy current liabilities and obligations including debt repayments; capital, decommissioning and reclamation estimates; prices for energy inputs, labour, materials, supplies and services (including transportation) and inflation rates remaining as estimated; no labour-related disruptions; no unplanned delays or interruptions in scheduled construction and production; all necessary permits, licenses and regulatory approvals are received in a timely manner; and the ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

Readers are cautioned that such forward-looking statements and information are neither promises nor guarantees, and are subject to risks and uncertainties that may cause future results, level of activity, production levels, performance or achievements of GSilver to differ materially from those expected including, but not limited to, failure to conclude definitive documentation for the New Facility; the TSX Venture Exchange does not approve the New Facility; market conditions, availability of financing, currency rate fluctuations, high inflation and interest rates, tariffs, geopolitical conflicts including wars, actual results of exploration, development and production activities, actual grades and recoveries of silver, gold and other metals from the Company 's existing mines including El Cubo, San Ignacio, VMC and Topia, availability of third party mineralized material for processing, unanticipated geological or structural formations and characteristics, environmental risks, future prices of gold, silver and other metals, operating risks, accidents, labor issues, equipment or personnel delays, delays in obtaining governmental or regulatory approvals and permits, inadequate insurance, and other risks in the mining industry. There are no assurances that GSilver will be able to continue to increase production, tonnage milled and recoveries rates, improve grades and reduce costs at El Cubo, San Ignacio, VMC and/or Topia to process mineralized materials to produce silver, gold and other concentrates in the amounts, grades, recoveries, costs and timetable anticipated. In addition, GSilver 's decision to process mineralized material from El Cubo, San Ignacio, VMC and Topia is not based on a feasibility study of mineral reserves demonstrating economic and technical viability and therefore is subject to increased uncertainty and risk of failure, both economically and technically. Mineral resources and mineralized material that are not Mineral Reserves do not have demonstrated economic viability, are considered too speculative geologically to have the economic considerations applied to them, and may be materially affected by environmental, permitting, legal, title, socio-political, marketing, and other relevant issues. There are no assurances that the Company 's projected grades of gold and silver at El Cubo and San Ignacio and the anticipated level of production therefrom will be realized. In addition, there are no assurances that the Company will meet its production forecasts or generate the anticipated cash flows from operations to satisfy its scheduled debt payments or other liabilities when due or meet financial covenants to which the Company is subject or to fund its exploration programs and corporate initiatives as planned. There is also uncertainty about impact of any future global pandemic, the ongoing war in Ukraine and conflict in Gaza, elevated inflation and interest rates and the impact they will have on the Company 's operations, supply chains, ability to access mining projects or procure equipment, contractors and other personnel on a timely basis or at all and economic activity in general. Accordingly, readers should not place undue reliance on forward-looking statements or information. All forward-looking statements and information made in this news release are qualified by these cautionary statements and those in our continuous disclosure filings available on SEDAR+ at www.sedarplus.ca including the Company 's most recently filed annual information form. These forward-looking statements and information are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances save as required by law.

SOURCE:Guanajuato Silver Company Ltd.

View the original press release on ACCESS Newswire

© 2025 ACCESS Newswire. All Rights Reserved.