Meridian Appoints Ausenco Brazil as Lead Engineer for the Cabaçal Definitive Feasibility Study and Signs LOI with Aurubis AG

Highlights:

Meridian has engaged Ausenco do Brasil Engenharia Ltda. (Ausenco) to undertake a definitive feasibility study ( "DFS ") of the Cabaçal Au-Cu project;

DFS targeted to be completed prior to the end of 1H 2026.

Meridian Signs Corporate Agreement with Aurubis AG, Europe 's largest smelter group;

Meridian and Aurubis to establish technical exchange to optimize Cabaçal 's Cu + Au-Ag sulphide concentrates:

Optimize Cabaçal 's Cu +Au-Ag sulphide concentrates for flash (copper) smelter performance;

Establishment of corporate framework to advance the export of Cabaçal 's future Cu-Au-Ag concentrates to Europe;and

To advance Meridian 's compliance with the EU Supply Chain Due Diligence Act and the OECD Due Diligence.

LONDON, UK / ACCESS Newswire / May 8, 2025 /Meridian Mining UK S (TSX:MNO)(Frankfurt/Tradegate:2MM)(OTCQX:MRRDF) ( "Meridian " or the "Company ") is pleased to announce that it has appointed Ausenco do Brasil Engenharia Ltda ( "Ausenco ") to undertake the Definitive Feasibility Study ( "the DFS ") for its advanced Cabaçal Au-Cu project ( "Cabaçal "), located in Mato Grosso, Brazil. Ausenco is an internationally respected engineering firm with extensive global and Brazilian experience in conducting feasibility studies on projects similar to the scale of Cabaçal. On completion of the DFS, Meridian will be positioned to make a final investment decision on the Cabaçal build in 2026.

Mr. Gilbert Clark, CEO, comments: "Having completed the PEA and PFS on Cabaçal, the later delivering nearly a billion dollars in NPV for Cabaçal, I 'm delighted to continue this long-term relationship with Ausenco by having them perform Cabaçal 's DFS. With Ausenco 's "A " team on the DFS who are already familiar with Cabaçal means that we can kick off the study immediately, progress it rapidly, and after its potential successful reporting, focus on the build.

I 'm very pleased to have established an important corporate relationship with Aurubis that will greatly help to grow the Company from being a resource developer to a mining and exporting company. With the Agreement, we can now start preparing the Company to be compliant with the import regulations of Germany and the European Union, look to access strategic European equity and project financing facilities while maintaining our schedule to be Brazil 's next near-term copper-gold-silver concentrate exporter ".

Cabaçal Definitive Feasibility Study Launch

Cabaçal 's Pre-Feasibility Study (effective date March 10, 2025) delivered strong economic results with a base case after-tax NPV5 of USD 984 million and 61.2% IRR from a pre-production capital cost of USD 248 million ( "the PFS "). This provides a strong platform from which to launch Cabaçal 's DFS and it is expected that the core elements of the PFS will be further developed to the DFS level with minimal change.

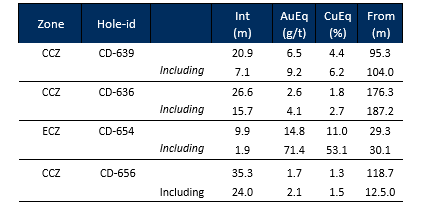

An updated resource and mine plan will be produced using drill results obtained after the PFS database was cut off. This will include such recent highlighted drill results1 of :

Cabaçal 's process flowsheet is expected to remain similar to that devised for the PFS with a moderately finer primary grind to be adopted.

Ausenco has developed a schedule to complete Cabaçal 's DFS and the time needed to generate the additional data required for the study 's completion. This indicates that the study should be completed before the end of 1H 2026. The company has advanced on complementary contracts related to the DFS with groups such as Brazil 's GE21 who were part of the PFS success.

Aurubis LOI

Meridian and Aurubis ( "together the Parties ") - a globally leading non-ferrous metals group - have signed a non-binding Letter of Intent to initiate a long-term corporate relationship and technical exchange to optimize Cabaçal 's future high-quality copper-gold-silver sulphide concentrates ( "the LOI "). The Parties will explore and exchange technical ideas to optimize future Cabaçal clean high-grade copper concentrate, with payable gold and silver credits, as outlined in Cabaçal 's PFS, for Outotec flash smelter performance. Flash smelters are the most common type of copper smelters in Europe, where Aurubis operates two sites; Hamburg (Germany) and Zlatitsa-Pirdop (Bulgaria).

The Parties will also work together to advance Meridian 's future compliance to the EU Supply Chain Due Diligence Act and the OECD Due Diligence Guidance. The result of this co-operation by the Parties is that the Company will be prepared for the future regulatory compliance to export Cabaçal 's copper concentrates to the 3rd largest market for copper concentrates, the European Union.

Strategic Equity and Project Finance Process

Meridian is actively engaging with international and domestic project finance banks and funds to advance the project financing process alongside the progress of the DFS. The LOI presents an opportunity to potentially access both debt and equity capital from German and other European government-backed institutions. This includes debt guarantees under the UFK Untied Loan Guarantee scheme and equity from the KfW2-managed Raw Materials Fund. Meridian 's management has over a decade of funds management and banking relationships with KfW. Such future arrangements would be associated with a copper concentrate off-take agreement, of a proportion of Cabaçal 's production, that would benefit a smelter group such as Aurubis or European manufacturers requiring copper units.

About Meridian

Meridian Mining is focused on:

The development and exploration of the advanced stage Cabaçal VMS gold‐copper project;

The initial resource definition at the second higher-grade VMS asset at Santa Helena as the first stage of the Cabaçal Hub development strategy;

Regional scale exploration of the Cabaçal VMS belt to expand the Cabaçal Hub strategy; and

Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil).

The Pre-feasibility Study technical report (the "PFS Technical Report ") dated March 31, 2025, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Pre-feasibility Study " outlines a base case after-tax NPV5 of USD 984 million and 61.2% IRR from a pre-production capital cost of USD 248 million, leading to capital repayment in 17 months (assuming metals price scenario of USD 2,119 per ounces of gold, USD 4.16 per pound of copper, and USD 26.89 per ounce of silver). Cabaçal has a low All-in-Sustaining-Cost of USD 742 per ounce gold equivalent & production profile of 141,000-ounce gold equivalent life of mine, driven by high metallurgical recovery, a low life-of-mine strip ratio of 2.3:1, and the low operating cost environment of Brazil.

The Cabaçal Mineral Reserve estimate consists of Proven and Probable reserves of 41.7 million tonnes at 0.63g/t gold, 0.44% copper and 1.64g/t silver (at a 0.25 g/t gold equivalent cut-off grade).

Readers are encouraged to read the PFS Technical Report in its entirety. The PFS Technical Report may be found under the Company 's profile on SEDAR+ at www.sedarplus.ca and on the Company 's website at www.meridianmining.co

The PFS Technical Report was prepared for the Company by Tommaso Roberto Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering Canada ULC; Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering Canada ULC; John Anthony McCartney, C.Geol., Ausenco Chile Ltda.; Porfirio Cabaleiro Rodriguez (Engineer Geologist FAIG), of GE21 Consultoria Mineral; Leonardo Soares (PGeo, MAIG), Senior Geological Consultant of GE21 Consultoria Mineral; Norman Lotter (Mineral Processing Engineer; P.Eng.), of Flowsheets Metallurgical Consulting Inc.; and, Juliano Felix de Lima (Engineer Geologist MAIG), of GE21 Consultoria Mineral.

On behalf of the Board of Directors of Meridian Mining UK S

Mr. Gilbert Clark - CEO and Director

Meridian Mining UK S

8th Floor, 4 More London Riverside

London SE1 2AU

United Kingdom

Email: info@meridianmining.co

Ph: +1 778 715-6410 (BST)

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at: www.meridianmining.co

Cautionary Statement on Forward-Looking Information

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors " in Meridian 's most recent Annual Information Form filed on www.sedarplus.ca. While these factors and assumptions are considered reasonable by Meridian, in light of management 's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

1 Meridian Mining News Releases of February 24, 2025 and April 29, 2025.

2 KfW, "Kreditanstalt fuer Wiederaufbau ",is the German state-owned investment and development bank, based in Frankfurt

SOURCE: Meridian Mining SE

View the original press release on ACCESS Newswire

© 2025 ACCESS Newswire. All Rights Reserved.

BREAKING NEWS: Crown Equity Holdings, Inc. Announces Partnership