Storm Exploration Enters Agreement to Sell the Miminiska Project

VANCOUVER, BC / ACCESS Newswire / December 1, 2025 /Storm Exploration Inc. (TSXV:STRM) ( "Storm " or the "Company ") is pleased to announce that it has entered into a mineral property purchase agreement (the "Definitive Agreement ") dated November 28, 2025 with European Electric Metals Inc. (TSXV: EVX) ( "European Electric "), pursuant to which Storm will sell, subject to the satisfaction of certain conditions, its interest in the Miminiska Project, located in northwestern Ontario, that Storm will acquire by exercising its option to acquire the Mininiska Project pursuant to an existing option agreement dated May 5, 2021, as amended (the "Option Agreement ") between Storm and Landore Resources Canada Inc. ( "Landore ") (collectively, the "Transaction "). The Transaction is an arm 's length transaction. The total consideration to be paid by European Electric includes cash and share payments equal to an aggregate of $5,812,500. The Company advises that trading in its common shares will remain halted pending receipt and review of acceptable documentation by the TSXV pursuant to Section 5.6 (d) of TSXV Policy 5.3.

"This an excellent opportunity for Storm. The proposed transaction provides the Company with a robust treasury to explore the Keezhik, Attwood and Gold Standard properties. These three district scale properties cover more than 400 km2 of prospective geology, including the Keezhik Project where historical drilling has confirmed high-grade gold intersections, " commented Bruce Counts, President and CEO of Storm Exploration Inc. "In addition, the proposed transaction will allow Storm to retain exposure to the potential for the discovery of a significant gold deposit at Miminiska through the issuance of shares in European Electric Metals. "

Transaction Terms

Cash Payments

Pursuant to the Definitive Agreement, European Electric will make cash payments totaling $3,525,000 as follows:

$200,000 non-refundable deposit (the "Deposit ") to Storm upon European Electric 's receipt of the TSX Venture Exchange 's (the "TSXV ") written confirmation that they do not object to payment of the Deposit;

$1,800,000 on the closing date of the Transaction (the "Closing Date "), $1,312,500 of which will be delivered to Landore in satisfaction of Storm 's remaining option payment under the Option Agreement (the "Option Payment ");

$1,000,000 within three (3) months of the Closing Date; and

$525,000 within nine (9) months of the Closing Date;

Share Payments

Pursuant to the Definitive Agreement, European Electric will issue an aggregate of $2,287,500 in common shares of European Electric (the "EVX Shares ") to Storm as follows:

7,500,000 EVX Shares (the "First Consideration Shares "), with an issuance price of $0.20, which equals an aggregate of $1,500,000 in EVX Shares; and

$787,500 in EVX Shares on the 9-month anniversary of the Closing Date, issued at the 30-day volume-weighted-average price of EVX Shares on the date that is five business days prior to the issuance date, subject to a minimum price equal to the "Discounted Market Price " (as such term is defined in the policies of the TSXV).

In addition, the First Consideration Shares issued to Storm will be subject to voluntary resale restrictions with 25% of the First Consideration Shares being locked-up for 4 months following the Closing Date, 25% of the First Consideration Shares being locked-up for 8 months following the Closing Date, 25% of the First Consideration Shares being locked-up for 12 months following the Closing Date, and the remaining 25% of the First Consideration Shares being locked up for a period of 12 months following the Closing Date.

Existing Option Agreement

Storm currently has an option to acquire a 100% interest in the Miminiska Project and the Keezhik Project pursuant to the Option Agreement. On the Closing Date, upon receipt of the Option Payment, Storm will exercise its option under the Option Agreement and acquire its interest in and to both the Miminiska Project and the Keezhik Project. Under the Transaction, Storm will sell its interest in the Miminiska Project and will retain its interest in the Keezhik Project.

Underlying Agreements and Property Obligations

Pursuant to the Definitive Agreement:

subject to the Eabametoong First Nation 's ( "EFN ") consent, Storm will (a) assign and novate, all of its right, title and obligations with respect to the Miminiska Project under the exploration agreement with the EFN dated May 16, 2024, and further amended on April 29, 2025 (the "Exploration Agreement "), and (b) retain all of its right, title and obligations with respect to the remaining portions of the properties under the Exploration Agreement;

European Electric will assume the obligations and liabilities with respect to the Miminiska Project under the royalty agreement to be entered into with Landore upon Storm 's exercise of its option pursuant to the Option Agreement; and

European Electric will assume all obligations and liabilities associated with the ownership, use or operation of the Miminiska Project, including all pre-existing royalty obligations.

Upon Storm 's exercise of its option under the Option Agreement, the Company will enter into a royalty agreement with Landore with respect to the Keezhik Project, whereby Landore will be entitled to receive 2.0% of "Net Smelter Returns " (as defined in such royalty agreement), which may be reduced to 1.0% of Net Smelter Returns in accordance with such royalty agreement.

Conditions to Closing

The completion of the Transaction is conditional on, among other things:

the parties ' receipt of all necessary regulatory and third party consents, approvals and authorizations, including the approval of the TSXV and the consent of the EFN;

Storm 's receipt of any necessary shareholder approval in respect of the Transaction, if required under the TSXV policies;

European Electric 's completion of a concurrent equity financing for minimum gross proceeds of $5,000,000; and

Other standard closing conditions for a transaction of this nature.

There are no finder 's fee payable in connection with the Transaction and the Company and its insiders do not have any relationship with European Electric.

Next Steps for Storm Exploration

Storm plans to advance its three projects, with drilling at Gold Standard set for Q2 2026 and Keezhik for Q3 2026.

Gold Standard

The Gold Standard Project is situated approximately 60 kilometres north of the community of Fort Francis and encompasses 6,018 hectares of mineral claims, with road access available. Storm has established exploration agreements with the Naicatchewenin and Nigigoonsiminikaaning First Nations, whose traditional territory includes the project area.

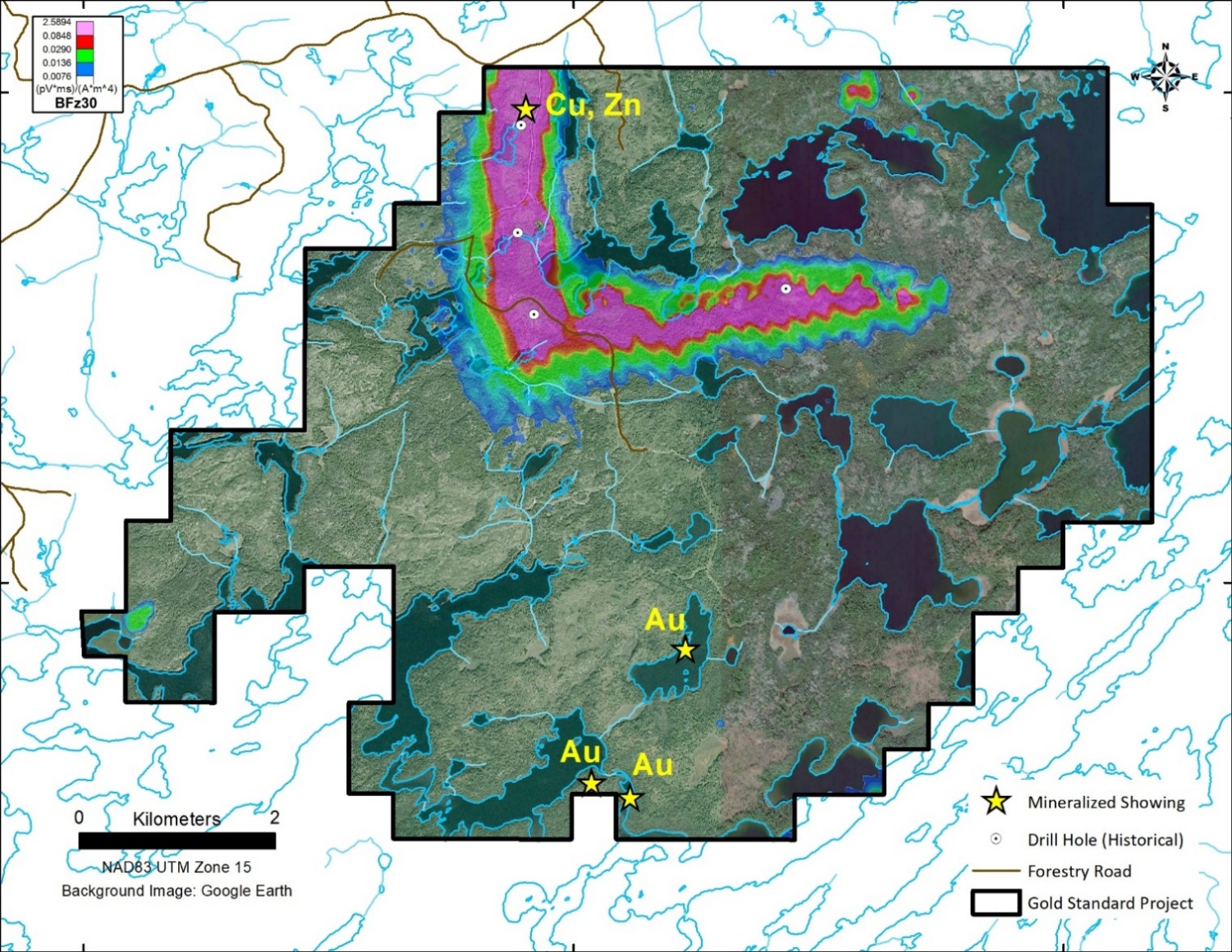

Figure 1: Gold Standard Conductivity Anomaly - 2022 VTEM Survey

Storm plans to evaluate a significant conductivity anomaly stretching over five kilometres which has been interpreted as potential Volcanogenic Massive Sulphide ( "VMS ") mineralization. This hypothesis is supported by results from four shallow exploratory holes drilled by Inco Limited in 1969 and 1970, which recorded copper and zinc mineralization in three of the four holes, although no assay data was reported.

The anomaly sits along the limbs of an apparent fold next to the Manitou Straits shear zone in the property 's southwest corner, where gold-bearing quartz veins were mined between 1901 and 1903. Existing forestry roads offer straightforward and cost-effective access to the anomaly.

Planned ground exploration will include geophysical surveys, prospecting, and geological mapping across the anomaly 's length, with drilling anticipated to begin in the second quarter of 2026.

Keezhik Project

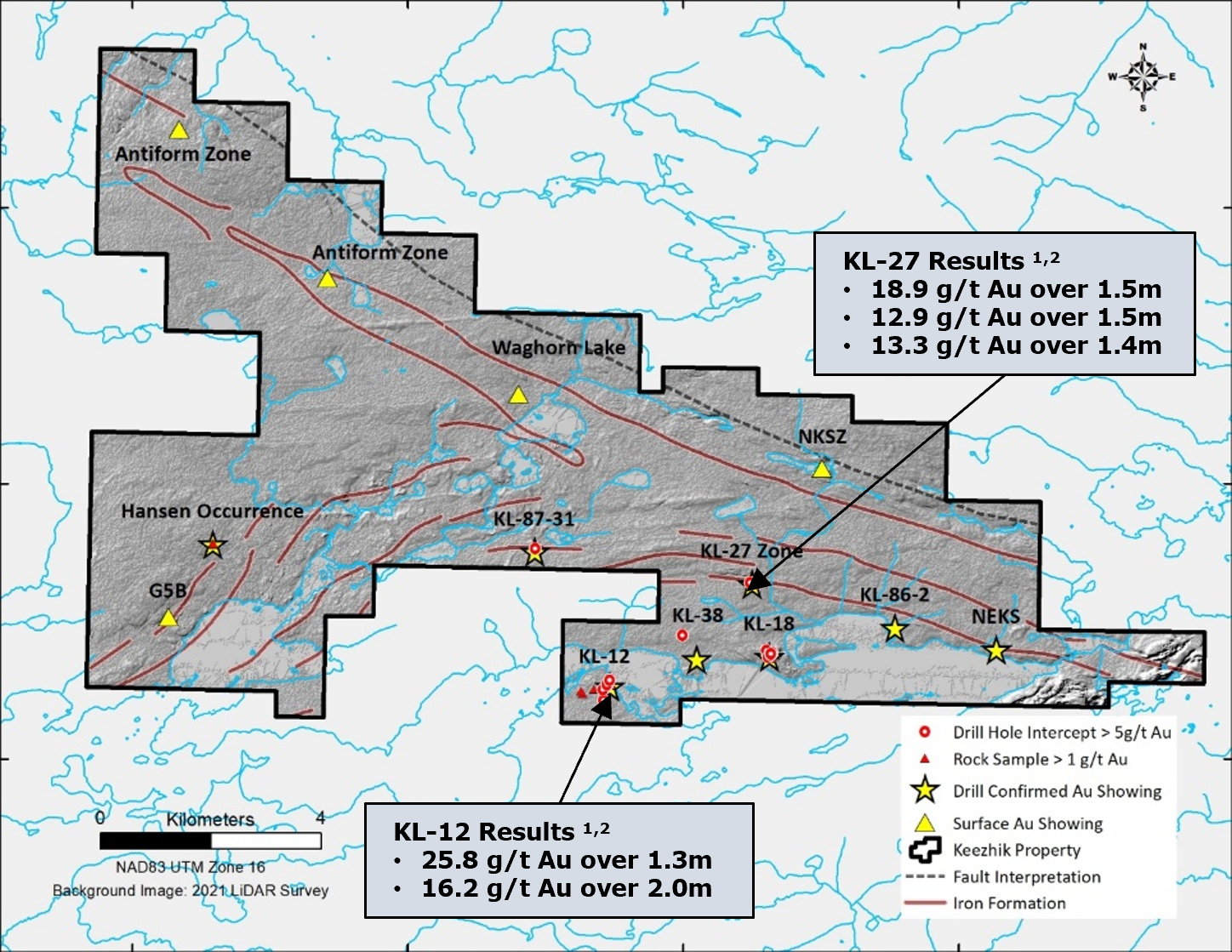

Figure 2: Keezhik Property

1Historical results have not been independently verified by Storm Exploration; and, there is no guarantee that the Company can reproduce the results in whole or in part. Potential investors should not rely on these historical results when making an investment decision

2NI 43-101 Technical Report on the Keezhik Lake Project: A. MacTavish, P.Geol & J. Arnold, P.Geol., 9-Oct-2007

The Keezhik Project is situated within the Miminiska-Fort Hope greenstone belt, approximately 380 kilometers north of Thunder Bay, Ontario. The property is located within the traditional territory of the Eabametoong First Nation, with whom the Company has entered into an exploration agreement.

Eight drill-confirmed gold showings have been identified on the property (see Figure 1). The exploration strategy at Keezhik will utilize a dual approach.

Exploration efforts will focus on the KL-12 and KL-27 showings, where historical assays have recorded 16.2g/t Au over 2.0m¹,² and 18.9g/t Au over 1.5m¹,², respectively. Ground geophysical surveys, soil sampling, prospecting, and geological mapping are planned to define and prioritize targets in advance of a drilling program scheduled in the third quarter of 2026.

Concurrently, the Company will undertake project-wide reconnaissance exploration aimed at identifying new targets. A comprehensive airborne magnetic and electromagnetic survey is planned for early 2026, to be followed by regional prospecting, sampling, and geological mapping.

Qualified Person

The technical contents of this news release have been reviewed and approved by Bruce Counts, P. Geo., President and CEO of Storm Exploration Inc. and Qualified Person under National Instrument 43-101.

About Storm Exploration Inc.

Storm Exploration is a Canadian mineral exploration company focused on the discovery and development of economic precious and base metal deposits on three district-scale projects in northwest Ontario: Keezhik, Attwood and Gold Standard.

For further information, please contact:

Storm Exploration Inc.

T: +1 (604) 506-2804

E: bcounts@stormex.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) has reviewed or accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Information

This news release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends ", "expects " or "anticipates ", or variations of such words and phrases or statements that certain actions, events or results "may ", "could ", "should ", "would " or will "potentially " or "likely " occur. This information and these statements, referred to herein as "forward-looking statements ", are not historical facts, are made as of the date of this news release and include without limitation, statements relating to the closing of the Transaction and the satisfaction of the related conditions precedent, Storm 's exercise of the option under the Option Agreement and the timing thereof, the entering into of the exploration agreement with EFN and the royalty agreement with Landore, the perceived benefits of the Transaction, Storm 's plans for drilling at Gold Standard and Keezhik, and the timing thereof, and ground exploration plans.

These forward-looking statements involve numerous risks and uncertainties, and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things: the parties receiving any necessary regulatory approvals or third-party consents, including the approval of the TSXV and the EFN 's consent; the receipt of necessary shareholder approval; European Electric 's completion of the Concurrent Financing, the inherent risks and uncertainties associated with the Transaction; the Company 's financial condition and exploration plans; and general business, economic, competitive, political and social uncertainties, as well as the other risks and uncertainties applicable to mineral exploration activities. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, that the receipt of any necessary regulatory approvals and third-party consents; the receipt of any necessary shareholder approval, and the current and future social, economic and political conditions. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended.

There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those expressed or implied in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. Readers are encouraged to read the Company 's continuous disclosure documents filed with the securities regulatory authorities in certain provinces of Canada and available at www.sedarplus.ca.

SOURCE:Storm Exploration Inc.

View the original press release on ACCESS Newswire

© 2025 ACCESS Newswire. All Rights Reserved.