Mako Mining Intersects 18.34 g/t Au over 4.2 m Estimated True Width, 48 m Below Surface, Extending El Golfo Strike Length to 630 m and Announces Receipt of Underground Mining Permit at Las Conchitas

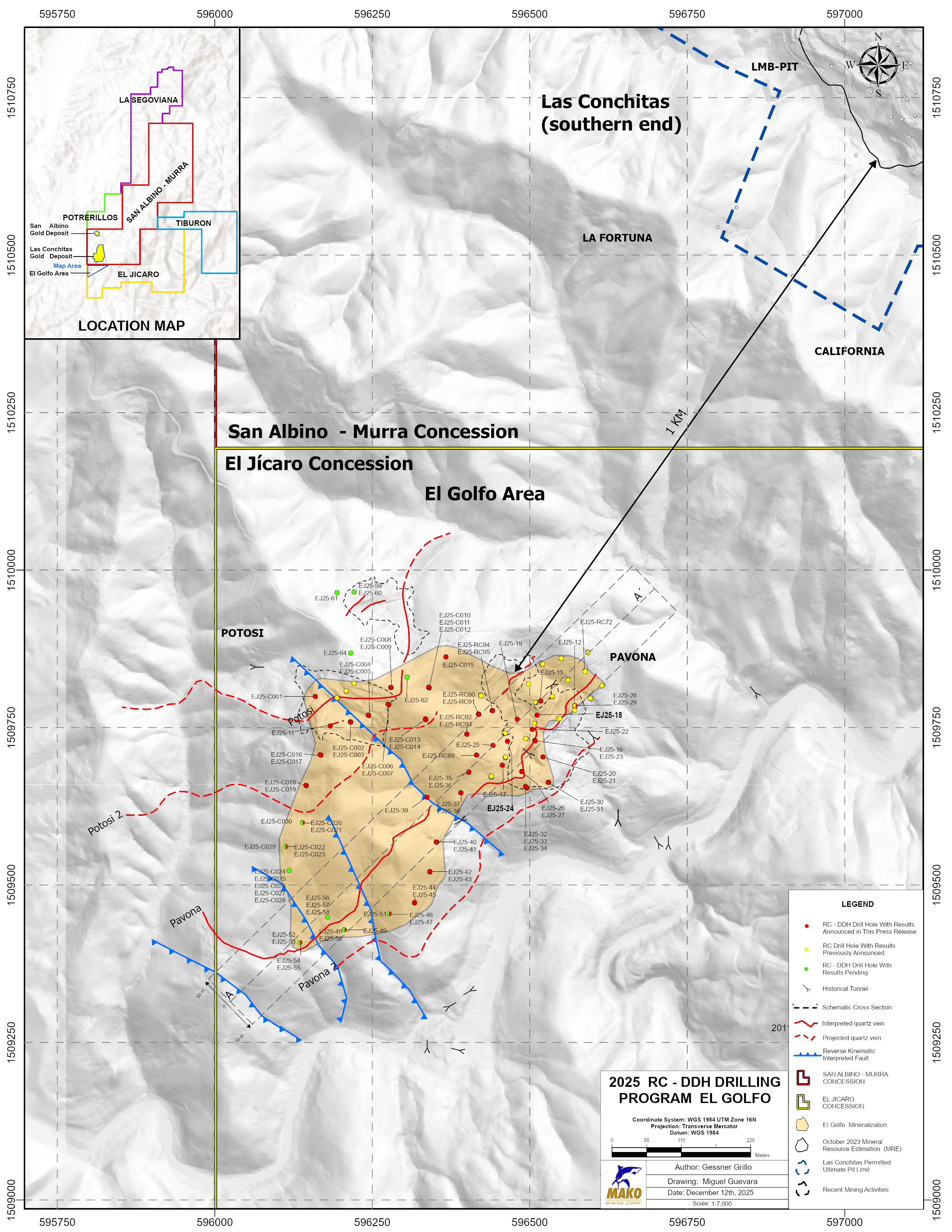

VANCOUVER, BRITISH COLUMBIA / ACCESS Newswire / January 6, 2026 /Mako Mining Corp. (TSXV:MKO)(OTCQX:MAKOF) ( "Mako " or the "Company ") is pleased to report additional results from the 2025 reverse circulation ( "RC ") and diamond drill program at the El Golfo area, located immediately south of the Company 's 100%-owned Las Conchitas and San Albino gold deposits and mining operations in Nicaragua (Figure 1).

In 2025, the Company completed 137 drill holes totalling 17,885 m. The objective of the most recent drilling was to further define the high-grade mineralization and to test for extensions of mineralization in areas that had not been previously drill-tested and/or disturbed by historical or more recent small-scale mining.

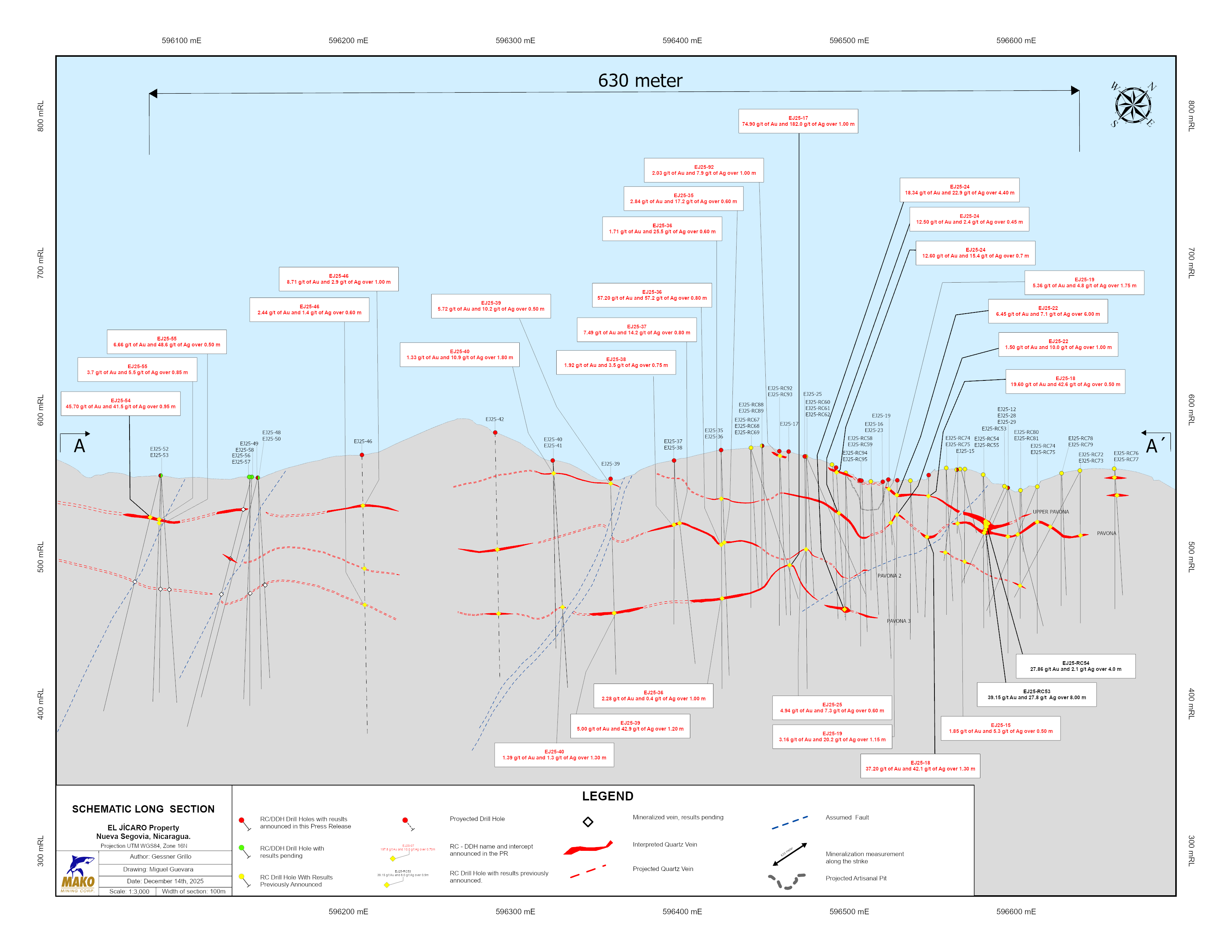

Recent drilling confirms the structural continuity of multiple, subparallel gold-bearing quartz veins in an area at least 630 m along strike and 305 m down-dip, or approximately 170 m from surface (see Figures 1 and 2).

Drill Highlights:

EJ25-24: 18.34 g/t Au and 22.9 g/t Ag over 4.4 m (4.2 m ETW)

EJ25-18: 37.20 g/t Au and 42.1 g/t Ag over 1.3 m (1.2 m ETW)

EJ25-17: 74.90 g/t Au and 182.0 g/t Ag over 1.0 m (0.9 m ETW)

EJ25-54: 45.70 g/t Au and 41.5 g/t Ag over 0.95 m (0.9 m ETW)

Akiba Leisman, CEO of Mako states: "El Golfo is shaping up to be a significant new discovery. High grades over widths similar to or greater than what we have been mining to the north since 2020 are prevalent. El Golfo, located 1km to the southwest of Las Conchitas contains lithologies that are essentially identical to what we have been mining at San Albino and Las Conchitas for the last six years. El Golfo has now been extended to 630 meters of strike and 305 meters of dip, and remains open in all directions. Furthermore, the receipt of underground mining permits at Las Conchitas will allow us to begin the development of two underground adits, with the ability to mine 150-250 tonnes per day for the next 6 years in addition to our open pit mining operations. "

The recent drilling confirms the geological model for the El Golfo mineralization which represents the southwest extension of mineralized structures found at the Las Conchitas deposit. The El Golfo target is located within the Company 's El Jicaro concession approximately 1 km to the southwest of Las Conchitas (see Figure 1). This model consists of multiple subparallel gold bearing quartz veins with a northeast-southwest strike and a gentle northwest dip. The veins are hosted by broadly uniform host rocks, consisting of deformed carbonaceous schists. Both the host rocks and mineralization style at El Golfo are very similar to those being mined by the Company at the San Albino and Las Conchitas deposits. Further drilling is planned to confirm the grade and distribution of mineralization.

Diamond drill hole EJ25-18 intersected two high-grade intervals close to surface (see Table), including 19.60 g/t Au and 42.6 g/t Ag over 0.5 m starting 9.4 m from surface; and 37.20 g/t Au and 42.1 g/t Ag over 1.3 m (1.2 m ETW) 36 m below the surface. This drill hole confirms structural and grade continuity of the mineralized zone over 41 m down-dip of the high-grade mineralization intersected in RC drill hole EJ25-RC54, which graded 27.86 g/t Au and 2.1 g/t Ag over 4.0 m (ETW) (see Press Release dated August 14, 2025).

Diamond drill hole EJ25-24 intersected three mineralized zones. The first interval, 1.0 m below surface, intersected 12.60 g/t Au and 15.4 g/t Ag over 0.7 m (0.5 m ETW), confirming a 45 m southwest strike extension of the zone intersected in diamond drill hole EJ25-22 which graded 6.45 g/t Au and 7.1 g/t Ag over 6.0 m (5.8 m ETW), 1.5 m below the surface. The second interval, 26.0 m from surface, intersected 12.50 g/t Au and 2.4 g/t Ag over 0.45 m (0.4 m ETW), represents a 65 m southwest strike extension from diamond drill hole EJ25-18, described above. The third high-grade interval, 18.34 g/t Au and 22.9 g/t Ag over 4.40 m (4.2 m ETW), was intersected 48 m below a pit excavated by artisanal miners. This drill hole successfully tested the potential for additional mineralized structures below previously identified mineralization. Additional drilling is required to test the full potential of this mineralized structure.

Diamond drill hole EJ25-17 (Figure 1 and 2), was designed to further test the high-grade mineralization mentioned above, this hole intersected 74.90 g/t Au and 182.0 g/t Ag over 1.0 m (0.9 m ETW), 71.5 m from surface, confirming a 42 m southwest strike extension of the mineralization intersected by EJ25-24.

Diamond drill hole EJ25-54, collared within an area that had not been previously drill-tested, intersected 45.70 g/t Au and 41.5 g/t Ag over 0.95 m (0.9 m ETW), extending mineralization 550 m southwest along strike from a wide zone of high-grade mineralization intersected by the drill hole EJ25-RC53 (see Press Release dated May 21, 2025). EJ25-RC53 intersected 39.15 g/t Au and 27.8 g/t Ag over 8.0 m (5.9 m ETW), 19.2 m below surface (Figure 2). Mineralization at El Golfo remains open along strike, beyond the currently known mineralization.

Las Conchitas Underground Mining Permit

At the end of 2025, the Company received from the Ministry of Environment and Natural Resources of Nicaragua (MARENA) a modification to the environmental permit for mining at the Las Conchitas deposit, located within the San Albino-Murra Concession, Nicaragua.

In addition to the previously authorized open-pit mining activities, the modified permit allows the Company to conduct underground mining through two adits, with planned production of approximately 150-250 tonnes per day over a six-year period.

Table - Assay Results of RC* and Diamond Drill Holes** Reported in This Press Release

Vein | Drill Hole | From (m) | To (m) | Width (m) | Au (g/t) | Ag (g/t) | Interval |

Pavona 2 | EJ25-RC90 | 118.00 | 119.00 | 1.00 | 8.95 | 8.4 | 7.03 g/t Au and 12.0 g/t Ag over 2.00 m |

119.00 | 120.00 | 1.00 | 5.10 | 15.5 | |||

Upper Pavona | EJ25-RC91 | 28.00 | 29.00 | 1.00 | 1.89 | 2.5 | 1.89 g/t Au and 2.5 g/t Ag over 1.00 m |

127.00 | 128.00 | 1.00 | 3.46 | 12.1 | 16.38 g/t Au and 19.1 g/t Ag over 2.00 m | ||

Pavona 3 | 128.00 | 129.00 | 1.00 | 29.30 | 26.0 | ||

Upper Pavona | EJ25-RC92 | 12.00 | 13.00 | 1.00 | 2.03 | 7.9 | 2.03 g/t Au and 7.9 g/t Ag over 1.00 m |

Pavona | EJ25-RC94 | 66.00 | 67.00 | 1.00 | 9.00 | 34.3 | 9.00 g/t Au and 34.3 g/t Ag over 1.00 m |

70.00 | 71.00 | 1.00 | 2.04 | 3.2 | 2.04 g/t Au and 3.2 g/t Ag over 1.00 m | ||

Pavona | EJ25-RC95 | 61.00 | 62.00 | 1.00 | 2.59 | 5.4 | 2.59 g/t Au and 5.4 g/t Ag over 1.00 m |

Pavona 3 | 117.00 | 118.00 | 1.00 | 9.70 | 5.1 | 11.60 g/t Au and 7.7 g/t Ag over 2.00 m | |

118.00 | 119.00 | 1.00 | 13.50 | 10.2 | |||

Potosi 2 | EJ25-11 | 59.00 | 59.70 | 0.70 | 25.60 | 6.6 | 25.60 g/t Au and 6.6 g/t Ag over 0.70 m |

Upper Pavona | 99.00 | 99.60 | 0.60 | 1.14 | 7.4 | 1.14 g/t Au and 7.4 g/t Ag over 0.60 m | |

Pavona | EJ25-15 | 37.00 | 37.50 | 0.50 | 1.85 | 5.3 | 1.85 g/t Au and 5.3 g/t Ag over 0.50 m |

Pavona 3 | EJ25-17 | 71.50 | 72.50 | 1.00 | 74.90 | 182.0 | 74.90 g/t Au and 182.0 g/t Ag over 1.00 m |

Upper Pavona | EJ25-18 | 9.35 | 9.85 | 0.50 | 19.60 | 42.6 | 19.60 g/t Au and 42.6 g/t Ag over 0.50 m |

Pavona | 36.50 | 37.80 | 1.30 | 37.20 | 42.1 | 37.20 g/t Au and 42.1 g/t Ag over 1.30 m | |

Upper Pavona | EJ25-19 | 6.45 | 7.50 | 1.05 | 8.27 | 7.3 | 5.36 g/t Au and 4.8 g/t Ag over 1.75 m |

7.50 | 8.20 | 0.70 | 1.00 | 1.0 | |||

Pavona | 32.50 | 33.65 | 1.15 | 3.16 | 20.2 | 3.16 g/t Au and 20.2 g/t Ag over 1.15 m | |

Pavona | EJ25-21 | 2.00 | 3.00 | 1.00 | 1.01 | 2.2 | 1.01 g/t Au and 2.2 g/t Ag over 1.00 m |

Upper Pavona | EJ25-22 | 1.50 | 3.00 | 1.50 | 1.44 | 4.6 | 6.45 g/t Au and 7.1 g/t Ag over 6.00 m |

3.00 | 3.90 | 0.90 | 5.31 | 10.2 | |||

3.90 | 4.70 | 0.80 | 13.60 | 13.3 | |||

4.70 | 5.70 | 1.00 | 5.69 | 5.2 | |||

5.70 | 6.50 | 0.80 | 16.50 | 12.2 | |||

6.50 | 7.50 | 1.00 | 2.02 | 1.0 | |||

Pavona | 17.50 | 18.50 | 1.00 | 1.50 | 10.0 | 1.50 g/t Au and 10.0 g/t Ag over 1.00 m | |

Upper Pavona | EJ25-24 | 1.00 | 1.70 | 0.70 | 12.60 | 15.4 | 12.60 g/t Au and 15.4 g/t Ag over 0.70 m |

Pavona | 33.50 | 33.95 | 0.45 | 12.50 | 2.4 | 12.50 g/t Au and 2.4 g/t Ag over 0.45 m | |

Pavona 3 | 81.80 | 83.00 | 1.20 | 31.40 | 19.9 | 18.34 g/t Au and 22.9 g/t Ag over 4.40 m | |

83.00 | 83.70 | 0.70 | 0.18 | 4.4 | |||

83.70 | 84.20 | 0.50 | 7.74 | 13.8 | |||

84.20 | 84.50 | 0.30 | 0.34 | 2.2 | |||

84.50 | 85.20 | 0.70 | 2.49 | 17.7 | |||

85.20 | 85.85 | 0.65 | 55.10 | 81.7 | |||

85.85 | 86.20 | 0.35 | 3.88 | 1.5 | |||

Pavona 2 | EJ25-25 | 76.50 | 77.00 | 0.50 | 1.73 | 0.2 | 1.73 g/t Au and 0.2 g/t Ag over 0.50 m |

78.50 | 79.10 | 0.60 | 4.94 | 7.3 | 4.94 g/t Au and 7.3 g/t Ag over 0.60 m | ||

Pavona 4 | EJ25-26 | 127.85 | 128.50 | 0.65 | 2.00 | 1.3 | 2.00 g/t Au and 1.3 g/t Ag over 0.65 m |

Pavona | EJ25-27 | 0.00 | 0.40 | 0.40 | 1.67 | 1.3 | 3.96 g/t Au and 1.2 g/t Ag over 1.00 m |

0.40 | 1.00 | 0.60 | 5.48 | 1.2 | |||

Pavona 3 | 48.40 | 49.50 | 1.10 | 7.34 | 11.9 | 7.34 g/t Au and 11.9 g/t Ag over 1.10 m | |

(Pavona) | EJ25-30 | 1.00 | 1.70 | 0.70 | 5.73 | 6.8 | Waste Dump |

Pavona 3 | EJ25-32 | 46.00 | 47.00 | 1.00 | 17.60 | 9.5 | 17.60 g/t Au and 9.5 g/t Ag over 1.00 m |

Pavona 3 | EJ25-33 | 40.35 | 40.90 | 0.55 | 33.80 | 68.3 | 33.80 g/t Au and 68.3 g/t Ag over 0.55 m |

Pavona 3 | EJ25-34 | 42.40 | 43.00 | 0.60 | 1.02 | 17.0 | 1.02 g/t Au and 17.0 g/t Ag over 0.60 m |

Pavona 2 | EJ25-35 | 64.90 | 65.50 | 0.60 | 2.84 | 17.2 | 2.84 g/t Au and 17.2 g/t Ag over 0.60 m |

Pavona | EJ25-36 | 31.50 | 32.10 | 0.60 | 1.71 | 25.5 | 1.71 g/t Au and 25.5 g/t Ag over 0.60 m |

Pavona 2 | 64.80 | 65.60 | 0.80 | 57.20 | 57.2 | 57.20 g/t Au and 57.2 g/t Ag over 0.80 m | |

Pavona 3 | 99.00 | 100.00 | 1.00 | 2.28 | 0.4 | 2.28 g/t Au and 0.4 g/t Ag over 1.00 m | |

Pavona 2 | EJ25-37 | 40.50 | 40.85 | 0.35 | 15.50 | 29.3 | 7.49 g/t Au and 14.2 g/t Ag over 0.80 m |

Pavona | EJ25-39 | 106.80 | 107.40 | 0.60 | 1.03 | 0.5 | 5.00 g/t Au and 42.9 g/t Ag over 1.20 m |

Pavona | EJ25-40 | 0.00 | 0.80 | 0.80 | 1.61 | 10.1 | 1.33 g/t Au and 10.9 g/t Ag over 1.80 m |

0.80 | 1.80 | 1.00 | 1.10 | 11.6 | |||

Pavona 3 | 104.70 | 106.00 | 1.30 | 1.39 | 1.3 | 1.39 g/t Au and 1.3 g/t Ag over 1.30 m | |

Pavona 3 | EJ25-43 | 72.50 | 73.20 | 0.70 | 26.90 | 23.2 | 26.90 g/t Au and 23.2 g/t Ag over 0.70 m |

Pavona 2 | EJ25-46 | 42.50 | 43.50 | 1.00 | 8.71 | 2.9 | 8.71 g/t Au and 2.9 g/t Ag over 1.00 m |

Pavona 4 | 117.40 | 118.00 | 0.60 | 2.44 | 1.4 | 2.44 g/t Au and 1.4 g/t Ag over 0.60 m | |

Pavona 3 | EJ25-47 | 79.00 | 80.00 | 1.00 | 1.29 | 0.6 | 1.29 g/t Au and 0.6 g/t Ag over 1.00 m |

Pavona 2 | EJ25-54 | 24.50 | 25.45 | 0.95 | 45.70 | 41.5 | 45.70 g/t Au and 41.5 g/t Ag over 0.95 m |

Pavona 2 | EJ25-55 | 29.15 | 30.00 | 0.85 | 3.70 | 5.5 | 3.70 g/t Au and 5.5 g/t Ag over 0.85 m |

31.90 | 32.40 | 0.50 | 6.66 | 48.6 | 6.66 g/t Au and 48.6 g/t Ag over 0.50 m | ||

Upper Pavona 2 | EJ25-C001 | 92.30 | 93.00 | 0.70 | 1.35 | 3.5 | 1.35 g/t Au and 3.5 g/t Ag over 0.70 m |

Potosi 2 | EJ25-C002 | 56.00 | 56.50 | 0.50 | 13.40 | 21.7 | 13.40 g/t Au and 21.7 g/t Ag over 0.50 m |

Upper Pavona | 96.50 | 97.50 | 1.00 | 7.72 | 4.8 | 7.72 g/t Au and 4.8 g/t Ag over 1.00 m | |

Upper Pavona | EJ25-C003 | 101.00 | 101.50 | 0.50 | 22.20 | 6.7 | 22.2 g/t Au and 6.7 g/t Ag over 0.50 m |

Potosi 2 | EJ25-C004 | 49.50 | 50.00 | 0.50 | 1.17 | 4.0 | 23.69 g/t Au and 29.2 g/t Ag over 1.00 m |

50.00 | 50.50 | 0.50 | 46.20 | 54.3 | |||

Potosi 2 | EJ25-C006 | 61.10 | 61.80 | 0.70 | 4.93 | 10.1 | 4.93 g/t Au and 10.1 g/t Ag over 0.70 m |

Pavona | 125.50 | 126.00 | 0.50 | 4.12 | 25.8 | 4.12 g/t Au and 25.8 g/t Ag over 0.50 m | |

Potosi 2 | EJ25-C007 | 64.40 | 65.00 | 0.60 | 1.21 | 2.6 | 1.21 g/t Au and 2.6 g/t Ag over 0.60 m |

Pavona | 116.50 | 117.00 | 0.50 | 1.37 | 1.2 | 1.37 g/t Au and 1.2 g/t Ag over 0.50 m | |

Upper Pavona | EJ25-C008 | 79.80 | 80.50 | 0.70 | 1.87 | 16.0 | 1.84 g/t Au and 11.4 g/t Ag over 1.70 m |

80.50 | 81.50 | 1.00 | 1.82 | 8.2 | |||

Pavona | EJ25-C011 | 113.10 | 114.10 | 1.00 | 2.88 | 12.2 | 2.88 g/t Au and 12.2 g/t Ag over 1.00 m |

Pavona 2 | 135.10 | 135.70 | 0.60 | 9.30 | 29.2 | 5.13 g/t Au and 17.0 g/t Ag over 1.30 m | |

135.70 | 136.40 | 0.70 | 1.56 | 6.6 | |||

Pavona | EJ25-C012 | 117.20 | 117.70 | 0.50 | 28.20 | 8.8 | 28.20 g/t Au and 8.8 g/t Ag over 0.50 m |

Pavona 2 | 134.50 | 135.00 | 0.50 | 6.51 | 11.7 | 6.51 g/t Au and 11.7 g/t Ag over 0.50 m | |

Pavona | EJ25-C013 | 106.50 | 107.05 | 0.55 | 2.28 | 7.2 | 2.28 g/t Au and 7.2 g/t Ag over 0.55 m |

Pavona 3 | EJ25-C020 | 141.50 | 142.00 | 0.50 | 2.41 | 1.8 | 2.41 g/t Au and 1.8 g/t Ag over 0.50 m |

Upper Pavona | EJ25-C021 | 59.10 | 60.40 | 1.30 | 2.91 | 12.2 | 2.91 g/t Au and 12.2 g/t Ag over 1.30 m |

Pavona | EJ25-C016 | 105.00 | 106.00 | 1.00 | 1.24 | 4.5 | 1.24 g/t Au and 4.5 g/t Ag over 1.00 m |

Pavona 2 | EJ25-C017 | 161.70 | 162.30 | 0.60 | 8.64 | 18.6 | 8.64 g/t Au and 18.6 g/t Ag over 0.60 m |

Pavona 2 | EJ25-C018 | 135.00 | 135.50 | 0.50 | 1.80 | 29.0 | 1.80 g/t Au and 29.0 g/t Ag over 0.50 m |

Pavona 3 | 145.50 | 146.00 | 0.50 | 1.14 | 0.5 | 1.14 g/t Au and 0.5 g/t Ag over 0.50 m | |

Pavona 2 | EJ25-C022 | 88.90 | 89.60 | 0.70 | 6.37 | 14.6 | 6.37 g/t Au and 14.6 g/t Ag over 0.70 m |

Pavona | EJ25-C023 | 74.50 | 75.50 | 1.00 | 17.60 | 24.8 | 17.60 g/t Au and 24.8 g/t Ag over 1.00 m |

*RC drill holes are denoted by "RC " prior to the drill hole name.

**Diamond only holes do not have a prefix prior to the drill hole number. Combination holes of RC & Diamond are denoted by "C " prior to the drill hole number.

Note: The mineralized intervals shown in both tables above utilize a 1.0 g/t gold cut-off grade with not more than 1.0 m of internal dilution. Widths are reported as drill lengths. Estimated True Width is estimated from interpreted sections. In addition to the drill holes presented in the tables above, the following drill holes returned only anomalous values: EJ25-RC89, EJ25-RC93, EJ25-16, EJ25-20, EJ25-23, EJ25-28, EJ25-31, EJ25-41, EJ25-42, EJ25-44, EJ25-45, EJ25-49 , EJ25-C005, EJ25-C009, EJ25-C010, EJ25-C014, EJ25-C015 and EJ25-C019. In addition to the drill holes presented in the tables above the following drill holes returned no significant values: EJ25-29.

Figure 1. Drill Plan view showing the location of drill holes presented in this release, and the interpreted surface projections of the veins at El Golfo

Figure 2. Longitudinal Section

Sampling, Assaying, QA/QC and Data Verification

Drill core was continuously sampled from inception to termination of the entire drill hole. Sample intervals were typically one meter. Drill core diameter was HQ (6.35 centimeters). Geologic and geotechnical data was captured into a digital database, core was photographed, then one-half split of the core was collected for analysis and one-half was retained in the core library. Drill core samples were kept in a secured logging and storage facility until such time that they were delivered to the Managua facilities of Bureau Veritas and pulps were sent to the Bureau Veritas laboratory in Vancouver for analysis. All reverse circulation (RC) holes were drilled dry i.e above the water table and no water or other fluids were injected into the hole. RC drill samples were collected every 1 meter using a center-return hammer and samples were obtained from a Gilson chip splitter which is cleaned using compressed air after each sample. Samples were bagged and labeled at the drill site under a geologist 's supervision and are logged on site by a geologist who visually selects potential mineralized intervals for fire assay. The mineralized interval(s) including 3-5 samples above and below, the selected interval are continuously sampled and shipped to the Bureau Veritas Lab (BV) in Managua, respecting the best chain of custody practices. Pulps are sent by Bureau Veritas to their laboratory in Vancouver under their chain of custody for analysis. Gold was analyzed by standard fire assay fusion, 30 gr aliquot, AAS finish. Samples returning over 10.0 g/t gold are analyzed utilizing standard Fire Assay-Gravimetric method. The Company follows industry standards in its QA&QC procedures. Control samples consisting of duplicates, standards and blanks were inserted into the sample stream at a minimum ratio of 1 control sample per every 10 samples. Analytical results of control samples confirmed reliability of the assay data.

Qualified Person

Brian Ray, M.Sc., P.Geo, a geologist and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Ray is a consultant to the Company.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako 's primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package.

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, E-mail: aleisman@makominingcorp.com , phone: (917) 558-5289 or visit our website at www.makominingcorp.com and SEDARPLUS www.sedarplus.ca.

Forward-Looking Information:Some of the statements contained herein may be considered "forward-looking information " within the meaning of applicable securities laws. Forward-looking information can be identified by words such as, without limitation, "estimate ", "project ", "believe ", "anticipate ", "intend ", "expect ", "plan ", "predict ", "may " or "should " or variations thereon or comparable terminology. The forward-looking information contained herein reflects the Company 's current beliefs and expectations, based on management 's reasonable assumptions, and includes, without limitation, that the Company high-grade production will generate significant cash flows for the foreseeable future. Mako 's primary objective to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, changes in the Company 's exploration and development plans and growth parameters and its ability to fund its growth to reach its expected new production numbers; unanticipated costs; the October 24 measures having impacts on business operations not current expected, or new sanctions being imposed by the U.S. Treasury Department or other government entity in Nicaragua in the future; and other risks and uncertainties as disclosed in the Company 's public disclosure filings on SEDAR at www.sedarplus.ca. Such information contained herein represents management 's best judgment as of the date hereof, based on information currently available. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE:Mako Mining Corp.

View the original press release on ACCESS Newswire

© 2026 ACCESS Newswire. All Rights Reserved.