Advisor M&A Scales Up: Larger Firms, Higher Multiples, More Complex Deals

PORTLAND, OREGON / ACCESS Newswire / February 5, 2026 /Succession Resource Group, Inc. (SRG) published its tenth annual review of advisor acquisition activity, unveiling key trends in buying, selling, and succession planning. SRG saw continued growth in the volume of transactions, size of the transactions, as well as valuations, leading to optimistic predictions for 2026 M&A activity. This study draws on 171 transactions representing more than $14 billion in assets under management completed during 2025.

Data was contributed from both PPC Loan and Oak Street Funding, with financial support coming from this year 's exclusive partner AssetMark. Overall, SRG saw a significant increase in internal equity sales (32% of total transactions in 2025), higher value multiples (up 6.1%), and continued interest in private equity and aggregator sales.

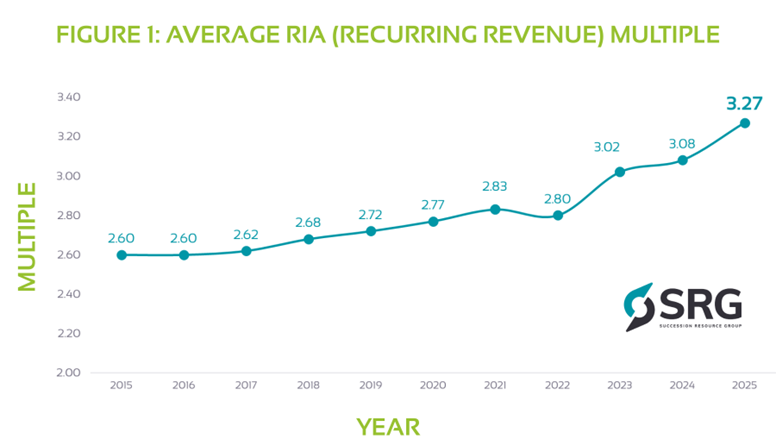

Figure 1: Average RIA (Recurring Revenue) Multiple

M&A Highlights:

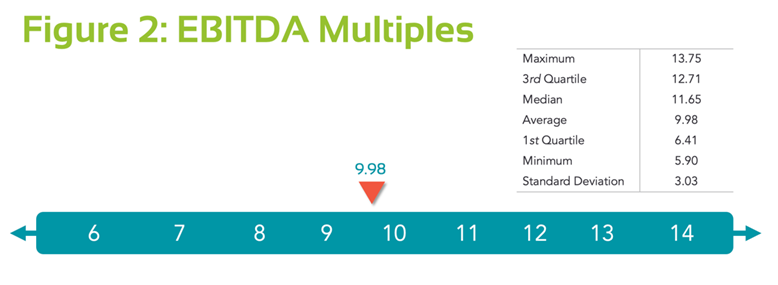

Based on current "rules of thumb " for benchmarking purposes, the average EBITDA multiple for advisory 'businesses ' in 2025 rose to 9.98x while the average topline recurring revenue multiple for 'books of business ' climbed to 3.27x.

Out-of-state buyers decreased from a high-water mark of 33.00% in 2024, down to 24.8% of deals.

Third-party financing has surged as the interest rate environment has calmed, with more than half of deals (56%) using outside financing, up from 43% in 2024. However, SRG notes that more of the bank and broker-dealer-financed deals are financing up to 70-80% of the purchase price, with sellers being asked to carry the balance on a note.

Earn-outs, which were increasingly rare until recently, are now being leveraged in deals to help create additional value for exiting advisors.

Buyer confidence appears to be up in 2025, as indicated by the decreased percentage of deals using a retention or clawback clause, dipping below 50% in 2025 (48.9% of deals had some form of a clawback).

Down payments remained consistent in 2025, trending up year-over-year, increasing slightly from an average of 63% cash down in 2023, to 65% in 2024, and now 68% in 2025. Buyers using third-party financing had an average down payment of 78%, down from the high-water mark of 86% in 2023. SRG 's Transaction Advisory expert Parker Finot attributes this reduction in the amount financed/paid in cash at closing to tougher underwriting and reduced LTV thresholds by lenders.

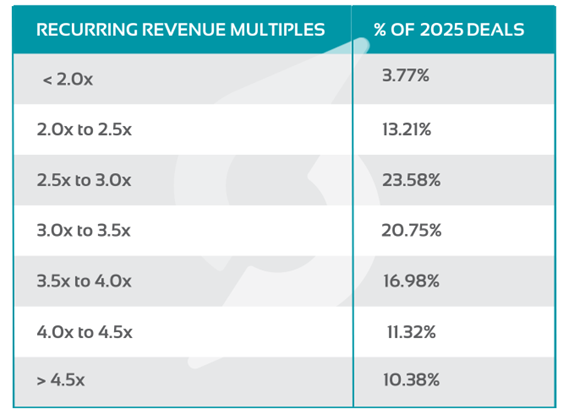

Looking closer at the average revenue multiple for an RIA, we see that nearly 40% of deals were transacted above 3.5x, and more than 20% selling for 4.0x or greater. David Grau Jr., President of SRG, noted, "The valuations paid today are higher than they 've ever been before, but the same core fundamentals still apply - the deals have to cash flow. Sellers can get a higher value than we 've ever seen, but it is paid for large (multi-billion-dollar RIAs), well-run firms, and the value is paid 'on terms ' meaning most of that value is contingent. "

According to Kristen Grau, CPA, CVA, CEPA, who heads up SRG sell-side team, the average buyer-to-seller ratio decreased slightly, dipping to 61:1, increasingly concentrated among fewer, larger, and more experienced acquirers. SRG noted a continued decline in casual or first-time buyers, with transactions increasingly led by firms with established acquisition experience and access to capital. This shift has contributed to more competitive processes, while also placing greater importance on preparation, positioning, and deal execution for first-time sellers.

Internal succession planning continues to mature:

SRG has seen a 200% increase in the number of firms deploying some form of phantom or synthetic equity-sharing plan, across the industry.

SRG 's succession experts noted that there are far fewer firms selling small (single digit) tranches of ownership each year. Instead, Gen2/Gen3 advisors are opting to leverage third-party financing and purchase more equity earlier. The average internal tranche sold in 2025 was a 21.9% stake. Nearly half (48%) of succession plans are using outside capital to fund the buy-ins.

PE and PE-backed aggregators remain active acquirers, paying above market values. These large acquirers are paying above-market rates by leveraging smaller cash down payments than the average peer-to-peer deal, paying with buyer equity, and including earn-outs with growth hurdles that give sellers the potential to achieve above-market values. SRG noted that there is an interesting trend emerging with PE firms, large RIA and IBDs, buying a minority stake in their affiliated teams, making the remaining equity more affordable for the internal team to purchase and retain control and providing capital for growth and hiring.

SRG expects increased transaction volume in 2026, but to fewer, larger, well-capitalized buyers. Sellers in 2026 should expect more creative offers with unique and contingent terms, but allowing those willing to take the risk, to unlock greater values than historically observed in the financial services industry. While the type of buyers and more unique terms appear to have been the most impactful factor on advisor valuation in 2025, David Grau Jr. restated his position, "Founders who focus on building a sustainable firm, optimizing their business, and remaining focused on the best fit for their clients at their exit will always get the best value. Period. "

About Succession Resource Group

Succession Resource Group (SRG) is a specialized consulting firm providing strategy-first expertise for independent advisory firms and RIAs navigating valuation, ownership, and transition decisions. SRG supports clients with valuation, equity and compensation design, entity formation and optimization, succession readiness, and transaction strategy - Including buy-side, sell-side, and merger representation. With deep industry knowledge and white-glove service, SRG combines technical expertise with strategic guidance to support firm leaders in protecting enterprise value, reducing risk, and executing transitions aligned with their long-term goals. For more information, visit SuccessionResource.com.

Contact Information

Guy Littlefield

Marketing Specialist

Marketing@successionresourcegroup.com

(503) 427-9910

David Grau

President

david.graujr@successionresourcegroup.com

(503) 427-9910

SOURCE: Succession Resource Group

View the original press release on ACCESS Newswire

© 2026 ACCESS Newswire. All Rights Reserved.