West Red Lake Gold Announces Positive Pre-Feasibility Study Results for Madsen Gold Mine with $315M After-Tax NPV and $70M Average Annual Free Cash Flow

VANCOUVER, British Columbia, Jan. 07, 2025 (GLOBE NEWSWIRE) -- West Red Lake Gold Mines Ltd. (“West Red Lake Gold” or the “Company”) (TSXV: WRLG) (OTCQB: WRLGF)is pleased to announce the results of the pre-feasibility study (“PFS”) prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects(“NI 43-101”) for the imminent restart of its 100% owned Madsen Mine project in the Red Lake Gold District of northwestern Ontario, Canada.

West Red Lake Gold will hold a conference call on January 8th at 11:00am ET, followed by a question-and-answer period. To access the call, please register here: https://www.amvestcapital.com/webinar-directory/westredlakegoldmines010825. The webinar will be archived for viewing at www.westredlakegold.com

All dollar amounts in this news release are in Canadian dollars ($) unless otherwise indicated.

The effective date of the PFS is December 31, 2024, and a technical report relating to the PFS will be filed on SEDAR+ within 45 days of this news release.

Madsen Mine PFS Highlights:

- Strong Value Underlines Mine Restart Rationale: Post-tax net present value (“NPV”) (5%) of $315 million at a long-term gold price of US$2,200 per oz. reinforces the rationale to restart the Madsen Mine imminently based on this initial mine plan; potential for Madsen to grow beyond this initial plan with further definition and exploration drilling strengthens the rationale

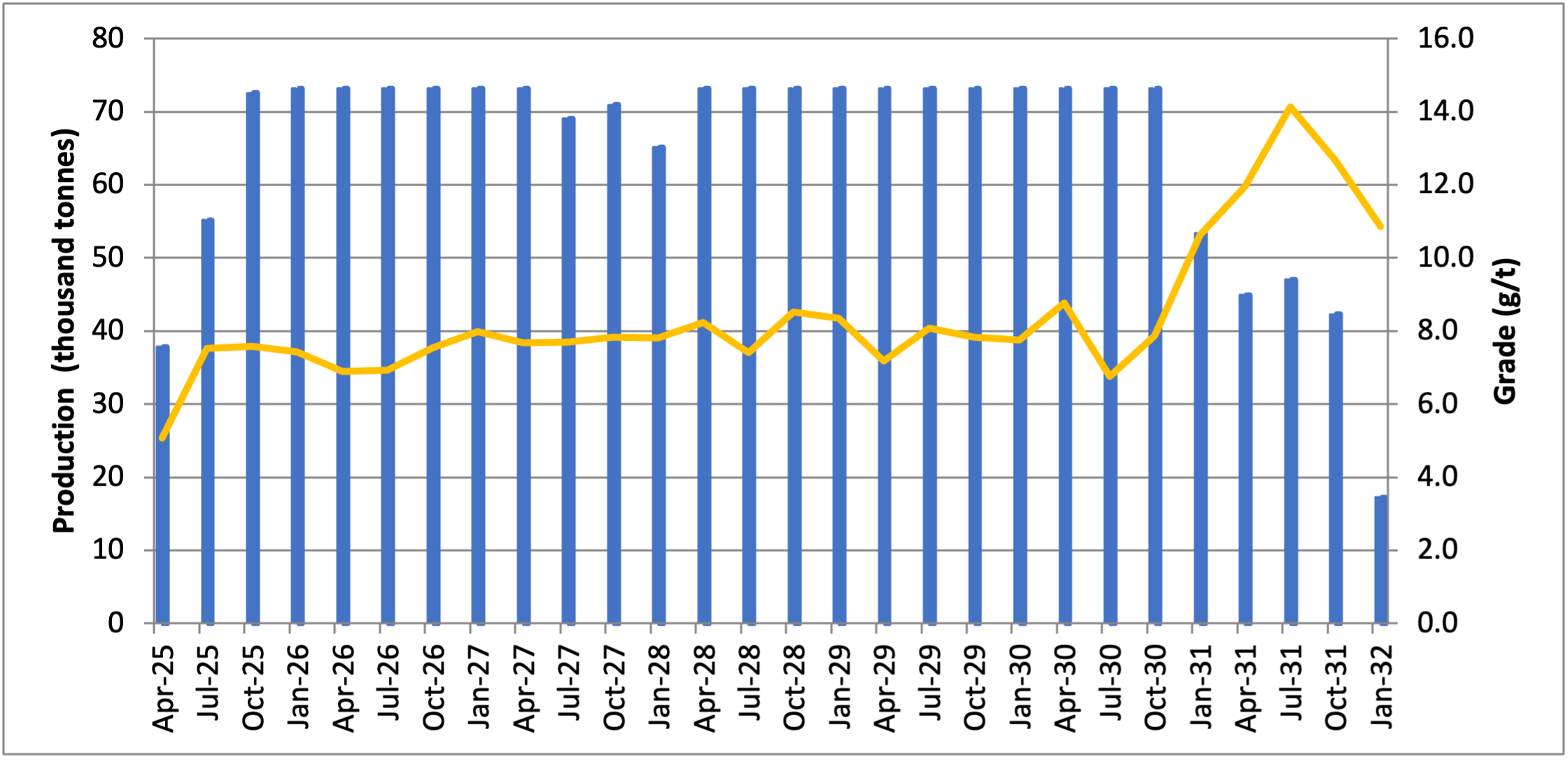

- High Grade Mine: Diluted head grade averages 8.2 g/t gold

- Average Annual Production: 67,600 oz. gold per year over 6 years of full production, within a 7.2-year mine life

- Strong Free Cash Flows: $69.5 million average annual free cash flow from an operation with average total operating cost of US$919 per oz. and average all-in sustaining cost (“AISC”) of US$1681 per oz.

- Construction and Capital Investment to Mine Startup Substantially Complete. Bulk sample currently being mined; mill startup to process bulk sample planned in March; 21 km of modern underground development (since 2019) provides good mining access and represents significant time and cost savings

- Production Start Date: Q2 2025

- Actual Costs: The Company has been operating underground for 16 months and the mill operated in 2022, which enabled a PFS based on realized costs for most operating metrics.

- Significant Upside Potential: There are multiple opportunities to extend mine life and enhance the economic returns of the Madsen Mine, including 1.1 million ounces of indicated resource that remain outside of this initial mine plan, resource growth near reserves and existing infrastructure, discovering new high-grade, near mine zones that add to the mine plan such as the Upper 8 Zone, and using a higher reserve cut-off price (the PFS used US$1680 per oz.).

“West Red Lake Gold has worked intensely over the last 16 months to greatly improve our knowledge of the orebody and de-risk the project with the objective of executing a successful restart of the Madsen Mine, and this PFS is the culmination of that effort,” said Shane Williams, President and CEO. “This initial reserve mine plan only taps well defined and tightly drilled parts of the deposit relatively close to existing workings and still generates robust margins based on a production rate of approximately 70,000 oz. per year that generate almost $400 million in post-tax free cash flow over a 7-year mine life.

“Initial capital is low because the capital projects needed for restart are well advanced or already complete. That is unusual for a ‘PFS-level’ project, as is having already completed 58,000 metres of definition drilling and detailed engineering to define 18 months of mineable inventory on a stope-by-stope level.

“We are excited to deliver a PFS that solidifies Madsen as a rare high-grade gold mine starting production in 2025. We built a realistic and achievable plan for this first mining opportunity at Madsen that we are confident we can deliver and that will justify returning the mine to production. Beyond that, we strongly believe Madsen has potential to grow well beyond this initial plan in the coming years as we source new resources and reserves near existing infrastructure while also gaining access to the deeper parts of the system, where notable upside optionality remains untapped.”

The PFS was prepared by independent consultants SRK Consulting (Canada) Inc., with input from AllNorth Consultants Ltd (infrastructure), T-Engineering Ltd (backfill), Nordmin Engineering Ltd (shaft), Fuse Advisors (processing), Mining Plus (mine design support), and Knight Piesold (tailings and waste rock).

Economic Results and Sensitivities

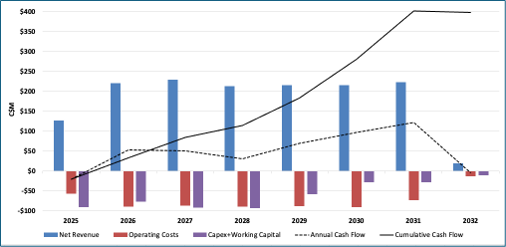

Table 1 summarizes the projected production and economic results of the PFS for this initial Madsen Mine plan. Figure 1 shows the Madsen Mine cash flow profile by year.

Table 1: Madsen Mine – Key Economic Assumptions and Results

| Mine Life | yrs | 7.25 |

| Total Ore Mined | million tonnes | 1.823 |

| Steady State Processing Rate | tpd | 800 |

| Average Head Grade | Au g/t | 8.16 |

| Gold Recovery | % | 95.7% |

| Average Annual Gold | oz / year | 67,600 |

| Total Payable Gold | oz. | 457,851 |

| Total Operating Cost | US$/oz | 919 |

| Long Term Gold Price | US$/oz | $2,200 |

| Gross Revenue | C$M | $1,480 |

| Net Revenue | C$M | $1,465 |

| Initial Capital | C$M | $44.1 |

| Sustaining Capital | C$M | $434 |

| Average AISC | US$/oz | $1,681 |

| Cumulative Net Cash Flow (pre-tax) | C$M | $392 |

| Cumulative Net Cash Flow (post-tax) | C$M | $391 |

| NPV (post-tax) | C$M | $315 |

| IRR (post-tax) | % | 255% |

| Discounted Payback Period | yrs | Less than 1 |

Figure 1: Madsen Mine Cash Flow Profile by Year

Upside Potential

The Madsen Mine project hosts probable reserves of 1.823 million tonnes grading 8.16 g/t gold, containing 478,000 oz. gold. This compares to an indicated resource of 6.9 million M&I tonnes grading 7.4 g/t gold hosting 1.65 million oz. gold, plus an inferred resource of 1.8 million tonnes grading 6.3 g/t gold hosting 366,200 oz. gold.

West Red Lake Gold sees two opportunities to potentially convert more of the Madsen Mine resource into reserves.

First, the PFS defines reserves using a gold price cut-off of US$1680 per oz.1 This highly conservative gold price cut-off resulted in significant portions of the indicated resource being excluded from the mineable reserve. Sensitivity analysis shows that increasing the cut-off price to US$1900 per oz. increases reserves sufficient to add approximately two years to the mine plan.

Second, there are many distal portions of the Madsen resource that would require access through un- or undertested areas with high geologic potential for mineralization. West Red Lake Gold plans to drill test these areas; success delineating mineralization in these gaps has the potential to transform additional resource areas into economic reserves while also growing the resource base. Notable underground expansion drilling is planned for 2025 from three key areas: 1) Connection Drift, 2) East Ramp decline targeting down-plunge North Austin, and 3) East Exploration Drive from 13L to access lower Austin and eastern extensions of main deposit.

The combination of delineating new mineralization in undertested gaps, extending known reserve areas, and converting more resources to reserves has the potential to add ounces and extend mine life via (1) reducing the access development needed per tonne of ore mined and (2) supporting increased flexibility between lower-cost Longhole Stoping (“LHS”) and Mechanized Cut and Fill (“MCF”). Currently, the PFS outlines 59% MCF and 41% LHS.

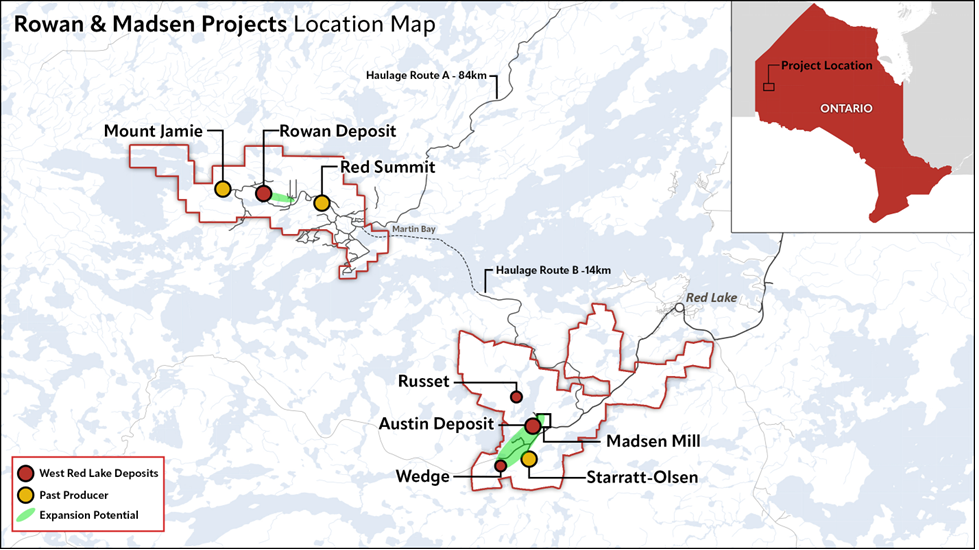

In addition, the PFS only considers four of the seven deposits that make up the Madsen resource (Austin, South Austin, McVeigh, and 8 Zone). Other deposits at the Madsen Mine site could potentially be included in a future mine plan, such as the Fork deposit where West Red Lake Gold recently identified a high-grade portion located 250 metres away from existing underground workings. The recent Upper 8 discovery also has potential to become a shallow zone of high-grade mineralization. Additionally, the Company owns the Rowan Project that is 80 km away by road and hosts indicated resources of 476,323 tonnes grading 12.78 g/t gold hosting 195,746 oz. gold and inferred resources of 410,794 tonnes grading 8.76 g/t gold hosting 115,719 oz. gold.

West Red Lake Gold sees strong potential to expand the Madsen Mine beyond the operation defined in this PFS if future drilling, engineering, and permitting demonstrates it is economic to include additional zones into an updated mine plan. The PFS is based on 800 tpd throughput; the Madsen Mill has nameplate capacity of 1,089tpd.

Mining

The mine will operate as a mechanized underground operation with a steady state production rate of 800 tonnes of mineralized material per day operating for 7.25 years.

Mining will be a combination of mechanized cut-and-fill (59%) and long hole stoping (41%). The minimum mining width is 2 metres. Average stope width varies with mining method from 3.2 metres to 7.2 metres.

Ore is moved to surface via a combination of ramp trucking and shaft skipping. Trucking will be utilised above 8 Level. Material from 8 Level and below will be trucked to a Main Shaft loading pocket at 12 Level and from there skipped to surface.

Rehabilitation of the Madsen Main Shaft is well underway. The PFS includes the cost for the continued rehabilitation and refurbishment of Madsen Main Shaft to allow for skipping from 12 Level. The Main Shaft is currently dewatered to 15 Level; dewatering will continue to allow for access to the lowest levels of the mine.

Once the mine is dewatered on 20 Level, a new shaft will be excavated to surface in two lifts using raiseboring methods. This Madsen East Shaft will supply ventilation to the lower reaches of the mine, allow for skipping of material and slinging of heavy equipment, and allow for possible future expansion at depth.

Steady state waste production is approximately 1,200 tpd. Care has been taken to optimize the backfill of waste rock into historic stopes and new excavations.

The existing Madsen mill contains a working Hydraulic Fill (HF) plant that the previous owners commissioned (but did not use). West Red Lake Gold will recommission the plant to pipe HF to the historic voids underground. HF is a way of backfilling underground workings using tailings from the mill, adding a binder (a low percentage of cement), and pumping the resulting slurry back underground. HF backfill provides an environmentally friendly way of disposing of tailings and provides a stable geotechnical environment for mining. Once the HF is decanted and cured, it is strong enough to mine immediately adjacent to, allowing the Company to optimize the extraction of ore around old stopes.

The mine is primarily ventilated via the Madsen Main Shaft and the West Ramp. The main fans are situated underground, on 12 Level. Air is downcast through the Main Shaft and is allowed to exhaust via the ramp. Once completed in year 4, the East Shaft will significantly enhance the ventilation to the lower reaches of the mine. A connection between the West and East ramps is being driven (the Connection Drift) that will assist in efficiencies for ventilation between the two districts. Currently, the East section of the mine (a much smaller section) is ventilated via the West through old workings. The air heater is situated near the Madsen Main shaft on surface.

Processing

At steady state operation, an average of 800 tpd of material will be processed in a plant that consists of primary crushing, followed by grinding to 80% passing 75 µm using a semi-autogenous grinding mill and ball mill. Gravity concentration will recover gold from the SAG screen undersize and ball mill discharge. Cyclone overflow will be thickened to 50% solids in a pre-leach thickener, then pre-aerated with oxygen followed by a 24-hour cyanide leach at a cyanide concentration of 150-170 ppm and a pH of 11.0 in five leach tanks. Gold in solution will then be recovered via carbon-in-pulp (CIP) adsorption in six CIP tanks with a residence time of five hours, followed by acid wash, elution, and refining to produce gold dore on site.

After cyanide destruction, the CIP tailings will be pumped to the tailings management facility initially. Starting later in year 1, a thickened tailings will be pumped into open stopes using a hydraulic backfill system.

The process plant gold recovery is estimated to average 95.7% over the LOM.

Figure 2: Average Annual Ore Production and Grade

Infrastructure

The Madsen Mine is adjacent to the community of Madsen, within the Red Lake Municipality of northwestern Ontario. Highway 618, a paved and provincially maintained road, connects the community and mine to the town of Red Lake 10 km to the northeast. Mining and mineral exploration is the primary industry in the Red Lake region; as a result, there is a full range of services and supplies for mineral exploration and mining and a strong pool of skilled labour.

All infrastructure needed to restart the Madsen Mine pursuant to this PFS plan is already in place. The mine has two underground access portals with ramps, over 21 km of modern underground development (from 2019 onward), a 1,275-metre shaft with a retrofitted and functional hoist mechanism, a processing facility with nameplate 1,089-tpd capacity built 2019-2020 (currently permitted for 800 tpd operations), a tailings facility also built 2019-2020 that saw a 4-foot dam lift in summer 2024, an office complex, a geology and core logging compound, and basic mine dry, maintenance, and warehouse facilities.

Further infrastructure projects currently underway include a 1.2-km tunnel that connects the two portals (on track for completion in March 2025), a 114-person workforce accommodations facility (on track for completion mid-February 2025), and a mine dry facility (on track for completion end February 2025).

The Madsen Mine is connected via a dedicated substation to the provincial hydroelectrical power grid and will access power at $0.12 per kilowatt hour.

Workforce

The Madsen Mine is expected to utilize a workforce of 221 people during steady state operations. There are currently approximately 140 workers employed, of which approximately 60% live locally.

Tailings and Mine Rock

Tailings will be managed through a combination of surface storage in the Tailings Management Facility (TMF) and underground deposition as hydraulic backfill. The TMF at the Madsen Mine is permitted to discharge tailings and will be expanded to manage a total of 1.6 Mt. The TMF is partitioned into two designated areas, Cell A and the Main TMF. Containment for the first four years of tailings deposition will be provided in Cell A, with the remainder of the tailings managed in the Main TMF.

Cell A is fully constructed and ready for operation, including a 4-meter dam raise that was completed in summer 2024.

The Main Dam will be constructed downstream of the existing polishing pond dams in year 4 to raise the perimeter crest elevation of the TMF and provide storage capacity for the remaining tailings. The two areas of the TMF offer sufficient capacity for supernatant ponds, surplus water storage, and flood water management.

Mine rock from underground development will be managed in the underground mine as backfill (42%) and stored in the existing mine rock management facility located adjacent to the TMF (58%). Multiple void historic stopes create good opportunity to store waste rock underground, thereby reducing costs.

Capital Expenditure

Modest expenditure requirement remains to get the Madsen Mine into production, slated for Q2 2025. Outstanding costs are modest because the historic Madsen Mine was rebuilt from 2019-2020, operating until late 2022 before shutting down. The rebuild established significant new infrastructure at the site, including the 800-tpd process plant, the West Portal, the tailings management facility, the water treatment plant, and 19 km of underground workings.

Since purchasing the Madsen Mine in June 2023, West Red Lake Gold has invested significant capital into projects the Company identified as necessary for a successful restart. This includes a 4-meter dam raise in Cell A of the TMF, a new primary crusher, the 1.2-km Connection Drift, a camp, a mine dry facility, many additions to the mining fleet, and over 2 km of underground workings.

Sustaining Capital

The mine requires $434 million in sustaining capital over its 7.2-year mine life, of which $9.1 million is closure and rehabilitation costs.

Mining development, additional equipment, replacement units, and major repairs make up the consistent parts of sustaining capital.

Rehabilitation of the Main Shaft and development of the East Shaft are the largest capital projects during the life of mine. West Red Lake Gold has already rehabilitated the hoisting mechanism in the headframe of the Main Shaft; the shaft itself now requires rehabilitation to be able to move material out of the mine starting in year 2. Year 1 see $22.5 million in sustaining capital allocated to this project.

The East Shaft is developed in years 3 and 4, at an estimated cost of $52 million. It will be raisebored once bottom access has been established via Madsen Main shaft, resulting in significant savings compared to blind sinking a shaft. During operations, mining generally follows the mineralized system northeast and downplunge. By year 4 the ventilation system centered on the Main Shaft is no longer sufficient and so a new vent raise is required. A cost-benefit analysis found a net savings in developing a skipping shaft, versus a simple vent raise, because it would cost approximately $20 per tonne to truck material to surface from the Madsen Deeps area versus approximately $4 per tonne to hoist material. This difference covers the $20 million additional cost of the full shaft over the vent raise, making the capital project a net benefit in this mine plan.

Beyond the PFS mine plan, the gold system at Madsen remains open at depth. Several deep historic intercepts returned good gold intercepts. If exploration is successful in defining resources downplunge of the reserves in this PFS, the East Shaft is well located to potentially render such resources economic to mine.

Operating Costs

Life of Mine (LOM) total operating cost is estimated at $322.67 per tonne of ore, as summarized in Table 2 below. The LOM total AISC is estimated to be US$1681 per oz. gold produced.

As noted in the Upside Potential section, the Company sees strong potential to create a more continuous reserve body, through this drilling work and through the practical application of a higher reserve cut-off grade.

Table 2: Operating Costs

| Mining | $212.93 per tonne |

| Processing | $75.25 per tonne |

| General & Administrative | $33.90 per tonne |

| Tailings | $0.59 per tonne |

| Total | $322.67 per tonne |

Financial Analysis

Using an average gold price of US$2317 per oz. and a US:CDN exchange rate of 1.4, the Madsen Mine project generates an after-tax NPV of $315 using 5% discount rate and an after-tax IRR of 255%.

The Project generates cumulative post-tax net cash flow of $391 million and average annual free cash flow of $69.5 million over the 6-year full production period.

Total taxes payable over the LOM at the assumed gold price are negligible because the combination of the significant tax losses that were acquired with the purchase of the project and the continued costs incurred on exploration and development cover the majority of the revenue considered in this mine plan.

Table 3: Key Operating, Cost, and Revenue Metrics

| Total | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2030 | 2032 | |

| Mill Throughput (kt) | 1,823 | 141.4 | 292.6 | 287.2 | 284.0 | 292.8 | 292.8 | 198.0 | 33.6 |

| Average Grade (g/t) | 8.16 | 8.2 | 7.2 | 7.8 | 8.0 | 7.9 | 7.8 | 11.7 | 6.0 |

| Production (kozs) | 457.9 | 35.3 | 63.6 | 67.7 | 70.0 | 70.8 | 70.8 | 73.2 | 6.4 |

| Gold Price (US$ per oz.) | $2317 (average) | $2,600 | $2500 | $2450 | $2200 | $2200 | $2200 | $2200 | $2200 |

| Net Revenue ($M) | $1,464.5 | $127.1 | $220.2 | $229.8 | $213.2 | $215.8 | $215.7 | $223.1 | $19.6 |

| Operating Costs ($M) | – $588.1 | – $57.1 | – $89.7 | – $87.1 | – $89.5 | – $88.3 | – $90.8 | – $72.8 | – $12.7 |

| Operating Cash Flow ($M) | $876.4 | $70.0 | $130.5 | $142.7 | $123.7 | $127.5 | $124.9 | $150.3 | $6.9 |

| Capital Expenditure + Working Capital ($M) | – $484.7 | – $90.4 | – $77.2 | – $91.8 | – $93.7 | – $58.5 | – $27.8 | – $28.3 | – $11.0 |

| Free Cash Flow ($M) | $391.8 | – $20.4 | $53.3 | $50.9 | $30.0 | $69.0 | $97.1 | $122.0 | -$4.2 |

| Average Annual Free Cash Flow (6 Full Production Years) ($M) | $69.5 | ||||||||

Table 4: Net Present Value ($M) Sensitivity to Gold Price, Opex, Capex

| -20% | -10% | 0% | 10% | 20% | |

| Gold Price | $68 | $192 | $315 | $407 | $496 |

| Opex | $388 | $352 | $315 | $267 | $218 |

| Capex | $382 | $349 | $315 | $272 | $229 |

Table 5: Net Present Value ($M) Sensitivity to US:CDN Exchange Rate

| US:CDN Exchange Rate | 1.30 | 1.35 | 1.40 | 1.45 | 1.50 |

| NPV (5%) | $227 | $271 | $315 | $349 | $382 |

Permitting and Environment

The Madsen Mine is permitted for operations. The Madsen Mine was put into Temporary Suspension, per the Mining Act, in October 2022. Since then, environmental monitoring and reporting have continued. It is expected that the Mine will transition from Temporary Suspension to Production status in Q1 2025.

In preparation for restart, West Red Lake Gold has met with Madsen Mine stakeholders including Indigenous partners, the Madsen Advisory group, and the Municipality of Red Lake to communicate plans and receive input. The Company has worked to focus contracting on local suppliers where possible. Site plans for the new camp and mine dry were discussed with the community and approved by the Municipality. Public meetings have focused on communicating restart plans, with emphasis on employment opportunities.

As part of future operations, West Red Lake Gold will update existing permits such as Environmental Compliance Approval for the Water Treatment Plant and the Closure Plan.

Mineral Resource Estimate

The mineral resource statement for the Madsen Mine deposits is provided in Table 6, with an effective date of December 31, 2021. The mineral resources have been adjusted to reflect the removal of all historical and recent production to the end of December 2021. The mineral resources are inclusive of mineral reserves and have been classified according to CIM Best Practise Guidelines (November 2019) and are reported as undiluted tonnes at a cut-off grade of 3.38 g/t gold and gold price of US$1800/oz. (Table 5).

The mining activity from the effective date of the mineral resource until the suspension of the Madsen Mine has been deemed immaterial. Based on the mining records, 164,604 tonnes of ore at 3.8 g/t grade were processed, resulting in the production and sale of 20,301 ounces of gold. This production figure is not considered significant for the purpose of this report and the mining activity during the period from January 1, 2022 to the mine’s transition to care and maintenance on October 24, 2022 will not have a material impact on the mineral resource estimates presented in this report.

Since the effective date of the mineral resource, additional diamond drilling was conducted until the mine closure on October 24, 2022. A total of 688 drill holes and 54,122 m of drilling was completed in 2022. An additional 205 drill holes and 19,872 m of drilling was completed by West Red Lake Gold between October 1, 2023 and May 15, 2024. Based on a review of the results of this drilling it has been determined by Cliff Revering, Qualified Person for the Madsen Mineral Resource Estimate, that the information obtained will not have a material impact on the mineral resource estimate presented in this report.

Table 6: Mineral Resource Statement, Madsen Mine, Red Lake, Ontario, effective date December 31, 2021.

| Classification | Deposit - Zone | Tonnes | Gold Grade (g/t) | Gold Troy Ounces |

| Indicated | Madsen - Austin | 4,147,000 | 6.9 | 914,200 |

| Madsen -South Austin | 1,696,000 | 8.7 | 474,600 | |

| Madsen - McVeigh | 388,700 | 6.4 | 79,800 | |

| Madsen - 8 Zone | 152,000 | 18 | 87,700 | |

| Fork | 123,800 | 5.3 | 20,900 | |

| Russet | 88,700 | 6.9 | 19,700 | |

| Wedge | 313,700 | 5.6 | 56,100 | |

| Total Indicated | 6,909,900 | 7.4 | 1,653,000 | |

| Inferred | Madsen - Austin | 504,800 | 6.5 | 104,900 |

| Madsen -South Austin | 114,100 | 8.7 | 31,800 | |

| Madsen - McVeigh | 64,600 | 6.9 | 14,300 | |

| Madsen - 8 Zone | 38,700 | 14.6 | 18,200 | |

| Fork | 298,200 | 5.2 | 49,500 | |

| Russet | 367,800 | 5.8 | 68,800 | |

| Wedge | 431,100 | 5.7 | 78,700 | |

| Total Inferred | 1,819,300 | 6.3 | 366,200 |

Mineral Reserve Estimate

The mineral reserve statement for the Madsen Mine deposits is provided in Table 7, with an effective date of June 30, 2024. The mineral reserves have been adjusted to reflect the removal of all historical and recent production to the end of June 2024. The Life of Mine plan, which starts April 1, 2025, was also checked against the planned test mining program to ensure that any material extracted to March 31, 2025 was not from the mineral reserves. The mineral reserves have been estimated according to CIM Best Practice Guidelines (November 2019) and reported as diluted tonnes delivered to the mill.

Access is via two existing ramps systems with the Madsen #2 Shaft currently being reconditioned down to 12-level (12L) to allow for skipping of ore in Q4 2025. A raisebored hoisting shaft (Madsen #3) is planned to allow future hoisting from 20L as Madsen #2 shaft does not have the required hoisting capacity from 24L. The current mineral reserves include ore down to 25L, which will be trucked up to the Madsen #3 Shaft for hoisting. Material sizing for both Madsen #2 and #3 shafts will utilize grizzlies and rockbreaker stations.

Two underground mining methods are planned with 0.75 Mt (41%) being extracted by longhole (LH) mining methods and 1.07 Mt (59%) by mechanized cut-and-fill (MCF) mining methods.

Stopes were designed using a LH cut-off grade of 4.30 g/t and a MCF cut-off grade of 5.28 g/t, using a gold price of US$1,680/oz. As a significant portion of the mining is remnant mining around historic workings, appropriate geotechnical constraints were also applied during the design process.

LH stopes are longitudinal with an average mining width of 2.8 m, 35% dilution and 95% mining recovery. Dilution increases with depth.

Three variations of the MCF mining method are defined based on the ground support requirements with operating costs estimated for each. These include:

- Normal MCF – average width 4.4 m, good ground conditions

- Historic MCF – average width 3.2 m, adjacent to filled historic stopes, requiring short rounds and in-cycle shotcrete

- 8 Zone MCF – average width 7.2 m (= two 3.6 m wide cuts of drift-and-fill mining method due to squeezing ground conditions, requiring short rounds and heavy support)

MCF stopes are designed to use a breasting method with variable width and 3.5 m high to allow for full mechanization. Average dilution is 22% with 97% mining recovery. Short 2.4 m rounds were selected for geotechnical reasons as well as challenging grade control due to there being no visual distinction between ore and waste. The normal MCF stopes assume that the round length can increase to 3 m in 2026 with the implementation of successful grade control procedures.

Stephen Taylor, Principal Mining Engineer with SRK Consulting (Canada) Inc., has overseen the development of the mineral reserve estimate and the Life of Mine plan in his role as Independent Qualified Person for the Madsen Mineral Reserve Estimate.

Table 7: Mineral Reserve Statement, Madsen Mine, Red Lake, Ontario (Effective date June 30, 2024)

| Classification | Deposit - Zone | Tonnes (kt) | Gold Grade (g/t) | Contained Metal (koz Au) |

| Probable | Madsen - Austin | 778 | 7.37 | 184 |

| Madsen - South Austin | 861 | 8.21 | 227 | |

| Madsen - McVeigh | 66 | 7.37 | 16 | |

| Madsen - 8 Zone | 118 | 13.38 | 51 | |

| Total Reserves | 1,823 | 8.16 | 478 | |

Notes:

- Mineral Reserves estimated in accordance with CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines, CIM, November 29, 2019.

- Longhole stope cut-off grade of 4.30 gpt Au based on an estimated operating cost of CAD287.34/t including mining, plant and G&A. The mining cost component was benchmarked based on an operating mine in Ontario.

- Mechanized Cut and Fill stope cut-off grade of 5.28 gpt Au based on an estimated operating cost of CAD354.90/t including mining, plant and G&A.

- Mineral reserve estimates based on a gold price of USD1680/oz and an exchange rate of 1.31 CAD/USD.

- Incremental development cut-off grade of 1 gpt Au.

- A small amount of incremental longhole tonnes were included at a cut-off grade of not less than 3.4 gpt Au, these must be immediately adjacent to economic stopes that will pay for the capital to access area.

Qualified Persons

The Prefeasibility Study was prepared for West Red Lake Gold by SRK Consulting (Canada) Inc. with input from AllNorth Consultants Ltd. (infrastructure), Nordmin Engineering Ltd. (shaft), Fuse Advisors (processing), and Knight Piesold Ltd. (tailings and waste rock). The following Qualified Persons (“QPs”) from these firms have reviewed and approved technical information provided on the Masden Mine prefeasibility study presented in this news release.

Stephen Taylor, MSc., Peng. SRK Principal Engineer. Professional Registration: Professional Engineers of Ontario #90365834. Area of Responsibility – underground mining (design, planning), underground mining cost estimate, mineral reserve statement, financial analysis

Cliff Revering, P.Eng, CPAG, BE. SRK Geology Associate. Professional Registration: Association of Professional Engineers and Geoscientists of Saskatchewan #9764. Area of responsibility: geological resource and mineral resource statement

Chris Dougherty, P.Eng. Nordmin President. Professional Registration: Professional Engineers of Ontario #90416876. Area of Responsibility: underground shaft rehabilitation and design (and associated cost estimate)

Danny Ruane, P.Eng. Knight Piesold Ltd. Specialist Engineer. Professional Registration: Engineers and Geoscientists of British Columbia #100546532. Area of Responsibility: waste and water management, site-wide water balance (and associated cost estimate)

Travis O’Farrell. P.Eng. Fuse Advisors Engineer. Professional Registration: Engineers and Geoscientists of British Columbia #46026. Area of Responsibility: processing and metallurgy (and associated cost estimate)

The technical content of this press release has been prepared, reviewed, and approved by Mr. Will Robinson, P.Geo., Vice President Exploration of West Red Lake Gold Mines Ltd., and by Mr. Maurice Mostert, P.Eng., Vice President Technical Services of West Red Lake Gold Mines Ltd.

ABOUT WEST RED LAKE GOLD MINES

West Red Lake Gold Mines Ltd. is a mineral exploration company that is publicly traded and focused on advancing and developing its flagship Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario. The highly productive Red Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts some of the world’s richest gold deposits. WRLG also holds the wholly owned Rowan Property in Red Lake, with an expansive property position covering 31 km2 including three past producing gold mines – Rowan, Mount Jamie, and Red Summit.

ON BEHALF OF WEST RED LAKE GOLD MINES LTD.

“Shane Williams”

Shane Williams

President & Chief Executive Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Gwen Preston

Vice President Communications

Tel: (604) 609-6132

Email: investors@wrlgold.com or visit the Company’s website at https://www.westredlakegold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

QUALITY ASSURANCE/QUALITY CONTROL

Drilling completed underground at the Madsen Mine consists of BQ-sized diamond drill core for definition drill programs and oriented NQ-sized diamond drill core for exploration focused drilling. All drill holes are systematically logged, photographed, and sampled by a trained geologist at the Madsen Mine core processing facility. Minimum allowable sample length is 0.5m. Maximum allowable sample length is 1.5m. Control samples (certified standards and uncertified blanks), along duplicates, are inserted at a target 5% insertion rate. Results are assessed for accuracy, precision, and contamination on an ongoing basis. The BQ-sized drill core is whole core sampled. The NQ-sized drill core is then cut lengthwise utilizing a diamond blade core saw along a line pre-selected by the geologist. To reduce sampling bias, the same side of drill core is sampled consistently utilizing the orientation line as reference. For those samples containing visible gold (“VG”), a trained geologist supervises the cutting/bagging of those samples, and ensures the core saw blade is ‘cleaned’ with a dressing stone following the VG sample interval. Bagged samples are then sealed with zip ties and transported by Madsen Mine personnel directly to SGS Natural Resource’s Facility in Red Lake, Ontario for assay.

Samples are then prepped by SGS, which consists of drying at 105°C and crushing to 75% passing 2mm. A riffle splitter is then utilized to produce a 500g course reject for archive. The remainder of the sample is then pulverized to 85% passing 75 microns from which 50g is analyzed by fire assay and an atomic absorption spectroscopy (AAS) finish (SGS Code GO-FAA50V10). Samples returning gold values > 100 g/t Au are reanalyzed by fire assay with a gravimetric finish on a 50g sample (SGS Code GO_FAG50V). Samples with visible gold are also analyzed via metallic screen analysis (SGS code: GO_FAS50M). For multi-element analysis, samples are sent to SGS’s facility in Burnaby, British Columbia and analyzed via four-acid digest with an atomic emission spectroscopy (ICP-AES) finish for 33-element analysis on 0.25g sample pulps (SGS code: GE_ICP40Q12). SGS Natural Resources analytical laboratories operates under a Quality Management System that complies with ISO/IEC 17025.

The Madsen Mine deposit presently hosts a National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) Indicated resource of 1.65 million ounces (“Moz”) of gold grading 7.4 g/t Au and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t Au. Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc. and dated June 16, 2023, and amended April 24, 2024 (the “Madsen Report”). The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the purpose of the Madsen Report. A full copy of the Madsen Report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

CAUTIONARY STATEMENT AND FORWARD-LOOKING INFORMATION

Certain statements contained in this news release may constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information generally can be identified by words such as “anticipate”, “expect”, “estimate”, “forecast”, “planned”, and similar expressions suggesting future outcomes or events. Forward-looking information is based on current expectations of management; however, it is subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from the forward-looking information in this news release and include without limitation, statements relating tothe Company’s intended use of proceeds from the Credit Facility; final approval of the Loan Bonus Warrants by the TSXV, plans for the potential restart of mining operations at the Madsen Mine, the potential of the Madsen Mine; any untapped growth potential in the Madsen deposit or Rowan deposit; and the Company’s future objectives and plans. Readers are cautioned not to place undue reliance on forward-looking information.

Forward-looking information involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking information. These risks and uncertainties include, among other things, market volatility; the state of the financial markets for the Company’s securities; fluctuations in commodity prices; timing and results of the cleanup and recovery at the Madsen Mine; and changes in the Company’s business plans. Forward-looking information is based on a number of key expectations and assumptions, including without limitation, that the Company will continue with its stated business objectives and its ability to raise additional capital to proceed. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking information. Accordingly, readers should not place undue reliance on forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. Additional information about risks and uncertainties is contained in the Company’s management’s discussion and analysis for the year ended November 30, 2023, and the Company’s annual information form for the year ended November 30, 2023, copies of which are available on SEDAR+ at www.sedarplus.ca.

The forward-looking information contained herein is expressly qualified in its entirety by this cautionary statement. Forward-looking information reflects management’s current beliefs and is based on information currently available to the Company. The forward-looking information is made as of the date of this news release and the Company assumes no obligation to update or revise such information to reflect new events or circumstances, except as may be required by applicable law.

For more information on the Company, investors should review the Company’s continuous disclosure filings that are available on SEDAR+ at www.sedarplus.ca.

__________

1 SRK determines a reserve cut-off price based on the Energy and Metals Consensus Forecast from Consensus Economics Inc. dated April 2024, when the mine design parameters for this PFS were established.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/59a8cc10-7ce2-4835-8af4-1ad0643060ee

https://www.globenewswire.com/NewsRoom/AttachmentNg/530cc0a9-5efc-4bc6-b2e6-4dc0b887bd3d

https://www.globenewswire.com/NewsRoom/AttachmentNg/650795ba-6d0c-4f55-9d66-df6447b32ec2

© 2025 GlobeNewswire, Inc. All Rights Reserved.