MoonFox Data | Li Auto Financial Report Analysis: Pure Electric SUV Model i8 to become the Key Breakthrough in 2025

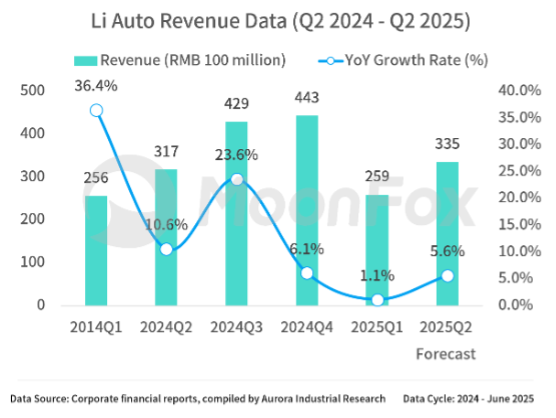

Li Auto faces mounting pressure as China’s EV market intensifies and product cycles accelerate. Q2 2025 revenue is projected at RMB 33.5 billion, up 5.6% YoY but with slowing growth. Despite stable gross margins and strong cash flow, delivery volumes have declined for the first time, prompting a downward revision of annual sales targets. The launch of the all-electric i8 SUV and advances in autonomous driving mark strategic pivots, while expanded charging infrastructure and overseas expansion aim to drive future growth. MoonFox Data highlights the need for accelerated product innovation to sustain Li Auto’s market leadership.

Shenzhen, Aug. 13, 2025 (GLOBE NEWSWIRE) -- Shenzhen, Aug 12, 2025 (GLOBE NEWSWIRE) - Currently, automakers are accelerating model upgrades, with new vehicles becoming larger, more intelligent, and offering extended range. Li Auto 's relatively limited product lineup is facing significant challenges.

According to financial modelling by MoonFox, Li Auto 's revenue for Q2 2025 is projected at RMB 33.5 billion, representing a YoY increase of 5.6%, with growth slowing by 4.96%.

Financial Outlook: Revenue and Profit Expected to Continue Declining Amid Intensifying Competition in the Future Market

From 2025 onwards, as competition in the automotive market further intensifies and Li Auto 's lineup remains overly concentrated, its family-oriented models, the L6, L7, L8, L9, and MPV model "MEGA ", have entered a phase of stock competition. The company 's revenue growth is showing a marked slowdown.

According to financial modelling by MoonFox, Li Auto 's revenue for Q2 2025 is projected at RMB 33.5 billion, representing a YoY increase of 5.6%, with growth slowing by 4.96%.

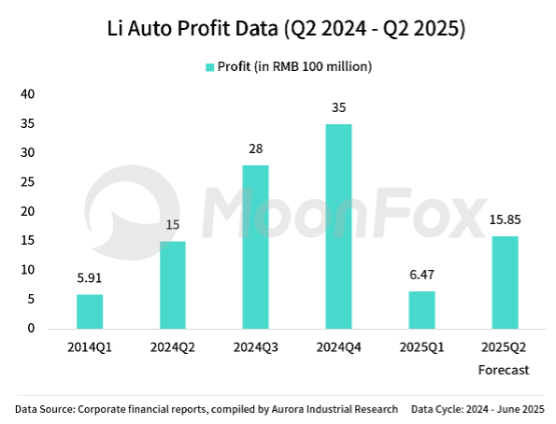

Li Auto 's gross profit margin remains relatively stable at a healthy level of 19-20%. However, with a deceleration in sales volume growth, the leverage effect of volume is weakening, thereby impacting profitability.

Profit also shows a downward trend. In Q1 2025, net profit was RMB 647 million, a YoY increase of 9.4% but a sharp QoQ decline of 81.7%.

Recently, Li Auto lowered its 2025 annual sales target from 700,000 units to 640,000 units.

According to the latest data as of July 1, Li Auto delivered a total of 111,074 vehicles in Q2.

As of June 30, 2025, the company 's cumulative historical deliveries stood at 1,337,810 vehicles.

This marks a YoY decline of 24% and a QoQ decline of 11.2%.

According to historical data, this marks the first YoY decline in vehicle deliveries for Li Auto in recent years.

Based on its financial model, MoonFox predicts the company 's net profit for the second quarter to be RMB 1.585 billion, with growth continuing to slow, representing a YoY increase of 5.6%.

Li Auto Seeks Breakthroughs in Four Key Areas under the Circumstances of Market Competition Intensification

Since 2025, overall demand in the automotive market has continued to contract, while competition in the new energy vehicle (NEV) sector has grown increasingly fierce. Numerous automakers have launched promotional campaigns and new models, diverting a portion of potential consumers and placing continuous pressure on Li Auto 's sales performance.

At the same time, following the downward revision of its sales targets, Li Auto has faced increasing scrutiny from investors.

In June 2025, Li Auto was served with a class-action lawsuit in the U.S. District Court for the Eastern District of New York. The lawsuit alleges that the company made false statements and material omissions in filings submitted to the United States Securities and Exchange Commission, in violation of the U.S. Securities Exchange Act of 1934.

The key focus of the class-action lawsuit is Li Auto 's revised delivery outlook and the subsequent decline in its stock price, which triggered investor action.

As a first-tier player among China 's emerging EV manufacturers, although Li Auto is facing various difficulties, the company continues to maintain a healthy financial position, with strong profitability and cash flow. At the same time, the company is pursuing breakthroughs in four strategic directions.

Li Auto is making parallel advances in its pure electric vehicle segment and autonomous driving technology.In July 2025, the company is set to launch its first all-electric SUV, the Li i8, along with its self-developed VLA (Vision-Language-Action) large model for driver assistance. This VLA model integrates spatial, linguistic, and behavioral intelligence, boasting 3D spatial comprehension and logical reasoning capabilities. It is designed to advance current L2-level driver assistance systems toward higher levels of autonomous driving.

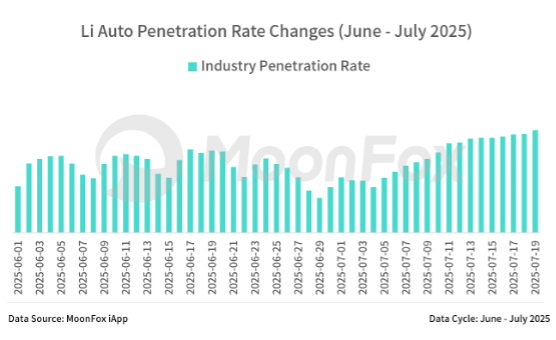

According to MoonFox Data, following the announcement of i8 pre-orders, Li Auto 's app saw a continued increase in online penetration rate, reflecting strong market enthusiasm.

The capital markets responded positively as well. On July 17, following the announcement of i8 pre-sales, Li Auto 's stock surged in the afternoon session, with intraday gains exceeding 10% and trading volume significantly increasing.

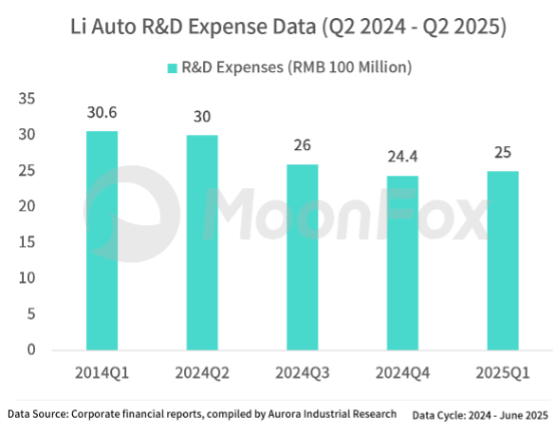

Throughout 2024 and 2025, Li Auto has consistently made substantial quarterly R&D investments focused on smart driving, intelligent in-car experiences, intelligent electric systems, and vehicle safety.

In the competitive market for large six-seat pure electric SUVs, the Li i8 faces strong rivals including the Model Y L, ONVO L90, and AITO M8.

To enhance support for its pure electric vehicle ecosystem, Li Auto is rapidly expanding its charging infrastructure. As of June 2025, the company had built 2,421 charging stations with a total of 13,200 charging piles.

To penetrate markets in lower-tier cities, Li Auto has launched the "Hundred-city Starry Plan "to establish a self-operated sale and service presence. The first batch includes 18 cities like Jiamusi, Mudanjiang, and Zhangjiakou, among others.

In addition, Li Auto has launched its overseas expansion plan, entering international markets through a dealership model. Over the past year, the company has established its own after-sales service centers in markets such as Kazakhstan, Uzbekistan, and the United Arab Emirates. Li Auto also plans to further expand its presence in the Middle East, Latin America, and the Asia-Pacific region.

Future Outlook: Li Auto Remains a Leading NEV Contender, but Growth Slowdown Expected to Intensify in 2025

Leveraging its extensive data resources, spanning online & retail stores, customer UVs, and manufacturing operations, MoonFox has built an investment model to comprehensively assess the investment value of Li Auto.

According to multidimensional data analysis, Li Auto 's overall investment value experienced rapid growth between 2022 and 2024, with its share price peaking at HKD 185.

Entering 2025, while Li Auto maintains its leading market position, its growth momentum has visibly decelerated.

Overall, competition in the domestic automotive market has reached a fever pitch. Li Auto remains at the forefront of China 's new-generation EV manufacturers and is proactively adjusting its strategies in response to rapidly shifting market dynamics. However, its core offerings are still centered around family-use scenarios, with the 4 models of L-series remaining its mainstay models.

Currently, automakers are accelerating model upgrades, with new vehicles becoming larger, more intelligent, and offering extended range. Li Auto 's relatively limited product lineup is facing significant challenges.

In the second half of the year, the domestic market is expected to see a surge of new model launches, alongside continued price promotions. To maintain competitiveness, Li Auto must accelerate its new product development and expand its model lineup to fill existing market gaps.

About MoonFox Data

MoonFox Data, a subsidiary of Aurora Mobile (NASDAQ: JG), is a leading alternative data provider delivering actionable insights to global financial institutions and investment firms. Trusted by top 50 funds, MoonFox leverages proprietary big data and advanced analytics to help clients uncover market trends and drive smarter decisions across China and emerging markets.

For Media Inquiries:

Contact: zhouxt@jiguang.cn | Website: http://www.moonfox.cn/en

CONTACT: Contact: zhouxt@jiguang.cn | Website: http://www.moonfox.cn/en

© 2025 GlobeNewswire, Inc. All Rights Reserved.