Montage Gold Reports on its Q3-2025 Activities

Koné project construction on-budget and well on-schedule • Strong continued exploration focus • Robust liquidity sources

CONSTRUCTION ACTIVITIES

- Rapid progress achieved with already +5.7 million hours worked with more than 2,900 employees and contractors on-site

- Well on track for first gold pour in Q2-2027 and on budget with $494.8 million of capital committed as at today, representing approximately 58% of the total capital expenditure, with prices in line with expectations

- Key process plant achievements include completion of all tanks erected on the first CIL train, ball mill foundation concrete pour, pre-leach and tailings thickeners concrete pours, and oxide circuit earthworks with concrete pour

- Other key infrastructure is well advanced including the commissioning and full operation of the river abstraction facility, TSF earthworks ahead of schedule, relocation site completed, and several plant buildings already fully operational

EXPLORATION ACTIVITIES

- 85,784 meters drilled in 2025 focused on delineating higher grade resources with further results expected to be published in the coming weeks

- The Gbongogo South, Koban North and ANV deposits, for which intermediary resources were published over recent months, are expected to continue to grow

- Further resource updates also expected for the Yeré North, Lokolo Main, Sena and Diouma North deposits, for which starter resources were published in early 2025, in addition to maiden resources for new targets

- Pre-production drilling, comprised of 56,000 meters at the Koné and Gbongogo Main deposits, confirmed the grade and continuity of mineralized envelopes and identified high-grade zones, with full results to be published in the coming weeks

FINANCIAL POSITION

- Robust liquidity and Koné project funding sources totalling $712.8 million compared to remaining capital disbursements of $597.7 million

VANCOUVER, British Columbia, Nov. 12, 2025 (GLOBE NEWSWIRE) -- Montage Gold Corp. (“Montage” or the “Company”) (TSX: MAU, OTCQX: MAUTF) is pleased to report on its construction and exploration activities for Q3-2025, with highlights provided in Table 1 below.

Table 1: Business and financial highlights

| THREE MONTHS ENDED | NINE MONTHS ENDED | |||||||||||

| All amounts in $ million unless otherwise specified | Sep 30, 2025 | Jun 30, 2025 | Sep 30, 2024 | Sep 30, 2025 | Sep 30, 2024 | Δ Q3-2025 vs. Q2-2025 | ||||||

| CONSTRUCTION ACTIVITIES | ||||||||||||

| Cumulative hours worked, million hrs | 4.8 | 2.7 | – | 4.8 | – | +2.1 | ||||||

| Lost-Time Injuries Frequency Rate | 0.2 | 0.0 | 0.0 | 0.2 | 0.0 | +0.2 | ||||||

| Total cumulative capital committed, inclusive of amount disbursed | 428.0 | 339.2 | – | 428.0 | – | +88.8 | ||||||

| - Cumulative capital disbursed1 | 262.3 | 158.8 | – | 262.3 | – | +103.5 | ||||||

| - Cumulative capital committed and to be disbursed1 | 165.7 | 180.4 | – | 165.7 | – | (14.7 | ) | |||||

| EXPLORATION ACTIVITIES | ||||||||||||

| Meters drilled, meters | 2,504 | 37,393 | 9,627 | 85,784 | 30,170 | (34,889 | ) | |||||

| Exploration expenditure | 2.4 | 6.4 | 6.8 | 15.8 | 12.6 | (4.0 | ) | |||||

| CASH FLOW AND LIQUIDITY POSITION1 | ||||||||||||

| Cash flows used in investing activities | (92.1 | ) | (88.3 | ) | (5.1 | ) | (237.2 | ) | (5.3 | ) | (3.8 | ) |

| Cash flows generated from financing activities | 156.8 | 150.5 | 130.1 | 307.7 | 156.5 | +6.3 | ||||||

| Cash and cash equivalents, end of period | 159.0 | 99.9 | 142.8 | 159.0 | 142.8 | +59.1 | ||||||

| Total Liquidity and Koné Project funding sources | 712.8 | 734.8 | 142.8 | 724.5 | 142.8 | (22.0 | ) | |||||

| 1As referenced in the Company’s Financial Statements and Management’s Discussion and Analysis for the three and nine months ended September 30, 2025, available on SEDAR+ and on the Company’s website. | ||||||||||||

The Company’s interim consolidated Financial Statements and associated Management’s Discussion and Analysis for the three and nine months ended September 30, 2025, and 2024, have been filed under the Company’s profile on SEDAR+ (www.sedarplus.ca) and are available for download on the Company’s website.

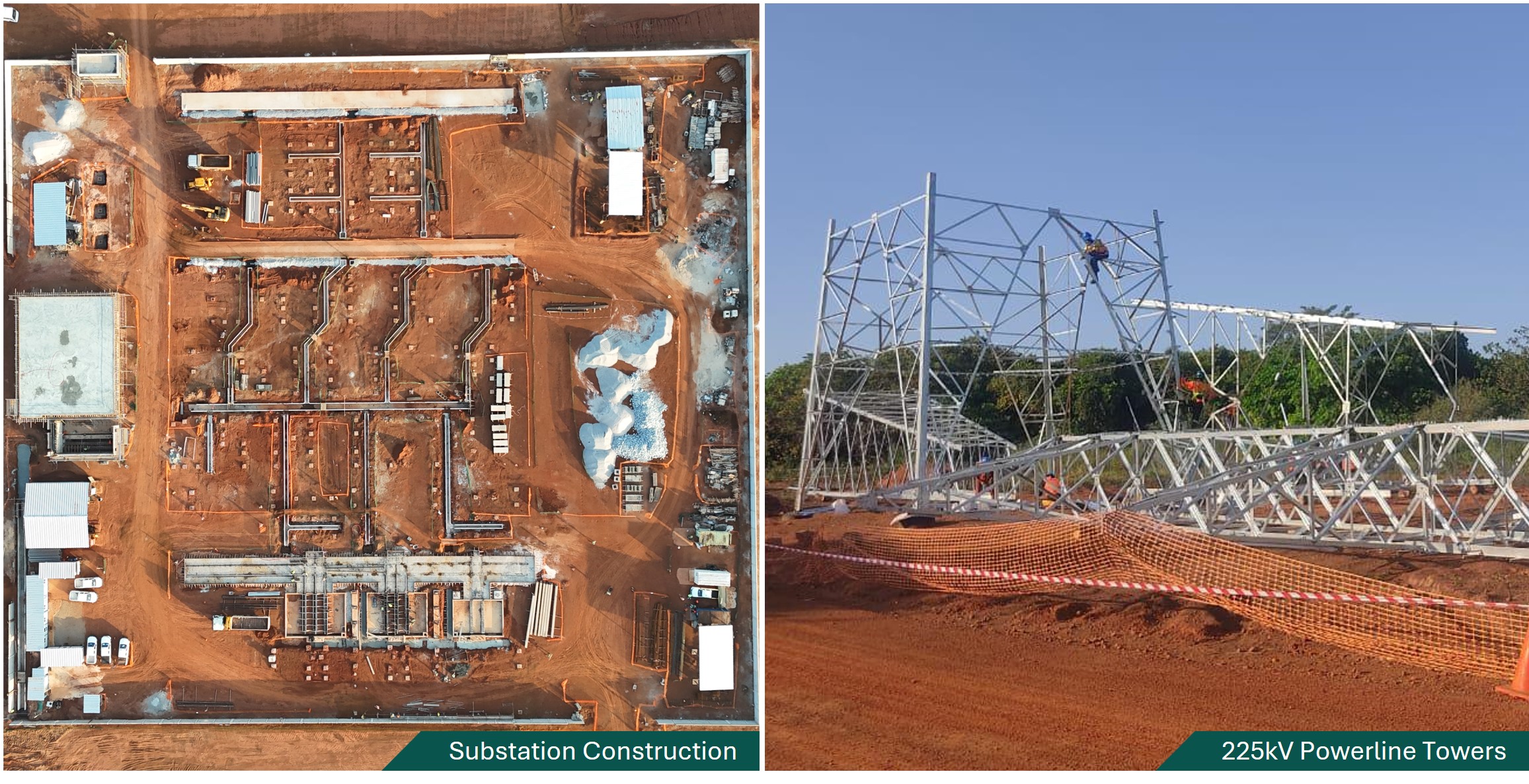

Rapid construction progress continues to be made at the Company’s flagship Koné project in Côte d’Ivoire which remains well on-schedule to pour gold in Q2-2027 and on-budget. A total of 2,051,952 construction hours were worked in Q3-2025, totalling over 5.7 million hours since the commencement of the project until today, with an industry-leading Lost Time Injury Frequency Rate (“LTIFR”) of 0.20. Significant progress is being made on the key processing infrastructure with notably the erection of all tanks on the first carbon in leach ( "CIL ") train complete and concrete pours completed for the ball mill, pre-leach and the tailings thickeners. The site water infrastructure was commissioned and is now fully operational while earthworks for the tailings storage facility (“TSF”) are progressing approximately three months ahead of schedule. Other key infrastructure including the construction of the 225kV electrical substation, preparation for grid connection, permanent camp and airstrip preparation also continue to advance ahead of schedule. The storage buildings, administrative and plant offices have all been completed and are now being occupied. The Gbongogo resettlement village has been completed with formal handover of homes to affected families to take place in the coming weeks. A total of $428.0 million of capital had been committed as at quarter-end (inclusive of $262.3 million disbursed), which has further increased to approximately $494.8 million as at today, representing approximately 58% of the total $860.0 million capital expenditure, with prices in line with expectations.

In parallel, the Company continues to be focused on unlocking value through its exploration programme. Since the start of the year, a total of 85,784 meters have been drilled, already exceeding the 81,815 meters completed during the full year of 2024. Exploration efforts are focussed on three parallel tracks: infill and extension drilling of previously delineated starter deposits, advancing pre-resource targets toward maiden resource definition, and testing new targets through regional scout drilling. The Company recently published an updated Mineral Resource Estimate ( "MRE ") for the ANV, Gbongogo South and Koban North deposits, all of which are expected to continue to grow as drilling remains ongoing. Furthermore, resource updates are expected for year-end for other targets such as Yeré North, Lokolo Main, Sena and Diouma North. Additionally, results from the Company 's pre-production drilling programme at the Koné and Gbongogo Main deposits, where preliminary assay results received to date have confirmed both the grade and continuity of the mineralized envelopes and identified high-grade zones, are expected to be released in the coming weeks.

Martino De Ciccio, Chief Executive Officer of Montage, commented: “We are very pleased with the rapid progress being made to unlock value at our Koné project in Côte d’Ivoire, which is one of the largest gold projects currently under construction globally.

On the construction front, we remain on budget and well on schedule for first gold pour in Q2-2027, with some key work packages tracking up to three months ahead of schedule. In the processing plant area, we have completed all seven tanks on the first CIL train and all major foundation pours have been completed. Meanwhile, plant offices, storage buildings, and the permanent camp are already in use. We are also pleased with the progress being made on the oxide circuit construction as its early completion may allow us to bring forward our first gold pour.

On the exploration front, the delineation of resources, as recently published with a Mineral Resource update at the ANV deposit, provides significant confidence in achieving our short-term objective of discovering at least 1 million ounces of Measured and Indicated Resources at a 50% higher grade compared to the Koné deposit, to be achieved prior to production commencing in Q2-2027. We expect to provide further resource updates as we complete our upsized 120,000 meter drill programme for 2025, with over 80,000 meters drilled in the first half of the year and now ramping up again post the rainy season.

Our success builds on the momentum generated thus far to advance our strategy of creating a premier African gold producer and delivering value for all our stakeholders.”

KONÉ PROJECT UPDATE

Construction continues to progress on-budget and well on-schedule for first gold pour in Q2-2027, with key highlights summarized below:

- On-site workforce now exceeds 2,900 employees and contractors, with over 5.7 million hours worked, and with over 90% local employment, demonstrating the Company’s commitment to local content.

- Process plant construction continues to rapidly advance:

- CIL tank construction is ongoing and tracking two months ahead of schedule with all concrete now poured and erection of all seven tanks on the first CIL train completed, while two of the seven tanks on the second CIL train have also recently been completed.

- Major mill foundations, concrete works and pre-leach and tailings thickener concrete base pours were completed two months ahead of schedule.

- Elution train concrete pours were completed on train 1 whilst one ring beam has been poured and a second is undergoing rebar installation on train 2.

- Piperack installation to and from the elution train has commenced two months ahead of schedule.

- Reagent, cyanide and lime storage shed construction has been complete, with all grouting and joint sealing also completed almost two months ahead of schedule.

- Gold room concrete pours were completed on all ring beams.

- Construction of process and site buildings has rapidly progressed, with the main admin building, plant office, control room, clinic, training center and temporary workshops complete and being utilised. Construction is ongoing on the light vehicle ( "LV ") and heavy vehicle ( "HV ") workshops, plant warehouse and corporate social responsibility ( "CSR ") buildings.

Figure 1: Process plant area overview

Figure 2: Process plant key infrastructure

- Oxide circuit construction is rapidly advancing with earthworks and concrete work already underway.All engineering for the oxide circuit has been completed, and the oxide sizer and associated equipment have arrived on site. As highlighted in the Company 's press release dated October 6, 2025, the oxide circuit is expected to provide several significant operational, financial and strategic benefits, including:

- Optionality to bring forward the first gold pour and reduce peak funding as the Company is investigating the opportunity to commission the oxide circuit ahead of completing the hard rock comminution circuit, with further updates expected to be provided as construction progresses.

- Enhanced flexibility and efficiency including the ability to bypass the hard rock comminution circuit enabling oxide processing to continue during planned maintenance activities in the hard rock crushing circuit and improved mining and rehandling costs due to the reduced oxide material pre-stripping requirements at both the Koné and Gbongogo Main deposits, along with reduced oxide stockpiling requirements over the life-of-mine.

- Ability to integrate higher grade oxide discoveries into the mine plan at the onset of production given the attractive oxide content found near-surface in satellite deposits, rather than being constrained to the 10% maximum oxide feed required in the primary crushing circuit. The capacity of the process plant based on a full oxide feed is expected to remain the same as that of the hard rock comminution circuit at 11Mtpa, enabling the throughput to remain unchanged regardless of mill ore feed blend.

- Engineering, design, and procurement are well advanced and continue to progress alongside site construction works. Ongoing engineering of the hard rock comminution circuit, including the primary and secondary crushers, as well as the high pressure grinding rolls ( "HPGR "), remain on schedule.

- Fabrication of long-lead items such as the crushers, mill, thickeners, HPGR and structural steel are all progressing on schedule with pricing in line with or below budget. The ball mill is anticipated to arrive on site in Q1-2026, which will mark an important milestone.

Figure 3: Pre-leach thickener fabrication

- Owner mining operating modelwas adopted following a comprehensive review and competitive tender process of both owner operated and contractor mining models. The owner-operated mining model is underpinned by a long-term contractual agreement with Neemba International Limited (“Neemba”), the Caterpillar dealership for 11 countries in West Africa, including Côte d’Ivoire, with fleet acquisition and mobilisation costs financed through a $75.0 million equipment financing agreement with CAT Financial. The owner-operated mining model is expected to provide greater mine planning flexibility, improve operating efficiencies, and aligns with Montage’s commitment to developing local talent through training programmes as evidenced with a number of tasks being self-performed during the construction phase. In anticipation, the first cohort of 15 trainees in the Heavy Machinery Equipment ( "HME ") training programme in Yamoussoukro have already completed their certification in September 2025. Furthermore, the owner-operated mining model is expected to enable the swift integration of higher-grade satellite deposits into the production schedule, with mine planning frequently optimized to incorporate new expected higher-grade discoveries.

- Water supply infrastructure was completed following the commissioning of the river abstraction and booster stations in August 2025, alongside completion of welding of the high-density polyethylene pipes. Pumping from the river to the Water Storage Facility is now operating 24/7.

Figure 4: River abstraction site and pumping infrastructure

- Water Storage Facilitywas completed ahead of the rainy season with accumulation of water on track and estimated to now hold over 2.4 million cubic meters of water, out of a total capacity of 6.5 million cubic meters.

Figure 5: Water storage facility

- Grid connectioncivil works are ongoing on the 225kV to 33kV reticulation where transformer walls and exterior block wall construction is ongoing and tracking approximately two months ahead of schedule. Excavation of the footings of the 225kV towers are ongoing, with the erection of the first towers taking place. Underground conduits for high voltage electrical cables are well advanced, connecting key processing and administrative buildings, while pole installations for the 33kV overhead line to key infrastructure sites, including along the Gbongogo haul road, are also well progressed.

Figure 6: Electrical substation and high-voltage grid connection preparation

- Gbongogo haul road clearing has been completed between the Koné processing plant and the Marahoué river. Culverts have been emplaced, with erosion protection ongoing across the length of the haul road. Earthworks have begun at the Marahoué river bridge location.

- Tailings Storage Facility (“TSF”) earthworks continue to progress approximately 3 months ahead of schedule with bush clearing, topsoil stripping and stacking taking place. TSF embankment and drainage footprint preparation has commenced. The TSF liner has arrived on site with installation set to begin in the coming weeks, following the end of the rainy season.

- Airstrip construction is largely complete with perimeter fencing now installed. Structural fill for the hanger pad is ongoing. The airstrip is expected to be fully operational with all required permits in place by early 2026.

Figure 7: Airstrip and TSF clearing

- The permanent camp construction is advancing well with accommodation capacity currently amounting to in excess of 400 rooms. Internal fitting of senior level blocks are ongoing, alongside the installation of fiber optic cables which is 95% complete and undergoing testing and commissioning. The camp restaurant, gym, laundry facilities were completed and are now fully utilised.

Figure 8: Permanent camp

- Resettlement village construction was completed over two months ahead of schedule, with 109 newly-built homes completed. Formal handover of homes to affected families is expected to take place in the coming weeks. Further progress continues to be made on construction of the village school and on places of worship, as well as clinics, a market and a community centre.

Figure 9: Resettlement village construction and pilot farming project

Timeline to first gold pour

The Company remains on-budget and well on-schedule for first gold pour in Q2-2027 alongside the potential to bring forward first gold production by commissioning the oxide circuit ahead of hard rock comminution circuit, with further updates expected to be provided as construction progresses. The timeline to first gold pour, on the hard rock comminution circuit, is based on a 27-month construction period, with key upcoming milestones presented in Table 2 below.

| Table 2: Koné project timeline to first gold pour | ||||||||||

| Work Stream | Q1-2025 | Q2-2025 | Q3-2025 | Q4-2025 | Q1-2026 | Q2-2026 | Q3-2026 | Q4-2026 | Q1-2027 | Q2-2027 |

| Tailings Dam & Water Dams | ||||||||||

| Tailings Dam | * | * | * | |||||||

| Water Storage & Dam | * | * | ||||||||

| Construction | ||||||||||

| Power Supply | * | * | * | * | * | |||||

| Site Infrastructure | * | * | * | * | * | * | * | |||

| Earth works & Concrete Works | * | * | * | * | * | * | ||||

| Structural, Mechanical, Piping | * | * | * | * | * | * | ||||

| Electrical | * | * | * | * | ||||||

| Process Plant Commissioning | * | * | * | |||||||

| First Gold | * | |||||||||

CASH FLOW, LIQUIDITY SOURCES AND CAPITAL REQUIREMENTS

Cash flows generated from financing activities increased by $6.2 million from $150.5 million in Q2-2025 to $156.8 million in Q3-2025, as equal portions of the Wheaton Stream were drawn down during both Q3-2025 and Q2-2025, whereas payments related to deferred financing fees and capitalized contract costs took place during Q2-2025. Cash flows used in investing activities increased by $3.8 million from $88.3 million in Q2-2025 to $92.1 million in Q3-2025. This increase reflects the ongoing construction activities for the Koné project.

As at September 30, 2025, the Company had a consolidated cash balance of $159.0 million, compared to $99.9 million as at June 30, 2025, as the Company drew $156.25 million of the Wheaton Stream in Q3‑2025, partially offset by the investments in mineral property, plant and equipment (Koné Project construction), as well as operating cash outflows for general and administrative expenses and exploration activities.

As at September 30, 2025, the Company had total liquidity and Koné Project funding sources of $712.8 million, comprised of $487.5 million of undrawn funding sources (composed of the $312.5 million Wheaton Stream, $50.0 million Zijin Loan Facility, $75.0 million Wheaton Loan Facility, and $50.0 million local Working Capital Facility), $159.0 million of cash on hand and $66.3 million of other liquid assets. In addition, the Company has $75.0 million of undrawn CAT Equipment Financing.

A total of $428.0 million of capital had been committed for the Koné project construction as at September 30, 2025 (inclusive of amounts disbursed), which further increased to $494.8 million as of today, representing 58% of the total $860 million capital expenditure estimate, with prices in line with expectations. A total of $262.3 million has been disbursed for the Koné project construction, of which $103.5 million in Q3-2025, with approximately $597.7 million remaining to be disbursed (inclusive of contingencies).

In Q3-2025, the Company signed a binding commitment letter for a Working Capital Facility of $50.0 million (31.5 billion West African Franc) with a 5-year term. As at September 30, 2025, the final loan documentation was well advanced. Upon closing of the Working Capital Facility, it would rank pari-passu with existing creditors, benefiting from the Securities and Guarantees from the Financing Package, with details as outlined below:

- Facility amount: US$50 million available to Montage over a 24-month availability period from closing.

- Use of proceeds: Proceeds to be used for working capital, exploration, general and administration, and capital expenditures.

- Interest rate:7.00% per annum.

- Maturity and repayment:36-month repayment period in quarterly installments after expiry of the availability period.

EXPLORATION ACTIVITIES

Montage remains on track to achieve its short-term exploration target, as published on October 7, 2024, of discovering more than 1Moz of Measured and Indicated Resources, at a grade 50% higher than the Koné deposit, to be achieved before the commencement of production1. Achieving the set exploration target would represent a significant return on the exploration investment and aligns with the Company’s strategic objective of improving the production profile from the onset. Indicated Resources for satellite deposits have already grown by 404koz to 924koz at 1.32 g/t Au with an additional 140koz at 1.09 g/t Au of Inferred Resources.

The Company completed 2,504 meters of drilling amounting to an exploration expenditure of $2.4 million in Q3-2025, in line with plan during the rainy season, with drilling resuming in October following the end of the rainy season. The Company completed 85,784 meters, amounting to an exploration expenditure of $15.8 million, during the nine-month period ended on September 30, 2025.

The Q3-2025 exploration programme continued to focus on delineating higher-grade satellite resources. In-fill and step-out drilling continued at higher grade satellite deposits for which starter maiden resources were published in early 2025, including Koban North, Gbongogo South and ANV. The programme resulted in an updated Mineral Resource Estimate on the Koban North and Gbongogo South deposits, as published on July 21, 2025, with both deposits increasing in size whilst exhibiting a high rate of conversion from Inferred to Indicated Resources. Additionally, an updated Mineral Resource Estimate was recently published for the ANV deposit, with results demonstrating the potential extensions of mineralization contemporaneous with large identified gold in saprolite geochemical anomalies. Exploration also continued to develop the pipeline of exploration targets, with drilling in 2025 taking place across the 6 other targets which were previously advanced to pre-resource stage, including Soman 1 & 2 and Petit Yao to access the grade profiles in order to prioritise drilling efforts. Exploration continues to identify earlier stage targets, with mineralisation confirmed at all 23 targets drilled in 2025.

The pre-production drilling programme of approximately 56,000 meters was completed in Q3-2025. The programme was comprised of approximately 70% Grade Control (“GC”) and 30% Advanced Grade Control (“AGC”) drilling at the Koné and Gbongogo Main deposits, designed to better identify mineralisation behavior and improve grade continuity before first gold pour. AGC was conducted on a 50 x 25 meter centered grid followed by a 25 x 25 meter grid which aims to improve the accuracy of resource modelling for approximately the first two years of production. The GC drilling was conducted on a 12.5 x 12.5 meter grid to further improve the resource model definition for the first year of production. Full results of the pre-production drilling programme is being integrated into the resource block model and will be published in the coming weeks.

ABOUT MONTAGE GOLD

Montage Gold Corp. (TSX: MAU) is a Canadian-listed company focused on becoming a premier African gold producer, with its flagship Koné project, located in Côte d’Ivoire, at the forefront. Based on the Updated Feasibility Study published in 2024 (the “UFS”), the Koné project has an estimated 16-year mine life and sizeable annual production of +300koz of gold over the first 8 years and is expected to enter production in Q2-2027.

QUALIFIED PERSONS STATEMENT

The scientific and technical contents of this press release have been verified and approved by Mr. Peder Olsen, a Qualified Person pursuant to NI 43-101. Mr. Olsen, President and Chief Development Officer of Montage, is a registered Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM).

CONTACT INFORMATION

| For Investor Relations Inquiries: Jake Cain Strategy & Investor Relations Manager jcain@montagegold.com +44-7788-687-567 | For Media Inquiries: John Vincic Oakstrom Advisors john@oakstrom.com +1-647-402-6375 | For Regulatory Inquiries: Kathy Love Corporate Secretary klove@montagegold.com +1-604-512-2959 |

FORWARD-LOOKING STATEMENTS

This press release contains certain forward-looking information and forward-looking statements within the meaning of Canadian securities legislation (collectively, “Forward-looking Statements”). All statements, other than statements of historical fact, constitute Forward-looking Statements. Words such as “will”, “intends”, “proposed” and “expects” or similar expressions are intended to identify Forward-looking Statements. Forward-looking Statements in this press release include statements related to the Company’s objectives of achieving first gold pour in the second quarter of 2027 and the optionality to accelerate that schedule; the Company’s mineral reserve and resource estimates; results of the drill programs including targeted additions to the estimated mineral resources at the Koné project, and the timing thereof; results of the pre-production drilling programme; expected recoveries and grades of the Koné project; timing in respect of the commencement and completion of construction of various components of the Koné project, the length of construction and of the mining operations at the Koné project, including estimated construction costs; timing and amount of necessary financing related to the mining operations at the Koné Gold project; the timing and amount of future production from the Koné project; anticipated mining and processing methods of the Koné project; anticipated mine life of the Koné project; anticipated economic and, operational and strategic benefits of the adoption of an owner-mining strategy; anticipated operational efficiencies and flexibility and other benefits of the construction of the oxide circuit; and the publication of a new resource estimate in 2025.

Forward-looking Statements involve various risks and uncertainties and are based on certain factors and assumptions. There can be no assurance that any Forward-looking Statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements, including that the returns from the Koné project will be lower than estimated, that targeted additions to the mineral resources will not be achieved or that the cost of construction of the Koné project will be higher than estimated. Important factors that could cause actual results to differ materially from include uncertainties inherent in the preparation of mineral reserve and resource estimates and definitive feasibility studies, and in delineating new mineral reserve and resource estimates, including but not limited to, assumptions underlying the production estimates not being realized, incorrect cost assumptions, decreases in the price of gold, unexpected variations in quantity of mineralized material, grade or recovery rates being lower than expected, unexpected adverse changes to geotechnical or hydrogeological considerations, or expectations in that regard not being met, unexpected failures of plant, equipment or processes (including construction equipment), delays in or increased costs for the delivery of construction equipment and services, unexpected changes to availability of power or the power rates, failure to maintain permits and licenses, higher than expected interest or tax rates, adverse changes in project parameters, unanticipated delays and costs of consulting and accommodating rights of local communities, environmental risks inherent in the Côte d’Ivoire, title risks, including failure to renew concessions, unanticipated commodity price and exchange rate fluctuations, delays in or failure to receive access agreements or amended permits, and other risk factors set forth in the Company’s Annual Information Form available at www.sedarplus.ca, under the heading “Risk Factors”. The Company undertakes no obligation to update or revise any Forward-looking Statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for Montage to predict all of them, or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any Forward-looking Statement. Any Forward-looking Statements contained in this press release are expressly qualified in their entirety by this cautionary statement.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/ea8a04e4-6e5a-44f7-9a86-a5065a302366

https://www.globenewswire.com/NewsRoom/AttachmentNg/959ee042-aed0-4970-8fb6-430f71e1d357

https://www.globenewswire.com/NewsRoom/AttachmentNg/2515de4f-644f-4894-9fde-c701248345ac

https://www.globenewswire.com/NewsRoom/AttachmentNg/6597fbe2-9447-42db-bd79-32ef54706d9e

https://www.globenewswire.com/NewsRoom/AttachmentNg/6647327e-0e98-4e92-9623-eb31664d665e

https://www.globenewswire.com/NewsRoom/AttachmentNg/a6fda2f0-6b29-44e0-9b2e-72cf6d4e23cd

https://www.globenewswire.com/NewsRoom/AttachmentNg/3b4fc700-0da5-4c85-9801-bf803fd959ed

https://www.globenewswire.com/NewsRoom/AttachmentNg/6acdb305-e349-4c55-ba0d-31c88e7f4459

https://www.globenewswire.com/NewsRoom/AttachmentNg/8247dd40-e00a-4c49-8e59-85ab8dbd0e1f

© 2025 GlobeNewswire, Inc. All Rights Reserved.