Abaxx Digital Title Pilots Achieve T+0 Collateral Mobilization for Gold and Yield-Bearing Securities

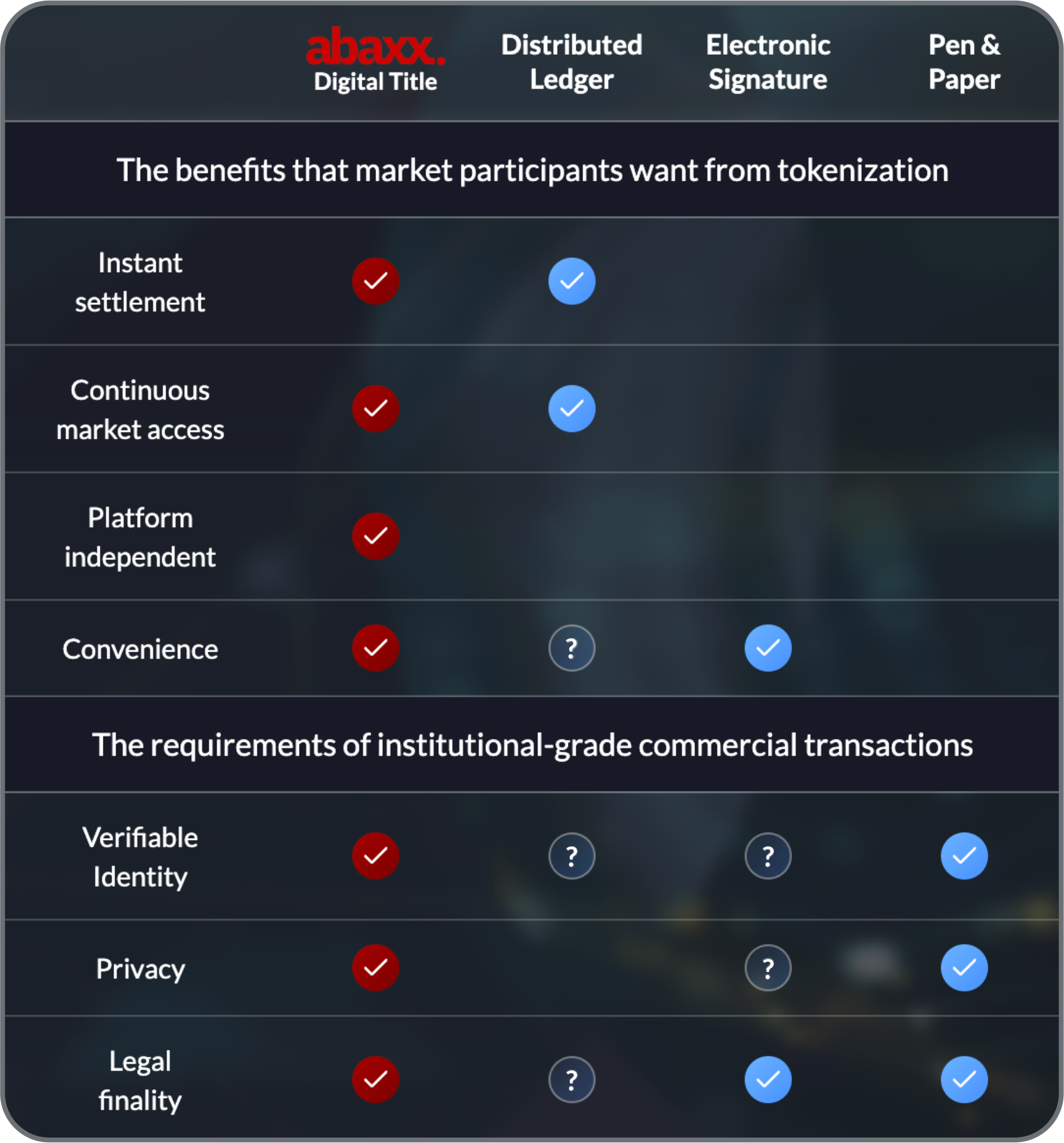

Abaxx’s proprietary market infrastructure innovation demonstrates that identity-anchored digital instruments can deliver T+0 finality and capital efficiency while reducing the regulatory risks and cross-jurisdictional ownership uncertainties inherent in blockchain tokenization

TORONTO, Feb. 10, 2026 (GLOBE NEWSWIRE) -- Abaxx Technologies Inc. (CBOE:ABXX)(OTCQX:ABXXF) (“Abaxx” or the “Company”), a financial software and market infrastructure company, majority shareholder of Abaxx Singapore Pte Ltd., the owner of Abaxx Commodity Exchange and Clearinghouse (individually, “Abaxx Exchange” and “Abaxx Clearing”), and producer of the SmarterMarkets™ Podcast, today announced the completion of two ID++ Digital Title pilot transactions as the Company moves toward commercial deployment.

The two pilot transactions achieved T+0 transfer of ownership of physical gold and money market fund shares, addressing inefficiencies in a US$1.4 trillion margin market and US$2.5 trillion trade-finance gap.¹ While blockchain tokenization initiatives often highlight the scale of the opportunity to increase the velocity of collateral, many institutional use cases remain constrained by whether digital token formats can deliver the same identity controls, cross-jurisdictional legal certainty, and transaction confidentiality that underpin today’s regulated markets. Abaxx’s Digital Title technology addresses this gap by converting physical commodities and regulated securities into legally enforceable, transaction-ready collateral for margin and financing within existing legal and regulatory frameworks.

Unlike existing tokenization models that rely on parallel ledgers or bearer instruments tied to offline identity whitelists, Abaxx Digital Title is a fully contained instrument that can be used to transfer ownership under internationally recognized standards, including UNCITRAL’s Model Law on Electronic Transferable Records (MLETR), positioning the Company to uniquely enable collateral mobility at institutional scale.

Highlights

- Completed a gold-backed Digital Title transaction between an investment firm and a regulated commodity lender that enabled futures-margin financing through repo-financed custodial gold at Abaxx Spot, converting vaulted inventory into transaction-ready digital collateral within regulated market infrastructure.

- Completed a second Digital Title pilot using money market fund shares as collateral, with evidence of legal title to principal value transferring on margin call, while the income yield continued to accrue to the holder — a superior and more flexible yield structure to stablecoin claims against reserves.

- Together, the pilots demonstrated a legally enforceable mechanism for direct ownership transfer and T+0 collateral mobilization across both physical commodities and regulated securities, addressing a core institutional constraint in posting margin, financing, and working-capital deployment.

- Following the successful completion of its first two pilots, Abaxx is pursuing integration of its Digital Title framework into the Company’s Singapore-regulated futures and clearing ecosystem, subject to meeting all regulatory requirements. To accelerate commercial adoption of this infrastructure, Abaxx is actively engaging with a coalition of Futures Commission Merchants (FCMs), prime brokers, and asset managers to align operational workflows, while concurrently finalizing a hybrid monetization framework designed to capture value through recurring SaaS fees for Console access with transaction-based pricing and basis-point participation in assets on network (AoN).

- Additional information on Abaxx’s Digital Title pilot program, including a pilot video demonstrating the use of Abaxx Digital Title to mobilize physical gold as collateral, is available at digital-title.abaxx.tech.

“Abaxx has engineered a superior infrastructure standard that unlocks the potential of 'Smart Collateral ' for the global economy,” said Josh Crumb, CEO of Abaxx. “Our proprietary ID++ architecture is the first Digital Title solution capable of turning static commodities and securities into high-velocity, yield-bearing T+0 instruments with legal finality under existing legal frameworks. By integrating digital identity directly into the settlement layer, we remove the friction that traps billions in over-provisioned and slow moving capital. These pilots prove that when you build on a foundation of verified identity and perfected title, you don 't just move assets faster— you fundamentally upgrade the quality of capital itself.”

Through executed commercial pilots in physical gold and regulated securities, Abaxx has validated a solution to long-standing inefficiencies in the post-trade movement of collateral.

Physical Gold Pilot Results

In December, the Company completed its first Digital Title pilot with an international venture financing firm and a regulated commodity lender, demonstrating how vaulted gold can be converted into transaction-ready collateral to finance cash margin requirements for a gold futures position within existing market structures. The transaction was structured as a repurchase agreement using gold held at Abaxx Spot, with Digital Title enabling T+0 ownership transfer for financing purposes while custody remained unchanged.

The pilot established Abaxx’s first legally enforceable Digital Title for physical gold under a bailee structure, providing lenders with direct, enforceable ownership rights against the custodian and enabling immediate financing against vaulted inventory.

Abaxx is pursuing additional bilateral financing transactions, as a part of the Company’s ongoing pilot program, with bullion banks and commodity lenders to extend beyond gold into a broader range of commodities.

Money Market Fund Pilot Results

In December, the Company completed a second pilot using money market fund shares, in which two entities executed a bilateral gold swap collateralized with approximately US$200,000 of BMO Money Market Fund shares (TSX: ZMMK) held at a third-party custodian.

The pilot proved that Abaxx’s Digital Title can provide a legally enforceable and operational mechanism to instantly mobilize money market fund shares for margin and financing. Evidence of legal title transferred immediately on margin call, giving the receiving party direct ownership of the underlying money market fund shares — rather than a pledged claim exposing them to an insolvency gap — while the original holder continued to earn yield on the same principal throughout the transaction.

The success of the pilot points to 150–275 basis points of potential annual value creation, through reduced intermediary costs and retained yield, across institutional markets, including prime brokers, asset managers, and bank treasury desks.²

Abaxx is now pursuing additional pilot transactions to evaluate multi-party structures and application of the framework across multiple jurisdictions.

In-Transit Commodities Pilot Update

Abaxx continues work on its third-announced pilot to mobilize in-transit cargo as collateral, extending the use of Digital Title to bills of lading in order to advance the Company’s broader effort to increase capital efficiency across commodity markets. This work includes exploring the potential of MineHub Technologies Inc.’s post-trade platform and logistics tracking capabilities for use in concert with Digital Title.

Commercialization Update

Following the successful completion of its first two pilots, Abaxx is pursuing integration of its Digital Title framework into the Company’s Singapore-regulated futures and clearing ecosystem, subject to meeting all regulatory requirements, to bring real-time collateral capabilities into exchange-linked margin processes.

Having demonstrated the capabilities of Abaxx’s console suite of applications, including Sign, Messenger, Drive and Verifier+, the Company is now advancing the console suite as a unified, identity-anchored operating layer for regulated markets. Built on Abaxx’s proprietary ID++ protocol, the system enables privacy-preserving, legally enforceable workflows that replace today’s fragmented communications, documentation and verification tools with interoperable applications designed to support Digital Title at institutional scale.

To accelerate network adoption, Abaxx is actively engaging with a coalition of FCMs, prime brokers, bullion banks and institutional asset managers to align operational workflows with market demand. Concurrently, the Company is finalizing a comprehensive monetization framework designed to capture value across the full collateral lifecycle. This updated business model targets a hybrid revenue stream, combining recurring SaaS-style fees for Console access with transaction-based pricing and basis-point participation in assets mobilized or pledged on network (AoN).

In January 2026, Abaxx Technologies Inc. achieved ISO/IEC 27001:2022 certification for its Information Security Management System, strengthening the Company’s ability to meet institutional security and governance requirements as it engages counterparties and expands commercial deployment of its Digital Title infrastructure.

“Institutional capital demands legal certainty, not just digital speed. While other tokenization models leave holders as unsecured creditors, Abaxx Digital Title functions as cryptographically-reconcilable evidence of ownership of the legal instrument itself, helping to close the insolvency gap that has held real time markets back,” said Leah Wald, Digital Title Lead at Abaxx Technologies. “With this validation, we are moving aggressively to expand the network to the FCMs, prime brokers, custodians, and asset managers who are ready to deploy this capital efficiency unlock at scale.”

¹Asian Development Bank. 2023 Trade Finance Gaps, Growth, and Jobs Survey. Asian Development Bank, 2023, www.adb.org/publications/2023-trade-finance-gaps-growth-jobs-survey; International Swaps and Derivatives Association. “ISDA Margin Survey: Year-End 2024.” ISDA, 14 May 2025, www.isda.org/2025/05/14/isda-margin-survey-year-end-2024/

² Morgan Stanley. 2026 Money Market Outlook: To Neutral and Beyond. Morgan Stanley Research, 2026; Deloitte. 2026 Banking & Capital Markets Outlook. Deloitte, 2026; Ernst & Young Global Limited. Collateral Optimization: Capabilities that Drive Resource Efficiency. EY, 2025; Depository Trust & Clearing Corporation. Understanding the Impact of the Settlement Discipline Regime (CSDR). DTCC, 2024.

About Abaxx Technologies

Abaxx Technologies is building Smarter Markets: markets empowered by better tools, better benchmarks, and better technology to drive market-based solutions to the biggest challenges we face as a society, including the energy transition.

In addition to developing and deploying financial technologies that make communication, trade, and transactions easier and more secure, Abaxx is the majority shareholder of Abaxx Singapore Pte. Ltd., the owner of Abaxx Exchange and Abaxx Clearing, and the parent company of wholly owned subsidiary Abaxx Spot Pte. Ltd., the operator of Abaxx Spot.

Abaxx Exchange delivers the market infrastructure critical to the shift toward an electrified, low-carbon economy through centrally-cleared, physically-deliverable futures contracts in LNG, carbon, battery materials, and precious metals, meeting the commercial needs of today’s commodity markets and establishing the next generation of global benchmarks.

Abaxx Spot modernizes physical gold trading through a physically-backed gold pool in Singapore. As the first instance of a co-located spot and futures market for gold, Abaxx Spot enables secure electronic transactions, efficient OTC transfers, and is designed to support physical delivery for Abaxx Exchange’s physically-deliverable gold futures contract, providing integrated infrastructure to deliver smarter gold markets.

Adaptive Infrastructure closes critical gaps in post-trade infrastructure by providing a unified custodial foundation across environmental markets and digital title assets. Incorporated in Barbados and regulated by the Financial Services Commission of Barbados, the company delivers institutional-grade custody, settlement, and transfer agency services designed to reduce risk and improve reliability across asset classes.

For more information, visit abaxx.tech | abaxx.exchange | abaxxspot.com | basecarbon.com | smartermarkets.media

For more information about this press release, please contact:

Steve Fray, CFO

Tel: +1 647-490-1590

Media and investor inquiries:

Abaxx Technologies Inc.

Investor Relations Team

Tel: +1 246 271 0082

E-mail: ir@abaxx.tech

Cautionary Statement Regarding Forward-Looking Information

This press release includes certain “forward-looking statements” and “forward-looking information” (collectively, “forward-looking statements”) within the meaning of applicable Canadian securities laws. All statements other than statements of historical fact are forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “believe”, “anticipate”, “estimate”, “project”, “intend”, “expect”, “may”, “will”, “plan”, “should”, “would”, “could”, “target”, “purpose”, “goal”, “objective”, “ongoing”, “potential”, “likely” or the negative thereof or similar expressions.

In particular, this press release contains forward-looking statements including, without limitation, statements regarding Abaxx’s business goals and objectives; the expansion and development of Abaxx’s product suite and Digital Title pilots; opportunities and anticipated market size for Digital Title; successful development, integration and implementation of Digital Title; successful completion of related transactions in connection with its Digital Title pilots; and the size and development of world energy and commodities markets. Forward-looking statements are based on the reasonable assumptions, estimates, analyses and opinions of management made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. Such factors impacting forward-looking information include, among others: risks relating to the global economic climate; the assumption that there will be a market for Digital Title and that it may be profitable; dilution; Abaxx’s limited operating history; future capital needs and uncertainty of additional financing; the competitive nature of the industry; currency exchange risks; the need for Abaxx to manage its planned growth and expansion; the effects of product development and need for continued technology change; protection of proprietary rights; the effect of government regulation and compliance on Abaxx and the industry; acquiring and maintaining regulatory approvals for Abaxx’s products and operations; the ability to list Abaxx’s securities on stock exchanges in a timely fashion or at all; network security risks; the ability of Abaxx to maintain properly working systems; reliance on key personnel; global economic and financial market deterioration impeding access to capital or increasing the cost of capital; and volatile securities markets impacting security pricing unrelated to operating performance. In addition, particular factors which could impact future results of the business of Abaxx include but are not limited to: operations in foreign jurisdictions; protection of intellectual property rights; contractual risk; third-party risk; clearinghouse risk; malicious actor risks; third- party software license risk; system failure risk; risk of technological change; dependence of technical infrastructure; changes in global weather patterns; changes in the price of commodities, capital market conditions, restrictions on labor and international travel and supply chains, and the risk factors identified in the Company’s most recent management’s discussion and analysis filed on SEDAR+. Abaxx has also assumed that no significant events occur outside of Abaxx’s normal course of business.

Abaxx cautions that the foregoing list of material factors is not exhaustive. In addition, although Abaxx has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, or intended. When relying on forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Abaxx has assumed that the material factors referred to in the previous paragraphs will not cause such forward-looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors. The forward-looking statements and information contained in this press release represents the expectations of Abaxx as of the date of this press release and, accordingly, is subject to change after such date. Abaxx undertakes no obligation to update or revise any forward-looking statements and information, whether as a result of new information, future events or otherwise, except as required by law. Accordingly, readers are cautioned not to place undue reliance on these forward-looking statements and information. Cboe Canada does not accept responsibility for the adequacy or accuracy of this press release.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/9ebdad1c-af41-4bca-8fb7-02dca5bf623c

© 2026 GlobeNewswire, Inc. All Rights Reserved.