H1 25 Results: Increased Profitability Despite Subdued Revenues

July 23, 2025 12:12 AM EDT | Source: medmix AG

Ad hoc announcement pursuant to Art. 53 LR

MEDIA RELEASE Baar, Switzerland--(Newsfile Corp. - July 23, 2025) - Ad hoc announcement pursuant to Art. 53 LR Half-Year 2025 Results |

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10892/259751_figure1.png

Increased profitability despite subdued revenues

HALF-YEAR 2025 HIGHLIGHTS

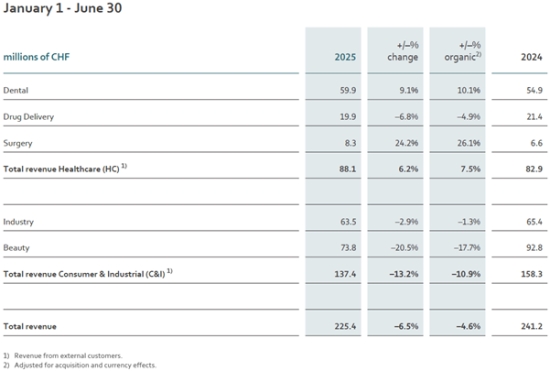

- Revenue at CHF 225.4m, -6.5% (- 4.6% organic FX adj.). Healthcare segment grew 7.5% (organic FX adj.) driven by Dental and Surgery. Consumer & Industrial segment declined 10.9 % organic FX adj. on low commercial activity and project delays in Beauty

- Adj. EBITDA margin at 19.9%, +80 bps YoY on higher Dental volume and continued gross profit margin improvements in Industry

- Segment gross profit margin up 390 bps to 47.9%, positively impacting EBIT as a percentage of revenues (+170 bps)

- Free Cash Flow at CHF 11.4m (+50.9% yoy); Operating Net Cash Flow (ONCF) at CHF 15.3m

(-24.1% yoy) reflecting inventory build-up mainly in Dental to mitigate potential tariff impact - Well on track with Growth and Efficiency program: CHF 15m savings impact secured, CHF 8.5m realized in first half 2025 and 70 efficiency initiatives initiated

- Acceleration of cost out initiatives and CHF 3m additional actions identified, specifically targeted at Beauty business unit

- Strengthened leadership team: new CHRO, CTO and Business Unit Head Drug Delivery

- Revised 2025 revenue guidance: decline similar to that seen in H1 2025 (FX adj.)

Confirmed 2025 profitability guidance: adjusted EBITDA margin 18% to 19%

- Confirmed mid-term guidance: CAGR in revenue of above 4%, adj. EBITDA margin of above 20%

CEO René Willi said: “We are on track with our strategy to pivot to high growth/high margin healthcare businesses. We have significantly improved profitability, which on the one hand is driven by strong growth in our most profitable Healthcare businesses Dental and Surgery, and on the other hand, by the impact of our Growth and Efficiency program. Our group revenues have been impacted by lower Beauty sales, which were the result of lower commercial activity, project delays and a high comparable in H1 2024. We have accelerated additional cost out measures of CHF 3m targeted at our Beauty business unit to maintain our high profitability levels.”

Revenue key figures

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10892/259751_figure2.png

GROUP REVIEW

In the first half of 2025, medmix generated revenue of CHF 225.4 million, 6.5% lower year-on-year. Foreign exchange rate effects of -2.0% negatively impacted underlying organic volume growth during the period which stood at -4.6%. Compared to the second half of 2024, however, Group revenues declined by -7.1% on a reported basis and by -5.1% organically.

Healthcare segment revenue grew strongly in the first half of 2025, with two of the three Healthcare business units delivering robust year-on-year organic growth well above market rates, Surgery 26.1% and Dental 10.1%. Adverse impacts from Drug Delivery offset some of this growth.

Healthcare segment revenues increased by 6.2% on a reported basis and 7.5% organically, with the difference of -1.3% entirely due to foreign exchange effects.

Dental business unit organic revenue grew 10.1% year-on-year due to successful growth outside the historically strong impression material sector, resulting in above market growth additionally supported by stronger market conditions. Sequential organic revenues were down slightly 0.3%, partly due to uncertainty generated by US tariffs timing.

Drug Delivery business unit revenue declined by 4.9% organically as H1 2024 included some non-repeat project milestones due to close out of a customer project.

Surgery business unit revenue saw a 26.1% organic increase due to a lower base in H1 2024. Our customer base is growing as we move our commercial and manufacturing HQ to Atlanta.

A continuation of the positive growth trajectory of the Dental and Surgery business units' revenue is expected in the second-half, at a more normalized level. The second source impact in the Drug Delivery business unit will again partly offset this growth.

Consumer & Industrial segment organic revenue declined by 10.9%, driven by continued weakness in the Beauty markets and overall low consumer confidence.

Industry business unit revenue reached CHF 63.5 million in the first half of 2025, organically 1.3% lower versus the first half of 2024. Sequentially, the Industry business unit delivered robust organic growth of 5.6% as we continue to deliver our full portfolio from our plant in Valencia and expand our greenLine offering. Management remains cautious of the global economic landscape and its impact on the Industry business unit.

Beauty business unit organic revenue declined year-on-year by 17.7% to CHF 73.8 million, due to project delays and lower commercial activity in our business. In comparison, H1 2024 saw Beauty’s highest half-year revenue in five years, where it benefited from a high level of launch activity after the lifting of covid restrictions. We expect this slower activity to continue in the second half. We have seen an increase in customer projects activity in Q2 2025, which will provide revenue growth momentum in 2026. Additionally, medmix has accelerated decisive cost-out measures to adapt the cost base to business volume and protect profitability.

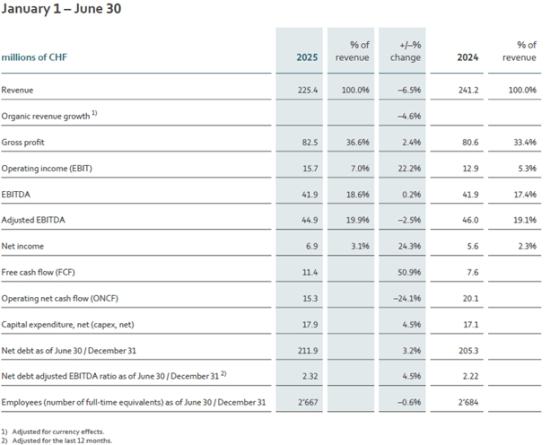

Gross profit margin, segment gross profit

Segment gross profit, which does not include shared cost and cost absorption, grew by 1.6% to CHF107.9 million, despite a decline in Group revenues, delivering a strong margin of 47.9%.

Healthcare segment gross profit increased by CHF 3.9 million, a growth of 7.5% year-on-year, in line with the revenue growth. Resulting segment gross profit margin was a strong 62.7%. Dental and Surgery segments margin growth was partly offset by the profit pressure from the Drug Delivery business unit as it remains in ramp-up mode, with more projects than commercial product sales.

Consumer & Industrial first-half segment gross profit decreased by 4.0% year-on-year, due to the impact of decrease in Beauty volumes. Importantly, the segment delivered a robust gross profit margin of 38.3%, an increase of 370bps year-on-year, driven by operational efficiencies from our Growth and Efficiency program, driving margin expansion across both Industry and Beauty business units.

Adjusted EBITDA

Group Adjusted EBITDA was CHF 44.9 million, a decrease of 2.5% year-on-year, with our Growth and Efficiency program limiting the impact on profitability resulting from lower revenues. While there was a decline in the absolute Adjusted EBITDA, Adjusted EBITDA margin was 19.9%, having grown sequentially for two consecutive halves, compared to 19.1% in H1 2024 and 19.2% in H2 2024. The group delivered a robust profitability improvement of 80bps year-on-year, offsetting the impact of lower volumes and additional investments made in our Growth and Efficiency program. The year-on-year and sequential improvement is primarily driven by the continuation of strong Dental volumes and operational efficiencies in Consumer and Industrial segment. EBIT increased year-on-year from CHF 12.9 million to CHF 15.7 million, EBIT as a percentage of revenues increased 170bps to 7.0%.

Net income

Net income increased by CHF 1.4 million to CHF 6.9 million (thereof CHF 6.8 million attributable to shareholders of medmix AG) from CHF 5.6 million (thereof CHF 5.2 million attributable to shareholders of medmix AG) in the prior period.

Operating Net Cash Flow (ONCF)

Operating Net Cash Flow for H1 2025 decreased to CHF 15.3 million compared to the same period a year ago (CHF 20.1 million) mainly due to inventory build-up in the Dental business unit while Free Cash Flow increased from CHF 7.6 million in H1 2024 to CHF 11.4 million in the first half of 2025, mainly due to lower CAPEX, which may however increase in the second half.

GROWTH & EFFICIENCY PROGRAM

Our Growth and Efficiency program launched in 2024 aims at enhancing growth by re-allocating resources to our strategic priorities and improving our performance by strategically reducing costs. With CHF 15 million savings impact secured and CHF 8.5 million realized in the first half of 2025, we are on track with our goal for H1 2025. We have implemented 70 efficiency initiatives, such as reducing headquarters and support functions or automating productions processes in our factories. We will also continue to invest in our sales organization and in R&D, which will ensure we remain at the forefront of innovation in both our segments. This program will not impact our ability to maintain our innovation pace and quality standards and will ultimately lead to an increase in our service levels.

STRENGTHENED LEADERSHIP TEAM

In the past half year, we have significantly strengthened our management team with seasoned leaders. Jasper Den Ouden joined medmix as of March this year as Chief Human Resources and Sustainability Officer. Jasper brings extensive international HR leadership experience. He most recently served as Chief Human Resources Officer at SR Technics Group in Zurich where he led HR for 2,200 employees and drove key initiatives in digital transformation, talent development, ESG and organizational change.

We are also very happy to welcome Francisco Faoro and Oliver Haferbeck to our Executive Leadership Team. Oliver was appointed as the new Head of Drug Delivery Business Unit in June. He brings a wealth of international leadership experience in the healthcare and medical technology sectors. Most recently, he served as Head of Gerresheimer Advanced Technology and CEO of Sensile Medical AG, where he led innovation in advanced drug delivery systems. His tenure at Gerresheimer was marked by a strong focus on strategic growth, technological advancement, and operational excellence.

Francisco Faoro joined medmix as Chief Technology Officer in May. Francisco brings extensive international leadership experience in technology and innovation. He held multiple senior leadership roles at Straumann Group, successfully preparing multiple implant innovations creating significant growth momentum. Prior to his tenure in the dental field, Francisco had several managerial positions in brand management and product development within the orthopedic and polymer processing industries.

OUTLOOK

Based on H1 2025 actuals and our outlook for the full year, we now expect a full year revenue decline similar to that seen in H1 2025 on an FX adjusted basis.

Our 2025 guidance for profitability with an adjusted EBITDA margin of 18-19% remains unchanged, as does our mid-term guidance –over a three-year period– with a compound annual growth rate in revenues of above 4% and an adj. EBITDA margin above 20%.

Key figures

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10892/259751_figure3.png

The medmix half-year report is available to download here.

Half-year 2025 results presentation

Webcast participation

medmix management will present the half-year results 2025 as a webcast on July 23, 2025, at 08:30 CET.

A webcast invitation was sent to medmix news subscribers early July. If you have not received it and wish to participate, please click here to pre-register by 08:00 CET latest to receive the link to the webcast and dedicated dial-in details.

Webcast playback

The playback of the webcast will be available shortly after the event under the same link.

Key dates in 2025/2026

February 26, 2026 | Full-year results 2025 |

About medmix

medmix is a global leader in high-precision delivery devices. Our customers benefit from a dedication to innovation and technological advancement that has resulted in over 900 active patents. Our 14 production sites worldwide together with our highly motivated and experienced team of nearly 2,700 employees provide our customers with uncompromising quality, proximity, and agility. medmix is headquartered in Baar, Switzerland. Our shares are traded on the SIX Swiss Exchange (SIX: MEDX). www.medmix.swiss

Disclaimer

This document may contain forward-looking statements including, but not limited to, projections of financial developments, market activity, or future performance of products and solutions containing risks and uncertainties. These forward-looking statements are subject to change based on known or unknown risks and various other factors that could cause actual results or performance to differ materially from the statements made herein.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/259751

© 2025 Newsfile Corp. All rights reserved.