Pelangio Exploration Inc. Files NI 43-101 Technical Report for the Mineral Resource Estimate Update on Its Manfo Project and Provides Exploration Update

September 10, 2025 4:30 PM EDT | Source: Pelangio Exploration Inc.

Toronto, Ontario--(Newsfile Corp. - September 10, 2025) - Pelangio Exploration Inc. (TSXV: PX) (OTC PINK: PGXPF) ("Pelangio" or the "Company") is pleased to announce that the updated, independent, Mineral Resource Estimate (the "Resource") for the Company's 100% owned Manfo Gold Project ("Manfo") in Ghana and completed by SEMS Technical Services Ltd. of Ghana is filed on SEDAR. As well, we are pleased to provide an exploration update.

- The Resource defines a total Indicated Mineral Resource of 441,000 ounces of gold at an average grade of 1.16 g/t Au and totalling 11,787,000 tonnes; and

- Defines a total Inferred Mineral Resource of 396,000 ounces of gold at an average grade of 0.77 g/t Au and totalling 16,048,000 tonnes.

- Adds a fourth deposit to the Resource for Manfo, the Nkansu deposit.

- Represents an increase of 126% in estimated gold ounces in the Indicated category plus an increase of 395% in estimated gold ounces in the Inferred category as compared to the Maiden pit-constrained mineral resource estimate that used $1,450 Au for its pit optimization.

- Plans for a $7,600,000 staged exploration program including up to 45,000 metres of drilling.

- Exploration programs are underway on Manfo and Nkosuo with the near completion of high-resolution UAV magnetics and orthophoto surveys and drilling is expected to start in November.

Manfo Mineral Resource Update

An updated Mineral Resource Estimate ("MRE") for the Manfo gold project in Ghana was completed in August 2025 by SEMS Technical Services Ltd. of Ghana. The NI 43-101 Technical Report detailing the MRE update, with an effective date of July 31, 2025 and signed on September 03, 2025 has been filed and is now available for review on SEDAR+ (www.sedarplus.ca) and will be posted to the company's website (www.pelangio.com).

The MRE update conducted by SEMS Technical Services resulted in a total Indicated resource for the Manfo Project of 11,787,000 tonnes averaging 1.16 g/t Au for 441,000 ounces of gold plus a total Inferred resource of 16,048,000 tonnes averaging 0.77 g/t Au for 396,000 ounces of gold. The Resource is contained in four deposits along a strike length of 4.9 kilometres. The pit-constrained MRE was conducted using a gold price of US$2,600/ounce for the conceptual pits and gold cut-off grades of 0.35 g/t Au for the transitional and fresh mineralization and 0.25 g/t Au for oxide mineralization (refer to Table 1).

The 2025 MRE update represents a substantial increase over the Maiden pit-constrained Mineral Resource Estimate, which was conducted at a gold price of US$1,450/ounce, with an increase of 126% in total Indicated gold ounces and a 395% increase in total Inferred gold ounces (refer to Table 2).

Refer to the 43-101 Technical Report "Independent Technical Report and Mineral Resource Estimation for the Manfo Gold Project, Ghana" filed on SEDAR+ for the details.

Table 1. 2025 Mineral Resource Statement for the Manfo Gold Project

| Classification | Indicated | Inferred | |||||

| Category | Cut-off Grade (g/t Au) | Quantity (000' tonnes) | Grade (g/t Au) | Cont. Gold (000' oz) | Quantity (000' tonnes) | Grade (g/t Au) | Cont. Gold (000' oz) |

| Oxide | 0.25 | 55 | 1.30 | 2 | 1,024 | 0.69 | 23 |

| Transition | 0.35 | 458 | 1.70 | 25 | 2,017 | 0.79 | 51 |

| Fresh | 0.35 | 11,274 | 1.14 | 414 | 13,007 | 0.77 | 322 |

| Totals | 11,787 | 1.16 | 441 | 16,048 | 0.77 | 396 | |

Notes:

- The Indicated mineral resource and the Inferred mineral resource are reported in accordance with Canadian Securities Administrators National Instrument 43-101 - Standards of Disclosure for Mineral Projects and have been estimated following the generally accepted CIM 'Estimation of Mineral Resource and Mineral Reserves Best Practices Guidelines' (2014).

- Mineral resources are distinct from mineral reserves, have not demonstrated economic viability, and there is no certainty that they will be converted into a mineral reserve.

- The Mineral Resource estimate was prepared by independent Qualified Persons Simon Meadows Smith (FIMMM # 49627) and Andrew Netherwood (MAusIMM #100463) of SEMS Technical Services Ltd. Ghana and has an effective date of July 31, 2025.

- Factors that could materially affect the reported Mineral Resource include changes in metal price and exchange rate assumptions; changes to assumed metallurgical recoveries, mining dilution and recovery; and assumptions as to the continued ability to access the site, extend and/or retain mineral and surface rights, titles and permits, maintain environmental and other regulatory permits, and continued community and stakeholder support for ongoing activities.

Table 2. Comparison of the Pit-Constrained Mineral Resource Estimations for 2013 and 2025

| Resource Parameters | Indicated | Inferred | ||||||

| Year | Cut-off Grades (g/t Au) | Gold Price USD | Quantity (000' tonnes) | Grade (g/t Au) | Cont. Gold (000' oz) | Quantity (000' tonnes) | Grade (g/t Au) | Cont. Gold (000' oz) |

| 2013 | 0.40/0.50 | 1,450 | 3,973 | 1.52 | 195 | 2,253 | 1.10 | 80 |

| 2025 | 0.25/0.35 | 2,600 | 11,787 | 1.16 | 441 | 16,048 | 0.77 | 396 |

| % Increase / (Decrease) | 197 | (24) | 126 | 612 | (30) | 395 | ||

Resource Growth and Exploration Potential

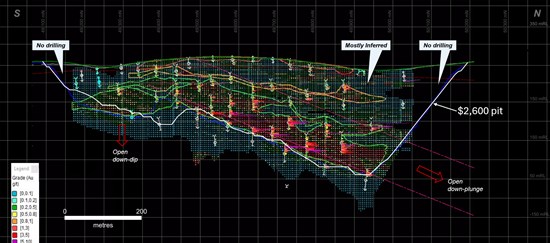

With 396,000 gold ounces (16,048,000 tonnes at an average grade of 0.77 g/t Au) of the Resource in the 2025 update being in the Inferred category, SEMS Technical Services has recommended drilling programs to upgrade the Resource. Additionally, much of the mineralization remains open-ended on the Manfo project and there is scope to expand the gold resource through successful resource extensional drilling and infill drilling follow up. Figure 2, which is a vertical long-section of the gold grade block model for the Pokukrom East deposit, shows the deposit remains open down-plunge and the shallower southern end of the deposit is open down-dip. Additionally, the northern and southern ends of the conceptual $2,600 Au optimized pit are undrilled and not reflected in the current Resource. Further drilling at Pokukrom East as well as at the other three deposits could potentially add significantly to the total Resource.

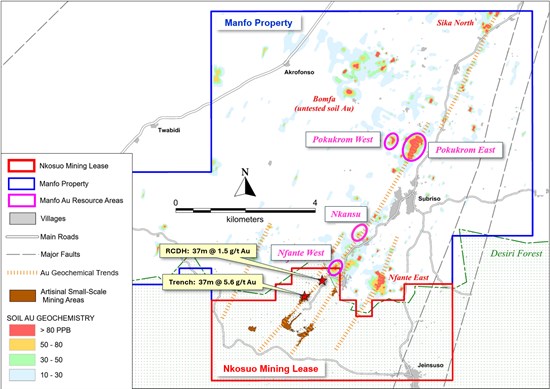

Exploration drilling programs have also been proposed for the Manfo property and there is potential to add one or more satellite deposits to the project with numerous compelling untested exploration targets remaining such as the large Bomfaa gold-in-soil anomaly two to three kilometres northwest of the Pokukrom deposits (refer to Figure 1).

The greatest exploration potential is believed to be through the recent addition of the Nkosuo Mining Permit immediately south of the Manfo property. Pelangio believes that there is potential for at least Manfo-scale discovery on Nkosuo. This view is based on limited historical exploration completed by AshantiGoldfields (now AngloGoldAshanti) demonstrating extensions to the Manfo mineralized structures and two or three subsidiary structures into Nkosuo Lease, plus the considerable past and current work by artisanal miners. Pelangio has commenced exploration on the Nkosuo Lease with a UAV (drone) orthophotography survey extending over both the Manfo and Nkosuo licenses now complete. The drone high-resolution magnetics survey over the same area is now 97% complete, although weather has delayed the flying of the last several lines. Geological mapping, prospecting and soil sampling will follow once the magnetic survey is completed and interpreted and will be combined with the orthophotography to assist targeted mapping and prospecting.

Between the resource expansion drilling and exploration programs for new discovery, Pelangio believes the gold resource contained in the Manfo-Nkosuo combined project can be grown substantially above its current level at relatively low discovery / resource addition costs. SEMS Technical Services in collaboration with Pelangio Exploration have designed a US$7.6M staged work program of resource expansion drilling, resource upgrade drilling plus aggressive exploration and follow-up drilling on both the Manfo and Nkosuo licenses with Nkosuo being the immediate priority. The program includes expenditures of US$3.3M with 27,000 meters of combined diamond and reverse-circulation drilling directed towards initial resource expansion and new discovery. Assuming success a follow up program costing US$4.3M with 18,000+ meters of mostly infill diamond drilling would be conducted to quantify possible resource additions to mostly the Indicated category. Drilling is expected to start in November 2025. The start of exploration drilling on the Nkosuo Lease will not begin until the drone surveys are completed and compiled and the mapping, prospecting and soil sampling programs are well underway. This will provide a well-documented list of rated and ranked targets to pursue. There are numerous compelling walk-up exploration drill targets already evident particularly at Nkosuo.

Figure 1. Map of the Manfo - Nkosuo Project and 2025 MRE Deposit Locations

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6179/265933_ce59e3b8c49d9b04_001full.jpg

Figure 2. Vertical Long-section of the Pokukrom East Block Model

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6179/265933_ce59e3b8c49d9b04_002full.jpg

Qualified Person

Mr. Kevin Thomson, P.Geo. (Ontario, #0191), Senior Vice-President, Exploration and Director, is a qualified person within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Thomson approved the scientific and technical disclosure in this release.

About Pelangio Exploration Inc.:

Forward-Looking Statements: Certain statements herein may contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Forward-looking statements or information appear in a number of places and can be identified by the use of words such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate" or "believes" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements and information include statements regarding the Company's ability to complete proposed targeted infill drilling, step-out drilling and exploration to further define and expand the resource base, as well as further drilling at Pokukrom East and the other deposits, potential expansion of the Resource, potential conversion of Inferred to Indicated ounces, planned work programs, advancing technical studies, future development decisions, the potential addition of satellite deposits, the potential for a large discovery at Nkosuo, the Company's strategy of acquiring large land packages in areas of sizeable gold mineralization, the Company's plans to follow-up on previous work, and the Company's exploration plans. With respect to forward-looking statements and information contained herein, we have made numerous assumptions, including assumptions about the state of the equity markets. Such forward-looking statements and information are subject to risks, uncertainties and other factors which may cause the Company's actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statement or information. Such risks include the changes in equity markets, share price volatility, volatility of global and local economic climate, inability to obtain necessary approvals or permits in Ghana, gold price volatility, political developments in Ghana and Canada, increases in costs, exchange rate fluctuations, speculative nature of gold exploration, including the risk that favourable exploration results may not be obtained, and other risks involved in the gold exploration industry. See the Company's annual and quarterly financial statements and management's discussion and analysis for additional information on risks and uncertainties relating to the forward-looking statement and information. There can be no assurance that a forward-looking statement or information referenced herein will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements or information. Also, many of the factors are beyond the control of the Company. Accordingly, readers should not place undue reliance on forward- looking statements or information. We undertake no obligation to reissue or update any forward-looking statements or information except as required by law. All forward-looking statements and information herein are qualified by this cautionary statement. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/265933

© 2025 Newsfile Corp. All rights reserved.

Not a Shortcut, But a Guide: The New Face of Ethical Assignment Help