First and Goal Capital Corp. Enters into Definitive Agreement with Copper Bullet Mines Inc. to Complete Qualifying Transaction

October 01, 2025 6:39 PM EDT | Source: First and Goal Capital Corp.

Toronto, Ontario--(Newsfile Corp. - October 1, 2025) - First and Goal Capital Corp. (TSXV: FGCC.P) ("F&G" or the "Company") and Copper Bullet Mines Inc. ("CBMI") signed a Letter of Intent ("LOI") on July 28, 2025. F&G and CBMI are now pleased to announce that they have entered into a definitive business combination agreement dated September 30, 2025 (the "DA"), pursuant to which F&G and CBMI intend to complete a proposed business combination which will constitute a reverse take-over of F&G (the "Transaction"). It is intended that the Transaction will constitute F&G's "Qualifying Transaction", as such term is defined in Policy 2.4 of the Corporate Finance Manual of the TSX Venture Exchange (the "TSXV").

Pursuant to the Transaction, CBMI and a wholly owned subsidiary of F&G will amalgamate to form a new amalgamated company, and upon such amalgamation, holders of common shares of CBMI will receive one post-consolidation F&G common share for each CBMI common share held. As a condition of the Transaction and subject to shareholder approval, F&G will consolidate its common shares on the basis of one post-consolidation common share for every 1.108 pre-consolidation common shares. On or immediately prior to the completion of the Transaction, it is anticipated that F&G will change its name to Coyote Copper Mines Inc. or such other name as may be determined by CBMI.

The parties to the Transaction are at arm's length and, as to the knowledge of the Company, no insider, promoter or control person of the Company has any material equity ownership or interest in CBMI prior to giving effect to the Transaction. As the Transaction is not a "Non-Arm's Length Qualifying Transaction" (as such term is defined in TSXV Policy 2.4), approval of the Transaction by F&G's shareholders will not be required pursuant to the policies of the TSXV. F&G shareholders will be asked to approve, among other things, the consolidation and name change at its annual and special meeting of shareholders anticipated to be held in November 2025.

In connection with the Transaction, all outstanding stock options and agent warrants of F&G will, on a post-consolidation basis, remain in effect on substantially the same terms and in accordance with the policies of the TSXV.

As a condition of signing the DA, F&G visited CBMI's projects and various surrounding properties and operating mines in the Copper Triangle in September. Following the tour of such copper projects, F&G and CBMI agreed to proceed diligently towards closing of the Transaction.

Copper Bullet is currently updating the technical report on its Copper Springs and Gibson projects in compliance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101"). The technical report is expected to be completed on or about October 15, 2025. As part of updating its NI 43-101 technical report, CBMI's team of Geologists, led by Dr. Michael Feinstein, collected and assayed 40 chip and grab samples between August 23-25, 2025. The full list of sample data can be found at the bottom of this press release.

SAMPLE HIGHLIGHTS

| Sample | East WGS84 | North WGS84 | Elevation (m) | Zone | Wt | Cu | Cu |

| ORE GRADE PPM | ORE GRADE % | ||||||

| 1939404 | 503450 | 3688662 | 1500.21347 | 12 N | 0.68 | 192,840 | 19.28% |

| 1939405 | 503450 | 3688661 | 1500.32226 | 12 N | 0.90 | 139,561 | 13.95% |

| 1939406 | 503450 | 3688660 | 1500.48021 | 12 N | 0.67 | 224,096 | 22.41% |

| 1939407 | 503437 | 3688624 | 1515.00655 | 12 N | 1.15 | 100,052 | 10.00% |

| 1939419 | 509008 | 3688951 | 1532.16000 | 12 N | 1.04 | 13,790 | 1.38% |

Highlights from the Aug 2025 sampling include 4 samples from the West Gibson zone, which show very high copper grades ranging from 10 to 22%. These were select grab samples, collected from historic ore piles, to characterize the mineralization. Quartz and chalcopyrite veining, massive Chalcopyrite and associated hematite are observed in relation to a set of thin, mineralized porphyritic dike sets which is parallel the primary Gibson mine structure. The Silver content of 10.6 to 69.3ppm (10.6 to 69.3 grams/tonne) is notable.

A total of 10 samples were collected in the Gibson area. Copper values ranged from 910 to 224,096ppm (0.091 to 22.4096%) and average value of 68,660ppm (6.866%) Cu. Silver values ranged from below detection to 69.3ppm (69.3 grams/tonne) with an average value of 15.6ppm (15.6 grams/tonne) Ag.

The historic tunnel of Santa Ana Canyon had not been previously sampled. In August 2025 the team, sampled more than 40 m of continuous outcrop which returned considerable copper values. Primary hypogene mineralization in Santa Ana Canyon is associated with strong, potassic alteration and is expressed as a stock-work of type-A and type-B veins with a surface expression of 120 x 40 m.

A total of 30 samples were collected in the Santa Ana Canyon area; all measured width chip samples totalling 41.05 m. Copper values ranged from 881 to 13,790ppm (.0881 to 1.379 %) with and average value of 3,564ppm (0.3564%) Cu. Molybdenum values ranged from 6 to 1,233ppm (0.0006 to 0.1233%) with an average value of 85.1ppm (0.0085%) Molybdenum. Silver values ranged from below detection to 2.2ppm with an average value of 0.75ppm (0.75 grams/ tonne). Sampling during the 2025 summer field program was carried out by Michael Feinstein and Mineoro staff. All samples were collected under Mineoro procedures with QA/QC protocols, securely stored and maintained through submission to American Assayers Laboratories in Sparks, Nevada. Samples are analyzed by four-acid digestion and ICP-MS analysis for 51 elements. Samples returning more than 10,000 ppm copper were re-assayed by ore grade methods.

Figure 1. Sample 1939405 from the West Gibson Target Area. Image at right shows porphyrytic dike with coarse euhedral chalcopyrite.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8516/268818_first%20and%20goal%20figure%201.jpg

ABOUT COPPER BULLET MINES INC.

CBMI is advancing a prolific copper project in the Arizona Copper Triangle.

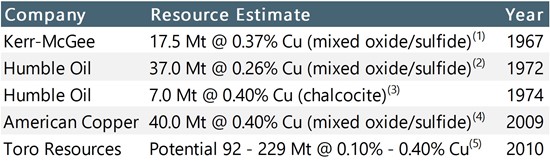

Since its incorporation on April 10, 2021, CBMI has acquired, through staking and option, a significant land package in the heart of Arizona's Copper Triangle. CBMI's Copper Springs Property (the "Property") has more than 96 historic drills holes and a non-NI 43-101 compliant mineral resource of 47 million tonnes grading 0.4% copper (NI 43-101 Technical Report Copper Springs Property, Gila County, Arizona, by M. Feinstein, 2022), equating to over 400 million lbs of copper contained*. This historic resource is one of many exploration targets across the Property and represents approximately 10% of the Historic Supergene Oxide Blanket (HSOB) footprint, which was defined by wide spaced drilling in the 1960s. The historical resource estimate is comparable to a modern inferred mineral resource, however quality assurance and quality control protocols do not meet current industry standards. The Qualified Person finds the historic resource to be reliable and relevant based upon: field observations, multiple post-resource exploration campaigns, review of the 2009 core, and thorough data compilation and analysis.

Please refer to Copper Bullet's NI 43-101 technical report that can be found on its website at: www.copperbulletmines.com.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8516/268818_first%20and%20goal%20table.jpg

* Please note, any reference to historical estimates and resources should not be relied upon. These historical estimates are not current and a "Qualified Person" under NI 43-101 has not done sufficient work to classify the historical estimate and CBMI is not treating the historical estimate as a current resource estimate.

Copper Bullet's NI 43-101 technical report dated January 20, 2022, outlines a phased exploration program of surface sampling, geophysics, and drilling on the Property, which is designed to modernize the non-compliant historic resources, as well as potentially upgrading and expanding the mineralized area.

The Property is adjacent to Arizona State highway 60, located 1 hour east of Phoenix. High voltage power lines cross the Property and water is available from perennial springs. The Property is surrounded by producing mines, including Capstone's Pinto Valley, KGHM's Carlotta mine, Group Mexico's Ray Mine, and various other mines and projects owned by South 32, BHP, Rio Tinto and Freeport-McMoRan.

The Globe-Miami area in Arizona, where the Property is situated, has produced over 37 billion lbs of copper. A recent report published by the Arizona Geological Study suggests unmined resources to be over 94 billion lbs of copper (Geology and History of the Globe-Miami Region, Gila and Pinal County, Arizona. Briggs, 2022). The Copper Triangle is also home to 2 of the 3 copper smelters in the USA.

From exploration through discovery, development, capital raising, and successful execution of commercial mining and milling operations, CBMI's team includes a full range of experienced industry professionals. Additional information about CBMI may be found on its website: www.copperbulletmines.com.

FINANCING

CBMI completed an oversubscribed financing by way of private placement for gross proceeds of approximately $738,000.00 through the issuance of common shares and warrants of CBMI. Paul G. Smith and Daiana Turcu, each a director of F&G, participated in the financing, resulting in each of them holding a minority equity interest in CBMI.

Pursuant to the DA, CBMI will also complete an additional private placement financing for additional proceeds of a minimum of C$750,000.00, through the issuance of units of CBMI at a subscription price of C$0.14 per unit. Each unit consists of one common share and one-half a warrant of CBMI. Each full warrant will entitle the holder to purchase one common share of CBMI at an exercise price of C$0.20 per share for a period of 36 months from the issue date. Upon CBMI receiving its drill permits, CBMI may deliver a notice (the "Acceleration Notice") to the warrant holders notifying such warrant holders that the warrants must be exercised within thirty (30) calendar days from the date of the Acceleration Notice, otherwise the Warrants will expire at 4:00 p.m. (Toronto time) on the thirtieth (30th) calendar day after the date of Acceleration Notice.

FIRST AND GOAL CAPITAL CORP.

F&G was incorporated under the Business Corporations Act (Ontario) on incorporated on June 3, 2021 and is a Capital Pool Company (as defined in the policies of the TSXV) listed on the TSXV. F&G has no commercial operations and no assets other than cash.

QUALIFIED PERSON

Michael N. Feinstein, PhD, CPG, is the "Qualified Person" under National Instrument 43-101-Standards of Disclosure for Mineral Projects, and he has reviewed and approved the scientific and technical disclosure contained in this press release.

Dr. Feinstein is a Consultant to Copper Bullet Mines, he is the author of Copper Bullet's NI 43-101 technical report dated January 20, 2022.

Cautionary Note Regarding Forward-Looking Information

This press release contains statements that constitute "forward-looking information" ("forward-looking information") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking information and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information. In disclosing the forward-looking information contained in this press release, the Company has made certain assumptions, including that: all applicable shareholder, and regulatory approvals for the Transaction, consolidation and name change will be received. Although the Company believes that the expectations reflected in such forward-looking information are reasonable, it can give no assurance that the expectations of any forward-looking information will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Such factors include, but are not limited to: the availability of financing; delay or failure to receive board, shareholder or regulatory approvals; and general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking information contained in this press release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking information to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking information or otherwise.

See below the full table of 40 sampled samples and 2 standards.

| Sample | East WGS84 | North WGS84 | Elevation (m) | Zone | Wt | Cu ORE GRADE PPM | |

| 1 | 1939401 | 503536 | 3688756 | 1526.98481 | 12 N | 0.77 | 910 |

| 2 | 1939402 | 503538 | 3688756 | 1527.0074 | 12 N | 0.97 | 1567 |

| 3 | 1939403 | 503541 | 3688755 | 1526.80442 | 12 N | 1.21 | 3210 |

| 4 | 1939404 | 503450 | 3688662 | 1500.21347 | 12 N | 0.68 | 192840 |

| 5 | 1939405 | 503450 | 3688661 | 1500.32226 | 12 N | 0.9 | 139561 |

| 6 | 1939406 | 503450 | 3688660 | 1500.48021 | 12 N | 0.67 | 224096 |

| 7 | 1939407 | 503437 | 3688624 | 1515.00655 | 12 N | 1.15 | 100052 |

| 8 | 1939408 | 504612 | 3687893 | 1477.56056 | 12 N | 1.07 | 8723 |

| 9 | 1939409 | 504612 | 3687896 | 1476.61283 | 12 N | 1.03 | 9037 |

| 10 | 1939410 | 504601 | 3687930 | 1472.76624 | 12 N | 1.1 | 6603 |

| 11 | 1939411 | 508997.83 | 3688954.19 | 1532.14 | 12 N | 1.08 | 2710 |

| 12 | 1939412 | 508997.77 | 3688953.14 | 1532.41 | 12 N | 0.94 | 2056 |

| 13 | 1939413 | 509005.76 | 3688951.08 | 1532.57 | 12 N | 0.91 | 2770 |

| 14 | 1939414 | 509006.23 | 3688950.49 | 1532.18 | 12 N | 1.23 | 3094 |

| 15 | 1939415 | 509008 | 3688949.72 | 1531.9 | 12 N | 0.93 | 3651 |

| 16 | 1939416 | 509010.14 | 3688948.7 | 1532.09 | 12 N | 1.06 | 3479 |

| 17 | 1939417 | 509011.75 | 3688948.3 | 1531.68 | 12 N | 0.97 | 2666 |

| 18 | 1939418 | 509010.38 | 3688949.84 | 1532.32 | 12 N | 0.97 | 4496 |

| 19 | 1939419 | 509008.41 | 3688951.96 | 1532.16 | 12 N | 1.04 | 13790 |

| 20 | 1939420 | 509013.76 | 3688953.64 | 1532.53 | 12 N | 1.11 | 2964 |

| 21 | 1939421 | Standard | 11198 | ||||

| 22 | 1939422 | 509019.88 | 3688956.89 | 1532.79 | 12 N | 0.89 | 6493 |

| 23 | 1939423 | 509019.51 | 3688957.49 | 1532.61 | 12 N | 1.11 | 4171 |

| 24 | 1939424 | 509021.25 | 3688956.25 | 1532.17 | 12 N | 1.1 | 4153 |

| 25 | 1939425 | 509022.97 | 3688956.83 | 1532.34 | 12 N | 0.94 | 5484 |

| 26 | 1939426 | 509023.18 | 3688958.14 | 1532.09 | 12 N | 0.98 | 5402 |

| 27 | 1939427 | 509022.8 | 3688959.12 | 1531.04 | 12 N | 0.65 | 3807 |

| 28 | 1939428 | 509015.96 | 3688955.88 | 1532.44 | 12 N | 0.91 | 4477 |

| 29 | 1939429 | 509005.89 | 3688953.01 | 1532.54 | 12 N | 1.09 | 2673 |

| 30 | 1939430 | 508988.51 | 3688963.17 | 1530.98 | 12 N | 0.61 | 2272 |

| 31 | 1939431 | 508988.53 | 3688964.16 | 1531.15 | 12 N | 0.82 | 2411 |

| 32 | 1939432 | 508985.77 | 3688966.26 | 1529.16 | 12 N | 1.1 | 2640 |

| 33 | 1939433 | 508985.4 | 3688967.65 | 1529.38 | 12 N | 0.88 | 2550 |

| 34 | 1939434 | 508984.79 | 3688969.12 | 1529.06 | 12 N | 0.99 | 1765 |

| 35 | 1939435 | 508983.76 | 3688970.72 | 1528.23 | 12 N | 0.96 | 4195 |

| 36 | 1939436 | 508982.27 | 3688972.32 | 1527.63 | 12 N | 0.83 | 1495 |

| 37 | 1939437 | 508981.96 | 3688973.51 | 1527.65 | 12 N | 0.81 | 2378 |

| 38 | 1939438 | 508980.34 | 3688978.08 | 1527.56 | 12 N | 1.11 | 3037 |

| 39 | 1939439 | 508978.6 | 3688981.27 | 1526.7 | 12 N | 1.04 | 2080 |

| 40 | 1939440 | 508952 | 3689079 | 1508.39411 | 12 N | 1.51 | 881 |

| 41 | 1939441 | Standard | 587 | ||||

| 42 | 1939442 | 508951 | 3689104 | 1501.74775 | 12 N | 0.97 | 2889 |

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

All information provided in this press release relating to CBMI, including any information about its property and the surrounding area and information on its website, has been provided by management of CBMI and has not been independently verified by management of the Company.

Completion of the Transaction is subject to a number of conditions, including but not limited to, TSXV acceptance and if applicable pursuant to TSXV requirements, majority of the minority shareholder approval. Where applicable, the Transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the Transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Transaction, any information released or received with respect to the Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative.

The TSXV has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this press release

Trading in the shares of F&G has been halted in accordance with the policies of the TSXV and will remain halted until such time as all required documentation in connection with the Transaction has been filed with and accepted by, and permission to resume trading has been obtained from, the TSXV.

Neither the TSXV nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Not for distribution to United States newswire services or for dissemination in the United States.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/268818

© 2025 Newsfile Corp. All rights reserved.