Mundoro Announces Option Agreement with BHP for Exploration Licences in Central Timok, Serbia

October 13, 2025 1:00 PM EDT | Source: Mundoro Capital Inc.

Vancouver, British Columbia--(Newsfile Corp. - October 13, 2025) - Mundoro Capital Inc. (TSXV: MUN) (OTCQB: MUNMF) (www.mundoro.com) ("Mundoro" or the "Company") announces it has entered into a definitive option agreement ("Agreement") with a wholly owned subsidiary of BHP Group Limited ("BHP"), in which Mundoro has granted to BHP an option to earn-in to seven (7) of Mundoro's exploration licenses (the "BHP-Mundoro Central Timok Project" or the "Project") located within the Timok Magmatic Complex ("Timok") in Serbia.

Highlights:

- BHP can earn 100% ownership over 10 years by funding US$ 35,000,000 (C$ 48,877,5001) in exploration expenditures.

- Mundoro retains a 2% NSR royalty upon exercise.

- BHP commits to escalating annual option payments, starting at US$ 323,000 (C$ 451,0701).

- Mundoro will operate the project and earn annual operator fees.

Teo Dechev, CEO of Mundoro commented: "We are pleased to announce the expansion of our strategic partnership with BHP, a world leader in the resources industry. This deepened collaboration focuses on exploring a package of additional exploration licenses in the highly prospective Timok region of eastern Serbia for copper porphyry systems.

"This expanded relationship combines Mundoro's decade of local and operational expertise in the Timok region, with BHP's global geoscience team, and specialization in porphyry exploration. This collaboration leverages the respective strengths of each company to systematically explore this prospective mineral district.

"Working together under a unified exploration methodology, both teams are committed to intensifying exploration efforts. This integrated approach, which draws upon Mundoro's deep understanding of local geological conditions and BHP's cutting-edge global exploration methodologies, is designed to enhance targeting capabilities and significantly increase the likelihood of new discoveries within the Timok region. We believe this expanded partnership will drive value for both companies and has the potential to contribute to the economic development of eastern Serbia."

Agreement Terms

Pursuant to the Agreement, Mundoro has granted to BHP an option to earn, over 10 years (the "Option Period"), a 100% interest in the BHP-Mundoro Central Timok Project. To exercise the option, BHP must:

- Fund cumulative exploration expenditures up to US$ 35,000,000 (C$ 48,877,5001) by set milestones:

| Anniversary | Cumulative Exploration Expenditures | ||

| 2nd | US$ 2,500,000 | ||

| 4th | US$ 7,000,000 | ||

| 6th | US$ 14,500,000 | ||

| 8th | US$ 27,000,000 | ||

| 10th | US$ 35,000,000 |

- Make annual option payments starting at US$ 323,000 (C$ 451,0701), increasing by 2% per year.

- Make milestone paymentsof US$ 2,000,000 (C$ 2,793,0001) each when certain resource estimates are declared, up to a total of US$ 10,000,000 (C$ 13,965,0001), or US$ 10,000,000 (C$ 13,965,0001) upon exercise of the option if no resource is declared.

Additional Terms:

- Operating Fees: Mundoro is the initial operator, responsible for overall operations related to the Project and will receive operating fees. If BHP has funded at least US$ 20,000,000 in exploration expenditures, or if at least 40,000 meters of cumulative drilling has been completed, BHP may elect to replace Mundoro as operator.

- Advanced Royalty Payments:Upon exercise of the option, BHP will begin making annual advanced royalty payments to Mundoro. The value of these advanced royalty payments will be equal to the dollar amount of the last option payment made under the Agreement prior to the exercise of the option, and such advanced royalty payments will increase by 2% per year.

- Royalty: Upon exercise of the option, Mundoro will retain a 2% Net Smelter Return Royalty ("Royalty"). Subject to the terms of the royalty agreement in respect of the Royalty, BHP will have the right to purchase 50% of the Royalty before production commencement. The buy-back price will be based on a certain tonnage of copper multiplied by the one year average copper price on the London Metal Exchange.

The aggregated sum of the exploration expenditures, the milestone payments and the option payments, to exercise the option, is approximately US$ 48,536,759 (C$ 67,781,5111) if BHP completes the earn-in over the Option Period.

Property Overview

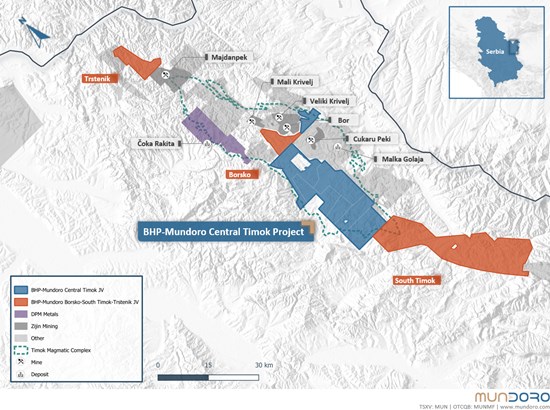

The BHP-Mundoro Central Timok Project comprises approximately 418 square kilometers (km²) of ground and is located within the Timok Magmatic Complex in Serbia (see Figure 1). Timok is one of the most prolific metallogenic domains in the Tethyan Belt, hosting several significant deposits and major producing mines, including:

- the Cukaru-Peki Deposit

- the Malka Golaja Copper-Gold Deposit

- the Timok Project

- the Čoka Rakita Project

- the Bor copper porphyry underground mine, the Majdanpek copper-gold porphyry open-pit mine and the Veliki Krivelj copper-gold porphyry open-pit mine.

Figure 1: Regional map highlighting Central Timok

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2408/270049_555208efa47c0b78_001full.jpg

A total of C$ 15.4 million has been spent on the Project by Mundoro and previous partners. Extensive work has been completed across the licenses in the Project area, including comprehensive geophysical surveys (AMT, IP, and Ground Magnetics), systematic geochemical surveys (stream sampling, soil sampling, rock sampling, and trenching), and targeted diamond drilling campaigns.

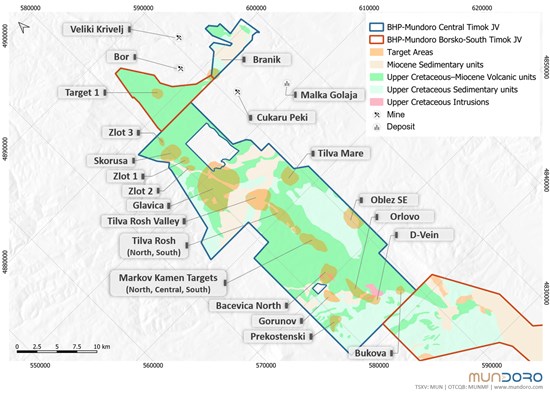

The Project contains numerous targets, with the most advanced being:

- the SkorusaPorphyry System, a defined 2 km x 3 km copper-gold porphyry system where drilling confirmed mineralization with an intercept of 201.2 meters at 0.11% Cu and 0.11 g/t Au; and

- the Tilva RoshProspect, which features a large 16 km² lithocap structure with a high-grade epithermal target at Tilva Rosh South where trenching returned 12 meters at 30.39 g/t Au and 171.27 g/t Ag.

Additional prospective targets include Markov Kamen, Orlovo, D-vein, Prekostenski, Zlot1-3, Bukova, Tilva Mare, Glavica, Bacevica North, Gorunov, Oblez SE and Branik(see Figure 2). The targets exhibit geological features, mineralization styles, and alteration patterns characteristic of porphyry and related high-sulphidation epithermal systems exhibited elsewhere in the region.

Figure 2: Location Map of target areas in the BHP-Mundoro Central Timok Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2408/270049_555208efa47c0b78_002full.jpg

Qualified Persons

The scientific and technical information contained in this news release was reviewed and approved by R. Jemielita, PhD, MIMMM, a Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects("NI 43-101") and Chief Geologist to the Company.

About Mundoro Capital Inc.

Mundoro is a publicly listed company on the TSX-V in Canada and OTCQB in the USA with a portfolio of mineral properties focused primarily on base and precious metals. To drive value for shareholders, Mundoro's asset portfolio generates near-term cash payments to Mundoro and creates royalties attached to each mineral property optioned to partners. The portfolio of mineral properties is currently focused on predominantly copper in two mineral districts: Western Tethyan Belt in Eastern Europe and the Laramide Belt in the southwest USA.

For more information, please visit www.mundoro.com.

Follow our regular updates on: LinkedIn and X.

Caution Concerning Forward-Looking Statements

This News Release contains forward-looking statements. Forward-looking statements can be identified by the use of forward-looking words such as "will", "expect", "intend", "plan", "estimate", "anticipate", "believe" or "continue" or similar words or the negative thereof, and include the following: the anticipated synergies and benefits of the Agreement, completion of the cumulative exploration expenditures, annual option payments, milestone payments, payment of operating fees and the advanced royalty payments upon exercise of the option by BHP and the exercise of the option by BHP. The material assumptions that were applied in making the forward looking statements in this News Release include expectations as to the mineral potential of the Company's projects, the Company's future strategy and business plan and execution of the Company's existing plans. We caution readers of this News Release not to place undue reliance on forward looking statements contained in this News Release, as there can be no assurance that they will occur and they are subject to a number of uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These factors include risks that the anticipated synergies and benefits of the Agreement will not be realized as anticipated or at all, risks that BHP will not complete the cumulative exploration expenditures, annual option payments, milestone payments, payment of operating fees and the advanced royalty payments upon exercise of the option at contemplated or at all, general economic and market conditions, exploration results, commodity prices, changes in law, regulatory processes, the status of Mundoro's assets and financial condition, actions of competitors and the ability to implement business strategies and pursue business opportunities. The forward-looking statements contained in this News Release are expressly qualified in their entirety by this cautionary statement. The forward-looking statements included in this News Release are made as of the date of this News Release and the Board undertakes no obligation to publicly update such forward-looking statements, except as required by law. Shareholders are cautioned that all forward-looking statements involve risks and uncertainties and for a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to the Company's filings with the Canadian securities regulators available on www.sedarplus.ca.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

1 Based on mid-market exchange rate $1 USD = 1.397 CAD

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/270049

© 2025 Newsfile Corp. All rights reserved.