The Nobel Prize-Winning Science Behind Your Bad Decisions

NEW YORK CITY, NY /ACCESS Newswire / April 23, 2025 /

1. Introduction: When Logic Fails

For centuries, economics was built on a clean, mathematical premise: people make rational choices. They weigh costs and benefits, analyze risks, and select the option that maximizes their utility. It was a beautiful theory. It just wasn 't true.

The reality? People are predictably irrational. They make impulsive choices, overpay for things they don 't need, fall for marketing tricks, and cheat just a little when they think they can get away with it. The rise of behavioral economics shattered the illusion of perfect rationality, replacing it with a more nuanced, psychology-driven model of human behavior.

At the center of this revolution are thinkers who didn 't just challenge economic orthodoxy-they lived their insights. Some drew from personal hardship, others from deep academic curiosity, but all arrived at the same conclusion: our decisions are shaped by forces we barely understand.

2. The Architects of the Irrational Mind

Daniel Kahneman & Amos Tversky: The Bias Detectives

Daniel Kahneman and Amos Tversky revolutionized our understanding of human decision-making by introducing the concept of cognitive biases. Their development of Prospect Theory challenged the traditional economic assumption of rational actors, demonstrating that people value gains and losses differently, leading to decisions that deviate from pure logic. For instance, their research showed that individuals are more sensitive to potential losses than to equivalent gains - a phenomenon known as loss aversion. This insight has profound implications, explaining behaviors like why investors might hold onto losing stocks longer than is financially advisable.

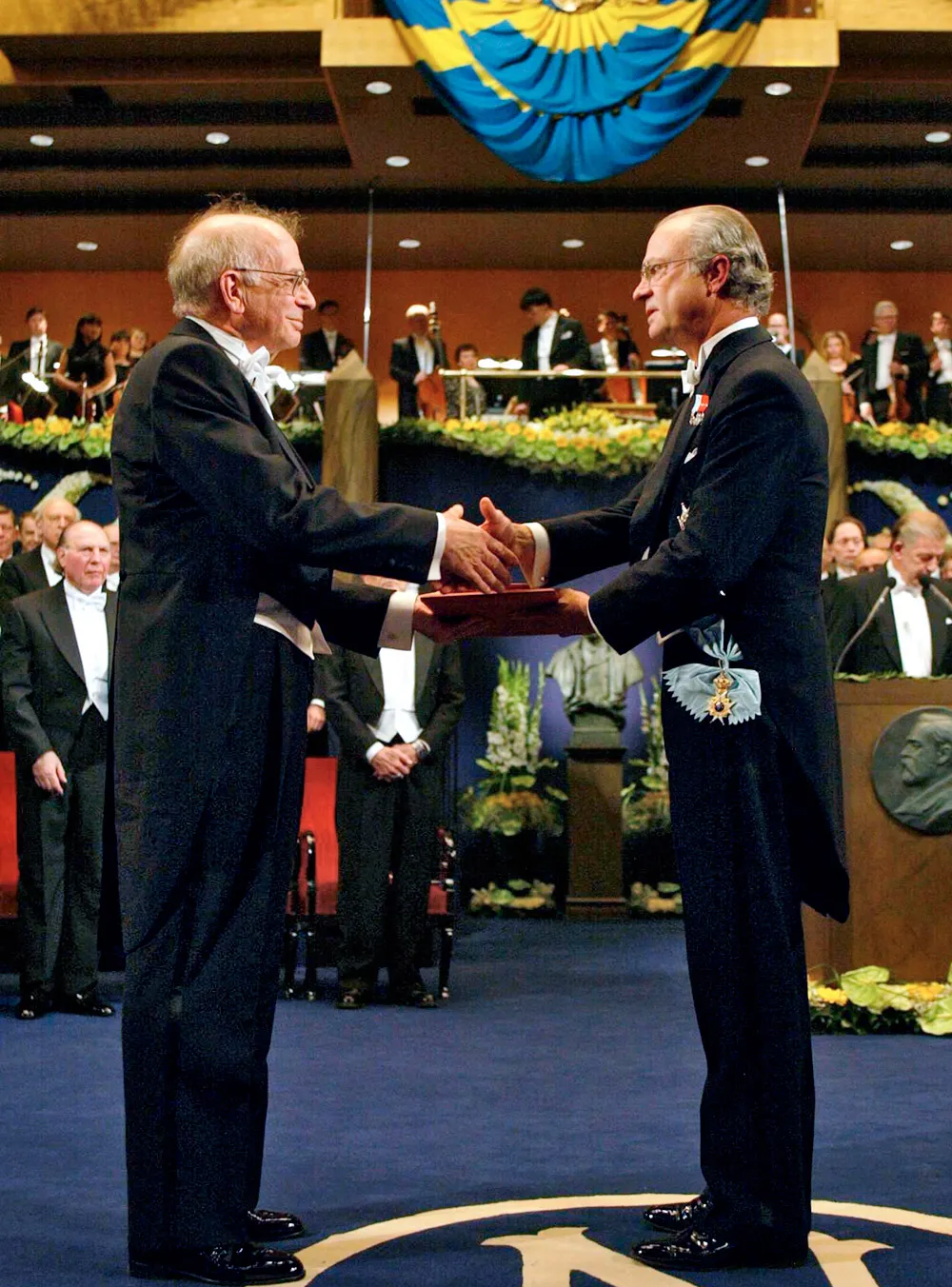

Their collaborative work laid the foundation for behavioral economics, earning Kahneman the Nobel Prize in Economic Sciences in 2002. Their legacy continues to influence fields ranging from finance to public policy, reshaping how we understand human behavior in economic contexts.

Richard Thaler: The Nudge Master

Building upon the insights of Kahneman and Tversky, Richard Thaler introduced the concept of "nudging"-subtle policy shifts that encourage people to make decisions that are in their broad self-interest without restricting their freedom of choice. In his book Nudge, co-authored with Cass Sunstein, Thaler illustrates how small design changes can significantly impact behavior. For example, automatically enrolling employees in retirement savings plans (while allowing them to opt out) dramatically increases participation rates.

Thaler 's work has had tangible impacts on public policy worldwide. The UK government 's Behavioural Insights Team, often referred to as the "Nudge Unit," has applied these principles to areas like tax collection and organ donation, leading to improved outcomes. In recognition of his contributions, Thaler was awarded the Nobel Prize in Economic Sciences in 2017.

George Loewenstein: The Emotion Engineer

George Loewenstein 's research delves into how emotions influence economic decisions, challenging the notion that humans are purely rational actors. He introduced the concept of projection bias, where individuals overestimate the extent to which their future preferences will align with their current ones. This bias explains why people might overcommit to gym memberships or make impulsive purchases they later regret.

Loewenstein 's work has practical implications for understanding behaviors like addiction, procrastination, and consumer spending. By acknowledging the role of emotions in decision-making, his research offers insights into designing interventions that can help individuals make better choices aligned with their long-term goals.

Colin Camerer: The Brain Mapper

Colin Camerer is a pioneer in the field of neuroeconomics, which combines neuroscience, psychology, and economics to study how people make decisions. By using tools like functional magnetic resonance imaging (fMRI), Camerer has explored the neural mechanisms behind economic choices, revealing how brain activity correlates with behaviors like risk-taking and impulse control.

His research has uncovered that certain areas of the brain, such as the prefrontal cortex, are crucial in evaluating rewards and making decisions under uncertainty. These findings have applications in understanding consumer behavior, financial decision-making, and even the development of policies aimed at improving economic outcomes.

Dan Ariely: The Experimenter of Everyday Life

If there 's one thinker who has made behavioral economics personal, it 's Ariely. His groundbreaking experiments didn 't just expose irrationality; they felt personal - as if they were uncovering hidden truths about the way all of us think, act, and justify our choices.

His studies on dishonesty revealed that most people will cheat just a little - enough to benefit but not enough to feel like a bad person. His work on social vs. market norms showed why people will help a friend move for free but feel insulted if offered $20 for the same effort. And his research on pain perception (shaped by his own experience with severe burns) redefined how we understand suffering, decision-making under stress, and even medical treatment.

These researchers, each in their own way, didn 't just study irrationality. They showed us how deeply human it is.

At a recent public lecture hosted by the UBS Center for Economics in Society at the University of Zurich, celebrated behavioral economist Dan Ariely dove into the odd, irrational ways we think about money - and why our brains can be terrible at managing it.

Speaking to a packed audience, Ariely tackled themes from his bestselling book Dollars and Sense, unpacking why everyday financial decisions often veer away from logic and land squarely in the land of cognitive error. "We all think we understand money," Ariely said. "But most of the time, we don 't actually behave like it."

Ariely 's talk was anything but dry. Using interactive examples and sharp humor, he walked the crowd through real-world experiments that showed how emotions, context, and even payment methods dramatically shape our economic behavior.

One example? The way people treat opportunity cost - or more accurately, fail to. Ariely described how someone might refuse to walk three blocks to save $8 on a $1,000 ski jacket, but gladly make that trek for the same savings on a $25 pen. The irrational kicker? The money is still $8 either way - but the brain doesn 't see it that way.

He also discussed the "pain of paying," a concept that shows how swiping a credit card feels less painful than paying in cash - a psychological illusion that often leads to overspending. Ariely argued that small behavioral tweaks, like switching back to cash for discretionary purchases, could help consumers regain control over their financial decisions.

Throughout the evening, Ariely returned to one core idea: humans are predictably irrational, but that doesn 't mean we 're doomed to bad choices. "The goal isn 't to become rational robots," he said, "but to recognize where our minds trip us up - and build better systems around those blind spots."

The UBS Center event wasn 't just about entertainment; it was about empowering the public with insights from behavioral economics to rethink their habits, financial planning, and policy perspectives. Judging from the crowd 's energy and the post-talk Q&A session, it struck a chord.

3. The Real-World Impact: How Behavioral Economics Rewired the System

This isn 't just academic theory - it 's a revolution that reshaped industries.

Finance: Why You Suck at Managing Money

Banks and fintech companies now design savings apps based on behavioral nudging.

Default enrollment in retirement plans boosted participation from 50% to 90% - because people are too lazy to opt in.

Robo-advisors use behavioral algorithms to counteract impulsive stock trading.

Marketing: The Science of Spending Too Much

Why do companies charge $9.99 instead of $10.00? Because anchoring effects make it feel way cheaper.

The "decoy effect" makes you pick the medium popcorn at the movies - because the large option is ridiculously priced on purpose.

Subscription services rely on default renewals to keep you paying (and forgetting to cancel).

Healthcare: Nudging People to Make Better Choices

Hospitals changed pain treatment protocols after research showed how we remember pain matters more than its actual intensity.

Governments used behavioral nudges to increase organ donor rates, boost vaccine uptake, and get people to show up for doctor 's appointments.

Tech & Social Media: The Attention Economy

Variable rewards (like social media notifications) keep people glued to screens, using the same psychological principles that make slot machines addictive.

Infinite scrolling is an Ariely-style experiment on attention and impulse control-one we 're all failing.

4. The Numbers Don 't Lie (Even If We Do): Behavioral Economics by the Stats

Concept | Real-World Impact |

Default Enrollment | 90% increase in retirement plan participation |

Organ Donation "Opt-Out" System | 80% more donors |

Dishonesty in Expense Reports | 30% of employees round up numbers when no audit is expected |

Effectiveness of "Limited Time Offers" | 40% increase in impulse purchases |

The science is clear: we 're not rational-but we are predictable.

5. The Future: AI, Big Data, and Behavioral Manipulation

The next frontier? AI-powered behavioral economics.

Amazon, Google, and Facebook don 't just predict your choices - they shape them.

Algorithms adjust real-time pricing based on your likelihood of buying.

AI can tailor nudges so subtly that you don 't even realize you 're being influenced.

The ethical question? At what point do nudges become manipulation? If AI understands your biases better than you do, are you still making your decisions?

Behavioral economics started as a challenge to old economic models. Now, it 's powering the biggest technological revolution of our time-one where psychology meets data, and free will becomes… negotiable.

6. Conclusion: The Invisible Hand of Human Nature

The traditional economists lost. The idea of the rational decision-maker is dead. But what comes next?

Kahneman, Thaler, Loewenstein, Camerer, and Ariely built a world where behavioral insights drive policy, business, and even the way we experience pain. They proved that irrationality isn 't a flaw-it 's the blueprint of human nature.

As AI, algorithms, and big data take behavioral economics into new territory, the real question isn 't whether we understand our biases.

It 's whether we can resist them.

Final Thought:

The minds who reshaped economics didn 't just study irrationality. They embodied it, lived through it, and built careers out of proving just how deeply human our choices are.

Some through intellectual battles. Some through experiments on dishonesty and morality. Some through personal pain, transformed into insight.

And whether or not we realize it, their influence is already in our wallets, our screens, and even our decisions.

Table: Behavioral Economics Concepts & Real-World Impact

Concept | Real-World Impact / Data Source |

Default Enrollment | 90% increase in retirement participation (Thaler & Sunstein, Nudge) |

Opt-Out Organ Donation | 80% increase in donor rates (OECD & European studies) |

Dishonesty in Expense Reports | 30% employees round up figures when audits are absent (Ariely, The Honest Truth About Dishonesty) |

Limited Time Offers & Urgency Bias | 40% increase in impulse purchases (Marketing Science Institute reports) |

Photo Credits

Kahneman & Tversky - The Atlantic (Illustration by Riccardo Vecchio for "The Friendship That Created Behavioral Economics")

George Loewenstein - Carnegie Mellon University Official Faculty Headshot

Colin Camerer - National Academy of Sciences / Caltech Profile Image

Dan Ariely at UBS Event - UBS Center for Economics in Society, Universität Zürich

Event Venue - University of Zurich, UBS Center Lecture Series (CC license images)

Sources & Citations

Section / Mention | Source / Citation | Link / Note |

Kahneman & Tversky | "The Friendship That Created Behavioral Economics" by The Atlantic | https://www.theatlantic.com/magazine/archive/2016/12/the-friendship-that-made-minds/505868/ |

Richard T haler | Nobel Prize 2017 Press Release - Economic Sciences | https://www.nobelprize.org/prizes/economic-sciences/2017/thaler/facts/ |

George Loewenstein | Carnegie Mellon University Faculty Page | https://www.cmu.edu/dietrich/sds/people/faculty/george-loewenstein.html |

Colin Camerer | National Academy of Sciences Profile | https://www.nasonline.org/member-directory/members/20008906.html |

Dan Ariely | UBS Center for Economics in Society - Public Lecture Event | https://www.ubscenter.uzh.ch/en/news_events/insights/2018-07- dollars_and_sense.html |

Book Reference - Ariely | Dollars and Sense: How We Misthink Money and How to Spend Smarter by Dan Ariely and Jeff Kreisler | |

Projection Bias / Emotion in Economics | George Loewenstein 's publication - "Projection Bias in Predicting Future Utility", Quarterly Journal of Economics | |

Default Enrollment & Opt-Out Organ Donation | Thaler & Sunstein - Nudge: Improving Decisions About Health, Wealth, and Happiness | https://www.penguinrandomhouse.com/books/560346/nudge-by-richard-h-thaler-and-cass-r-sunstein/ |

Dishonesty & Cheating Behavior | Dan Ariely - The (Honest) Truth About Dishonesty | https://danariely.com/books/the-honest-truth-about-dishonesty/ |

"Pain of Paying" & Credit Cards | Ariely et al. - MIT & Duke University research on pain of paying | https://journals.sagepub.com/doi/abs/10.1509/jmkr.41.1.91.25076 |

Variable Rewards / Social Media | B.J. Fogg 's Behavioral Model - Stanford Persuasive Tech Lab | |

Slot Machine Psychology & Infinite Scroll | Adam Alter - Irresistible: The Rise of Addictive Technology and the Business of Keeping Us Hooked | https://www.penguinrandomhouse.com/books/529384/irresistible-by-adam-alter/ |

Neuroeconomics Research (Camerer) | Caltech Behavioral & Brain Sciences - Colin Camerer Publications | |

Behavioral Economics Stats Table | Aggregated from Nudge, Ariely 's books, and OECD Behavioral Insights reports | https://www.oecd.org/gov/regulatory-policy/behavioural-insights.htm |

Big Tech and Behavioral Data Use | Harvard Business Review - "How Companies Learn Your Secrets" | |

AI & Behavioral Manipulation | World Economic Forum - Ethics of AI and Behavioral Engineering | https://www.weforum.org/agenda/2022/10/ai-nudges-and-behavioral-science/ |

UBS Ariely Talk Summary | Official UBS Center Event Page - Dan Ariely Public Lecture | https://www.ubscenter.uzh.ch/en/news_events/insights/2018-07-dollars_and_sense.html |

General Behavioral Economics Overview | Misbehaving: The Making of Behavioral Economics by Richard H. Thaler |

Disclaimer

The content provided in this article,"The Nobel Prize-Winning Science Behind Your Bad Decisions" is for informational and educational purposes only. The views expressed herein are based on research, case studies, and public statements by the cited experts and institutions.

1. Not Financial, Medical, or Legal Advice

This article does not constitute professional advice in economics, finance, psychology, or any other field. Readers should consult qualified experts before making financial, health, or policy decisions.

2. Accuracy & Interpretation

While efforts have been made to ensure accuracy, behavioral economics is an evolving discipline. Data, statistics, and theories may be subject to reinterpretation or new findings.

3. Third-Party Sources & Citations

All external sources, including books, research papers, and institutional references, are credited for transparency. Evrima Chicago does not endorse or assume responsibility for the content of linked third-party materials.

4. Ethical Considerations

The discussion of AI and behavioral manipulation highlights emerging ethical debates. Evrima Chicago advocates for responsible use of behavioral insights-not exploitation-in business and policy.

5. Copyright & Permissions

Images, quotes, and data are used under fair use for commentary and education. All photo credits and citations are attributed to the best of our knowledge. Unauthorized reproduction of this article is prohibited without permission.

6. No Guarantee of Outcomes

Case studies (e.g., nudges in policy) may not produce identical results in all contexts. Real-world applications depend on cultural, economic, and individual variables.

Evrima Chicago is an independent tech firm dedicated to exploring the intersection of human behavior, technology, and economics. This article reflects our commitment to accessible, thought-provoking analysis - not vested interests.

For press inquiries or corrections, contact: Team PR - PR@EvrimaChicago.com

For tips & editorial waasay@evrimachicago.com

© 2025 Evrima Chicago. All rights reserved.

SOURCE:Evrima Chicago LLC

View the original press release on ACCESS Newswire

© 2025 ACCESS Newswire. All Rights Reserved.